Robust tanker demand will keep freight costs high

Louisa Follis, SSY Consultancy & Research, SSY Shipbrokers, London

Oil tanker rates have proven very firm so far this year, following the pattern set in 2003 and leaving charterers to pay a hefty fee for their freight costs.

Spot prices for some of the key oil trades to the US soared from the very low levels seen in the global economic downturn of late 2001 and 2002. But with global economic recovery and greater trading of oil, freight rates have bounced back.

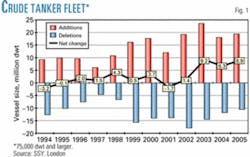

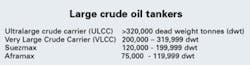

In January 2004, the cost of freight for a Suezmax tanker (see accompanying box) carrying 180,000 tonnes of West African crude to the US was equivalent to about 11% of the cost of cargo. This compares with 7% of the cost of cargo in January 2003 and only 4.6% in January 2002 and is despite the growth in the crude tanker fleet of about 1% in 2002 and a further 4% in 2003.

Several factors are at work in the current buoyant market conditions, and these factors have combined since late 2002 to create a highly volatile freight market.

The factors include the loss of Venezuelan exports early in 2003, the war in Iraq, the shut-in of some of Japan's nuclear energy sector, and tighter European and UN regulations following the sinking in November 2002 of the tanker Prestige off Spain's northern coast.

The largest influence on tanker freight rates over the last 12 months, however, has been the huge rise in oil demand on the back of economic growth.

China leads all

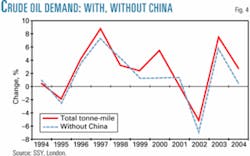

Of particular interest to the tanker markets is the pull of the Chinese market as its economy feeds a near double-digit gross domestic product growth rate.

Commodity markets worldwide have been influenced by the unprecedented expansion in Chinese trade flows with a 40% rise in iron ore imports, 50% rise in steel imports, 60% rise in grain imports, and a 34% rise in oil imports in 2003.

Crude imports were up by 30% and averaged 1.84 million b/d in 2003, with most of this met by long-haul sources.

As the Chinese national fleet is far too small to carry the cargoes required, promptly available ships (spot tonnage) have become very much in demand. This was particularly reflected in the volume of spot VLCC cargoes fixed to China, up by about 13% year-on-year in 2003.

Even though the crude tanker fleet grew by a net 4% in 2003, demand still outweighed supply of ships leading to an increase in freight rates.

The International Energy Agency, Paris, has estimated that about 58% of China's crude oil imports were shipped from the Middle East, predominantly on VLCC tankers.

A further 18% of crude imports were from West Africa on VLCC and Suezmax tonnage.

The surge in Chinese oil imports, together with the exceptional energy demand conditions in Japan, meant far more oil in 2003 traveling over longer distances to Pacific discharge ports than in 2002. This meant more ships tied up for much longer voyages.

North America

On the North American trades, disruptions to short-haul Venezuelan supplies in first-quarter 2003 exaggerated the effects of increased cargo volumes on tonne-mile demand.

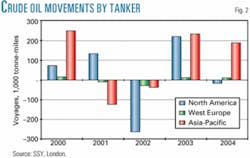

In 2002 both the tonne and the mile components of crude tanker demand turned negative on the North American trades.

In 2003, the position was reversed, particularly with the dependence on longer haul VLCC and Suezmax cargoes at the start of the year and the reduction in short-haul Aframax cargoes from Venezuela.

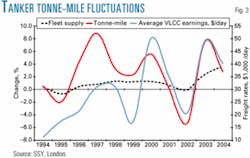

In its latest publication of World Oil Tanker Trends, SSY has estimated that tonne-mile demand for crude carriers on the major import trades (OECD North America, OECD Europe, OECD Pacific, Singapore and China) grew by about 8% in 2003. This followed a 5% decline in 2002.

The rise in tonne-mile demand has a very close correlation with last year's rebound in VLCC tanker spot earnings, which averaged $50,000/day for the major trading routes in 2003 compared with $21,000/day in 2002, and underlines the extent to which the freight market is demand-driven.

The lengthening in average voyages on the crude oil trades ensured that, in terms of vessel size, VLCCs and Suezmax tankers showed the biggest improvement in tonne-mile demand, although Aframax also posted a positive change.

More but slower growth

For 2004, the outlook is for slower (although still positive) growth in crude tanker tonne-mile demand as:

- OPEC restricts the supply of long- haul crudes.

- Some of 2003's extraordinary influences fade. In particular, Japan's demand for oil seems set to drop as nuclear power generation gradually rises from last year's lows.

China will remain the major driver of crude tanker demand growth, while robust US demand should also support rates.

On balance, SSY's current base forecast is for a 2.6% rise in crude tanker tonne-mile demand in 2004 and depends heavily on the Chinese trades.

Buoyant freight rates have prompted more tanker ordering, with 2003 being the highest annual total for new contracting since the early 1970s: 45.8 million dwt of orders placed. For VLCC tankers, the end-2003 orderbook equates to 17% of the existing fleet for VL/ULCCs.

Even though crude-carrier-fleet supply growth is rising at more than 3%/year this year, SSY's tonne-mile projections do not imply a dramatic deterioration in tonnage balances (and, by implication, freight rates).

On the contrary, the outlook for the tanker market for the next 12 months is for a period of tight supply-demand balances, which can be expected to support period charter rates and ensure that spot rates remain extremely responsive to short-term variations in demand.

Risks

Further upside risks on crude tanker freight rates in the near term include:

- Any rise in OPEC output (leading to more available cargoes and higher tanker demand).

- Any disruption in Venezuelan exports to the US, which then would lead to greater demand for substitute cargoes from longer-haul sources, thus driving up tonne-mile demand.

- Faster-than-expected global economic recovery or Chinese expansion leading to greater energy demands and oil imports.

- Failure to restart Japan's off-line nuclear power plants to mean sustained higher volumes of oil imports.

The major downside risks on crude tanker freight rates include:

- A slow-down in China's rate of oil import growth.

- A slowdown in global economic recovery.

- A reduction in OPEC output.

The author

Louisa Follis ([email protected]) is SSY's principal tanker market analyst, covering research, analysis, publication, and presentation of oil and tanker markets for a wide range of clients including ship owners and charters as well as oil & tanker industry organizations. Before joining SSY, she worked as a shipping journalist for 7 years in Singapore, the US, and the Middle East. Follis holds an MSc in shipping, trade, and finance from City University, London.