EIA: Tanker rates reach highs on Ukraine war, Panama Canal delays

Tanker rates for crude oil, petroleum products, and LPG reached historic highs in November 2022, driven largely by the effects of Russia’s invasion of Ukraine and delays at the Panama Canal, according to the US Energy Information Administration (EIA). Tanker rates could continue to increase through the winter, EIA said, because of the European Union ban on importing seaborne crude from Russia and the G7 $60/bbl price cap for countries purchasing Russia’s crude oil using European banks, insurance, or shipping, which took effect Dec. 5, 2022 (OGJ Online, Dec. 2, 2022).

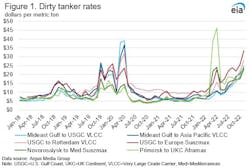

Tanker rates decreased as demand and production cuts increased and remained relatively low from September 2020 to September 2021. In February 2022, rates for both clean and dirty tankers rose because of both geopolitical instability related to Russia’s invasion and rising bunker fuel prices. Dirty tanker rates have continued to increase since.

Rates for very large crude carriers (VLCC, 2 million bbl) have increased the most. VLCC rates from the Middle East Gulf to the US Gulf Coast (USGC) and Asia Pacific more than tripled from February 2022 to November 2022. At the same time, the VLCC rate from the USGC to Rotterdam tripled, increasing from more than $8.00/tonne to nearly $27.00/tonne. Rates for Suezmax vessels (one size class smaller than VLCC, 800,000-1 million bbl) from the USGC to Europe nearly tripled to almost $34.00/tonne in November 2022, according to EIA.

Dirty tanker rates for voyages originating in Russian sea ports on the Baltic Sea (Primorsk) and Black Sea (Novorossiysk) increased significantly from January to April 2022 following an insurance risk premium related to Russia’s invasion of Ukraine and higher bunker fuel costs. However, from April 2022 to November 2022, rates from Primorsk decreased by about 46% and from Novorossiysk by about 4%. In spite of these decreases, rates are still more than double what they were in February 2022, EIA said.

Since February 2022, clean tanker rates for ships operating in ports closely associated with Russia and Europe have also increased because of geopolitical uncertainty and insurance risk premiums. Clean petroleum products are typically transported on medium range (MR) tankers, which are generally smaller than dirty tankers. MR clean tanker rates have risen to record highs since April 2020 and remained elevated as of November 2022.

At the same time tanker rates have increased, European countries are purchasing distillate from countries further away from Russia, and the longer voyage is also adding to the cost of delivering supplies, even if some rates have fallen. To make up for fewer diesel imports from Russia, Europe has been increasing imports from other sources, particularly the US, according to trade press and ship tracking services.

Weekly US distillate fuel exports to all destinations were near or above the top of the 5-year (2017-21) range from May to September 2022, but have since dropped to average volumes. From May to November 2022, rates from the USGC-Caribbean to the UK-Continent (UKC) and the US Atlantic Coast to the UKC fell 6% and 7%, respectively, according to EIA.

Propane

Very large gas carrier (VLGC) rates are highly seasonal, increasing in the winter when demand for propane as a heating fuel is highest and decreasing in the summer when heating demand subsides. Petrochemical demand also affects VLGC rates because propane is used as a petrochemical feedstock.

VLGC rates in the 2021-22 winter were relatively high. US winter propane exports averaged about 1.3 million b/d from October 2021 to February 2022, the second-most during that timeframe behind winter 2020-21. In May 2022, VLGC rates rose due to delays on the Panama Canal, tightening the VLGC fleet and keeping vessels out of the market. In October 2022, rates on all three VLGC benchmark routes exceeded the previous December 2020 peak due to further delays associated with the Panama Canal as well as a higher petrochemical demand for propane, EIA said.

In China, operating rates at propane dehydrogenation units, which consume propane as a feedstock to produce propylene, increased from about 60% in September 2022 to around 80% in October 2022. US propane exports have been consistently above the 5-year range since the end of May 2022, based on EIA weekly data.