OGJ Newsletter

GENERAL INTEREST — Quick Takes

Argentina, UK to seek Falklands oil accord

The governments of Argentina and the UK have agreed to work toward removal of restrictions on oil and gas work offshore the Falkland Islands. As part of its longstanding claim to sovereignty over the islands, the South American country in 2010 imposed restrictions on movements of ships between it, the Falklands-which it calls the Malvinas-and other islands in the South Atlantic (OGJ Online, Feb. 17, 2010).

The Argentine government, under former President Cristina Fernandez de Kirchner, objected to offshore exploration then reviving under auspices of the government of what the UK considers one of its self-governing offshore territories.

Among results of drilling during that period was the discovery by Rockhopper Exploration PLC of Sea Lion oil field, which is under development (OGJ Online, Sept. 14, 2011). Argentina and the UK fought a 74-day war over the Falklands in 1982 and didn't reestablish diplomatic relations until 1990.

Mauricio Macri, who replaced Fernandez de Kirchner as president last December, has moved to improve relations with the UK. He met with British Foreign Office Minister Alan Duncan during a series of high-level meetings in Buenos Aires this month that yielded an agreement on travel and other issues related to the Falklands and that included the statement about working toward lifting restrictions on oil and gas activity.

In a visit to London before those meetings, Argentine Foreign Minister Susana Malcorra said her government would be willing to pursue joint exploration in the Falklands.

Total exercises preemption rights in Barnett JV

Total E&P USA said it is exercising its preemption right to acquire Chesapeake Energy Corp.'s 75% interest in the jointly held Barnett shale operating properties near Fort Worth. Total already owns the remaining 25% and will become the operator.

Properties include 215,000 net developed and undeveloped acres and 65,000 boe/d in production. Chesapeake of Oklahoma City previously announced its plans to exit the Barnett (OGJ Online, Aug. 22, 2016).

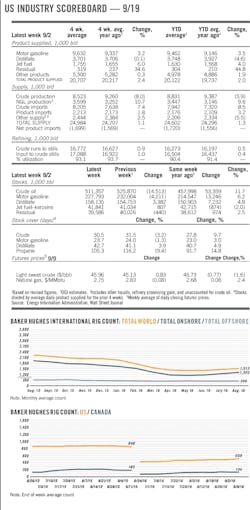

Drilling for new gas wells has diminished in the Barnett shale in recent years. Baker Hughes Inc. reported 4 rigs drilling in the Barnett during August.

Total said the preemption and associated transactions are subject to numerous conditions, including third-party consents. Closing is expected in the fourth quarter.

Chesapeake will pay $334 million to Williams, the gatherer and processor of 80% of the gas from the Barnett shale properties. Chesapeake is terminating its gathering agreement.

Total will supplement Chesapeake's payment with $420 million to Williams for a fully restructured, competitive gas-gathering agreement.

In addition, Total will pay $138 million to be released from three midstream capacity reservation contracts.

Total also holds a 25% interest in the Chesapeake-operated Utica shale joint venture in Ohio. In the Gulf of Mexico, Total holds a 17% interest in Tahiti field and a 33.3% interest in Chinook field. Additionally, Total and Cobalt International Energy plan to explore for oil in the deepwater Gulf of Mexico.

Charger Shale Oil JV targets Permian basin

Charger Shale Oil Co. LLC, Midland, Tex., and funds managed by Oaktree Capital Management LP, Los Angeles, have formed a joint venture targeting 100 horizontal well locations across multiple horizons in the Permian basin.

Before Oaktree's pledge of $600 million in an initial equity commitment a "runway commitment" of a further $300 million, Charger had secured more than 40,000 acres in the Delaware basin with capital from managers and other investors. The company has closed on the initial acreage and plans to expand development to more than 85,000 acres.

Charger's leaders are former key executives of Tall City Exploration (TCE), which acquired and developed more than 34,500 acres and held a further 48,000 prospective acres. TCE sold those properties for $1.2 billion in two transactions in 2014 and 2015.

