India advancing LNG projects to bridge gas-supply gap

Sanjay Kumar Kar

Rajiv Gandhi Institute of Petroleum Technology

Uttar Pradesh, India

Manish Vaid

Observer Research Foundation

New Delhi

On May 5, 2016, Indian Petroleum Minister Dharmendra Pradhan hinted that the country seeks to further increase natural gas's share of India's energy basket by both increasing domestic production and importing LNG at competitive prices.

India is already the fourth largest importer in the world, taking 5.7% of global volumes in 2014. It has signed long-term contracts with suppliers and also plans to help set up an LNG liquefaction plant at Chabahar, Iran, to ship natural gas back to India.

This article assesses India's drive to increase its LNG imports and scrutinizes its current LNG infrastructure and the need for expansion in light of the projected increase in domestic natural gas demand. The authors will offer policy recommendations for the government to ensure sustained LNG imports, with an ultimate objective of closing the country's natural gas demand-supply gap and ensuring its energy security.

Global LNG supply

Global liquefaction capacity measured 308 million tonnes/year (tpy) at end-2015, compared with regasification capacity of 777 million tpy.1 But pending liquefaction additions in the US and Australia will change global LNG supply dynamics in the near future.

LNG pricing is gradually moving from crude oil indexation to gas-hub linked prices, but two-thirds of LNG is still sold at prices linked to crude oil.

India's LNG demand

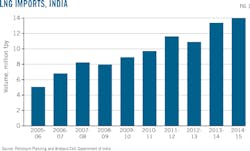

Fig. 1 shows India's LNG imports growing from about 5 million tpy in 2005-06 to about 14 million tpy in 2014-15. LNG imports jumped another 15% during 2015-16. The biggest increases occurred in February and March 2016, up 63%2 and 58%3 respectively from the corresponding months a year earlier.

Policy interventions by the government aimed at improving utilization of stranded power plants4 and pooling domestic gas5 with regasified LNG (R-LNG) to produce urea have combined with lower crude oil prices to boost India's demand.

Grid-connected gas-fueled power generation capacity in India is 24,150 Mw, out of which 14,305 Mw lacks access to domestic gas.6 On Mar. 20, 2016, nine stranded power plants with an installed capacity of 5,