Joseph Magoto, former president of TCE, is chief executive officer and president of Charger. He said Charger's goal is to assemble more than 100,000 acres and prove 1,500 locations.

Oklahoma, EPA shutting down 32 disposal wells

Oklahoma state and US Environmental Protection Agency regulators said 32 disposal wells in northeastern Oklahoma must shut down following the discovery of a fault line believed to have caused a 5.3-magnitude earthquake on Sept. 3.

The newly discovered fault is near the town of Pawnee, farther east than most previous Oklahoma earthquake activity. The fault has yet to be named.

Jim Marlatt with the oil and gas division of the Oklahoma Corporation Commission said the latest action means wastewater being injected in the area will be reduced to 35,000 b/d from 75,000 b/d.

Exploration & Development — Quick Takes

Oil Search, ExxonMobil farm into CNOOC permits

Oil Search Ltd., of Sydney and Port Moresby, has refocused its attention offshore in the Gulf of Papua in a bid to explore areas with potential to support the company's expanding LNG portfolio. Its Papua New Guinea LNG (PNG LNG) joint-venture partner, ExxonMobil Corp., also has joined the project.

Oil Search has entered agreements with CNOOC Ltd. subsidiary Gini Energy Ltd. to acquire 40% interest in each of two deepwater exploration permits 150 km south of Papua New Guinea's capital of Port Moresby. Gini previously had 100% interest in each.

The two contiguous permits, PPL 374 and PPL 375, have a combined area of just fewer than 25,000 sq km. Water depths range 1,000-2,500 m.

ExxonMobil also will acquire 40% interest in the two permits, leaving Gini in possession of 20% share.

Oil Search Managing Director Peter Botten noted that the company undertook a comprehensive study of exploration opportunities in Papua New Guinea during 2015-16. This work identified the Papuan Gulf as an area of high gas potential. Several leads and prospects with the possibility of holding multitrillions of cubic feet of gas have already been identified in the two permits.

Botten acknowledged ExxonMobil's expertise in deepwater exploration and production as a major plus for the coming exploration venture. It is also the first time that Oil Search has worked with CNOOC.

It is not the first time that Oil Search has ventured into the gulf, although the earlier forays were in relatively shallow water. The last program took place several years ago in partnership with Total SA and resulted in the uncommercial Flinders and Hagana gas discoveries about 150 km east of Daru and the Fly River Delta.

The relatively close proximity of the new farm-in permits to the existing PNG LNG Project and proposed Papua LNG Project production plants at Caution Bay 20 km northwest of Port Moresby will be a bonus for development if the exploration program is a successful.

Arctic coalition: Keep Alaska sales in next OCS program

A coalition of 20 Alaskan and national organizations formally launched a campaign urging the US Department of the Interior to keep two oil and gas lease sales offshore Alaska in the next 5-year US Outer Continental Shelf resource management plan.

The effort-which is being led by the Independent Petroleum Association of America and the Alaska Oil & Gas Association-included a full-page advertisement in several major newspapers in which former US Sec. of Defense William S. Cohen and 19 other former US military officers said omitting the sales would harm the nation's ability to protect its interests and promote cooperation in the Far North.

The Wilderness Society and other Alaska OCS leasing opponents have argued that the oil industry's reduction of operations in the state in response to depressed crude-oil prices shows reduced interest is untrue, said Jeff Eshelman, IPAA senior vice-president for operations and public affairs.

"The oil and gas industry's impact on the economy of the Alaska is well known. What is less well understood is the crucial role it plays in supporting homeland security in the Arctic, so this is a theme that [the campaign] will really emphasize," Eshelman said.

"The breadth of Alaskan organizations which have come together, 16 in total, demonstrates the importance of this issue to our state," AOGA Pres. Kara Moriarty said. "Despite repeated claims to the contrary by environmental groups, Alaskans overwhelmingly support oil and gas development.

"Without the lease-sale option, there is simply no prospect of future investment in the infrastructure which we need," Moriarty said. "I can't stress this enough: Taking lease sales off the table now sends a clear message that the federal government is hanging a 'closed for business' sign on our state, at a time when we are already facing huge budgetary challenges."

Other members of the coalition, the Arctic Energy Center, include the National Ocean Industries Association, the International Association of Geophysical Contractors, the Arctic Slope Regional Corp., and other Alaskan business, labor, and consumer organizations.

A draft of the proposed 2017-22 OCS plan, which DOI released in March, included a 2020 lease sale in the Beaufort Sea and one in the Chukchi Sea in 2022. Oil and gas trade associations and other groups called on the US Bureau of Ocean Energy Management to not remove or modify the lease sales as the comment period for the next 5-year plan closed.

JV gets license for Caspian structure

Central Oil & Gas Co., a joint venture of Lukoil, Gazprom, and KazMunayGas, has received a subsoil use license for the Tsentralnaya structure in the Caspian Sea offshore Russia.

The JV tested light, sweet oil at what it said were commercial rates in the Tsentralnaya-1 exploration well on the structure in 2008 (OGJ Online, June 24, 2008).

The well went to 4,227 m TD in 456 m of water. It's 150 km east of Makhachkala, Dagestan, and a similar distance west of Aktau, Kazakhstan.

The new license has a 27-year term, including a 7-year exploration phase.

Russia's government granted the license under an agreement with the Kazakh government on delineation of the northern Caspian.

Eni, Novatek ink contract for blocks off Montenegro

Italian multinational firm Eni SPA and Russian gas producer OAO Novatek have signed a concession contract with the Montenegrin government for the exploration of four offshore blocks.

Eni will become operator with 50% interest in exploration licenses 4118-4, 4118-5, 4118-9 and 4118-10, and Novatek will hold the other 50%. The blocks collectively cover 1,228 sq km.

The firms jointly submitted their bid for the blocks in 2014 as part of Montenegro's First International Competitive Bid Round.

Drilling & Production — Quick Takes

CAODC slashes Canadian drilling outlook

The Canadian Association of Oilwell Drilling Contractors has slashed its forecast for 2016 oil and gas drilling from the already pessimistic projection it published last November.

"The oil and gas services industry is facing the most difficult economic time in a generation," CAODC Pres. Mark Scholz said in a statement. "In fact, 2016 will be the worst year in our recorded drilling activity history."

CAODC records begin in 1977.

The association now projects 3,562 wells drilled this year vs. 4,728 in the earlier forecast, 40,252 operating days vs. 56,260 earlier, and a fourth-quarter rig count of 140 vs. 204 earlier.

It cut its estimate of land rigs for which contracts are expected to 671 from 758.

CAODC expects drilling employment this year to be down 69% (34,560 jobs) from the 2014 level. It earlier expected the decline to be 57% (28,485 jobs).

Scholz said regulations and fiscal policies are aggravating problems of a market depressed by low oil prices.

"The introduction of new carbon taxes and higher corporate taxes in Alberta, compounded with federal delays on new pipelines and LNG approvals, are creating significant investment uncertainty in Canada," he said.

Egypt's Nooros field gas output reaches 700 MMcfd

Production has reached 700 MMcfd of natural gas, or 128,000 boe/d, from Nooros field of the Abu Madi West concession in the Nile Delta, reported partners Eni SPA and BP PLC.

The output benchmark comes just 13 months after the discovery and follows drilling of the Nidoco North 1X exploration well and the Nidoco North West 4 development well.

Later this month, the Nidoco W-2 exploration well is expected to spud to test a western segment of the field. Another exploration well, the BSW-1 (Barakish), was spudded in April to test an analogous but separate reservoir north of Noroos (OGJ Online, June 9, 2016).

Development wells, including the Nidoco North West 5 well spudded on May 7, are expected to increase production over the course of 2016. By spring of 2017, production capacity is expected to reach 160,000 boe/d.

Gas and condensate produced from Nooros are sent to Abu Madi's treatment system, 25 km from the discovery.

Eni through its subsidiary IEOC holds 75% interest in Abu Madi West, and BP holds the remaining 25%. Nooros is operated by Belayim Petroleum Co. (Petrobel), a joint venture of IEOC and state partner Egyptian General Petroleum Corp.

Eni says production costs from Nooros are among the lowest in its portfolio because of "the mature operating environment and the conventional nature of the project."

More Weizhou oil wells start flow in S. China Sea

CNOOC Ltd. has brought the Weizhou 6-9/6-10 comprehensive adjustment project on stream. The oil field is in the Beibu Gulf in the South China Sea in 35 m of water.

The latest adjustment project includes one wellhead platform. One well produces 850 b/d. The adjustment project is expected to reach production of 3,800 b/d in 2018.

CNOOC operates Weizhou with 100% interest. The development of a series of fields is being brought on stream in stages.

CNOOC started production from Weizhou 6-12 oil field in 2013. Two development wells were drilled from a wellhead platform in about 29 m of water (OGJ Online, Mar. 27, 2013).

Ophir starts gas flow in central Kalimantan

Ophir Energy PLC, London, has started production from Kerendan natural gas field in central Kalimantan, Indonesia.

The region's first commercial hydrocarbon production began at 3-5 MMscfd, flowing to a 155-Mw power plant 3 km away being commissioned by Indonesian National Power Co. After commissioning of the plant, Kerendan output will be 5 MMscfd, restricted by nearby power needs.

Gas output will increase to 20 MMscfd after completion of a transmission line to Tanjung later this year.

Ophir said 122 bcf of Kerandan gas is covered by an existing sales agreement. It estimates the field has a contingent resource of 458 bcf gross not covered by contract.

The company holds 70% operated interest in the Bangkanai production-sharing contract (PSC) encompassing the field. PT Saka Bangkanai Kalimantan holds 30% equity interest.

Ophir also holds interests in nearby the nearby Northeast and West Bangkanai PSC areas, which it says have structures analogous to Kerendan.

PROCESSING — Quick Takes

SOCAR wraps planned maintenance at Baku refinery

State Oil Co. of Azerbaijan Republic (SOCAR) has resumed operations following more than a month of scheduled maintenance at its Heydar Aliyev, formerly New Baku, refinery at Baku in Azerbaijan.

Part of SOCAR's ongoing modernization and expansion program for Heydar Aliyev, the planned turnaround, which began in early August, included a series of routine maintenance and repair works as well as equipment installations and upgrades at the refinery's No. 21 primary processing unit, No. 31 catalytic reformer, No. 43 coker, and No. 55 catalytic cracker, SOCAR said.

All units taken offline during the maintenance period have been restarted, with the refinery resuming normal output as of Sept. 14, SOCAR said.

Due to be completed in stages through 2019-20, the Heydar Aliyev modernization and upgrading program will expand the refinery's crude processing capacity to about 7.5 million tonnes/year from its current 6 million-tpy capacity, resulting in 100% production of fuels that meet Euro-5 quality standards as well as high-quality raw feedstock to be transported via pipeline to an associated ethylene and polyethylene plant operated by SOCAR subsidiary Azerikimya Production Union (OGJ Online, Mar. 16, 2016).

The refinery revamp follows the Jan. 1, 2015, shutdown and subsequent merger of processing activities at SOCAR's Azerneftyag refinery with those of the nearby Heydar Aliyev refinery as part of the company's plan to eliminate economically inefficient production activities and management structures associated with the operation of two separate refineries (OGJ Online, Dec. 29, 2014).

SOCAR also has advanced its previously announced plan to add a 400,000-tpy grassroots bitumen plant as part of the Heydar Aliyev refinery overhaul (OGJ Online, Sept. 18, 2015).

In early August, Austria-based Porner Ingenieur GMBH began preliminary activities for construction of the bitumen plant, which will be the first unit under the refinery modernization program to be commissioned, SOCAR said.

The new bitumen plant is scheduled for startup in mid-2018, the company said.

Irving closes Whitegate refinery purchase

Irving Oil Ltd., Saint John, NB, has closed its purchase of the 71,000-b/d Whitegate refinery near Cork, Ireland, from Phillips 66 (OGJ Online, Aug. 3, 2016).

Irving said it plans to continue full operation of the refinery and maintain the existing workforce.

Whitegate is Ireland's only refinery.

Ineos lets contract for Chocolate Bayou LAO unit

Ineos Oligomers, a division of Ineos AG, Rolle, Switzerland, has let a contract to Jacobs Engineering Group Inc., Pasadena, Calif., to design and build a linear alpha olefin (LAO) unit at Ineos Olefins & Polymers USA's Chocolate Bayou petrochemical complex in Alvin, Tex.

Jacobs will provide engineering, procurement, and construction services for the 420,000-tonne/year unit based on Ineos Oligomers' proprietary and differentiated LAO technology, the service provider said.

Scheduled for startup in November 2018, the LAO unit comes as part of Ineos' plan to help meet rising demand for LAO in the US Gulf Coast (USGC) and abroad, Jacobs said.

A value of the contract was not disclosed.

The contract award follows Ineos' announcement in May that it had taken final investment decision on the Chocolate Bayou LAO unit, which alongside the company's existing LAO units in Joffre, Alta., and Feluy, Belgium, will contribute to an aggressive expansion of its international LAO business (OGJ Online, May 17, 2016).

The LAO unit at Ineos' Chocolate Bayou site-which already houses two ethylene crackers and provides ready access to the USGC ethylene pipeline network-also will supply growing USGC polyethylene capacity, as well as provide feedstock to enable the company's long-term polyalphaolefin capacity growth to support demand for high-performance synthetic lubricants.

Ineos has yet to reveal how much it will spend to complete the Chocolate Bayou project.

TRANSPORTATION — Quick Takes

Gazprom, Nogaholding to cooperate in LNG

Gazprom and Nogaholding of Bahrain have signed a memorandum of understanding to cooperate in liquefied natural gas.

Nogaholding is the investment and business development arm of Bahrain's National Oil and Gas Authority (NOGA).

In December, Nogaholding and NOGA signed project agreements for an LNG regasification terminal in the Hidd industrial area of Bahrain with a consortium of Teekay LNG Partners, Samsung C&T, and Gulf Investment Cooperation.

The terminal is to be owned and operated by Bahrain LNG WLL, a joint venture of Nogaholding 30% and the Teekay-Samsung-GIC group 70%. Initial capacity is to be 400 MMscfd. A doubling of capacity is possible.

The project will include a floating storage unit, offshore LNG receiving jetty and breakwater, an adjacent regas platform, pipelines from the platform to shore, an onshore receiving facility, and an onshore nitrogen production facility.

GS Engineering & Construction has the engineering, procurement, and construction contract.

Rio Grande LNG gets FTA export authorization

NextDecade LLC has received US Department of Energy authorization to export LNG from its proposed Rio Grande LNG liquefaction plant in Brownsville, Tex., to Free-Trade Agreement countries. DOE authorized export of 27 million tonnes/year (tpy) of LNG-equivalent to about 3.6 bcfd of natural gas-for a 30-year term subject to ongoing regulatory approvals.

NextDecade announced in November 2015 it had signed nonbinding agreements for the sale of 14 million tpy of LNG to customers in Asia and Europe. The company says it now has agreements in place for 30 million tpy.

NextDecade expects to receive US Federal Energy Regulatory Commission approval for Rio Grande LNG in 2017 with initial LNG exports shipping by yearend 2020.

CB&I is performing front-end engineering design and engineering, procurement, and construction of the project, which includes as many as six 4.5 million-tpy liquefaction trains (OGJ Online, May 14, 2015).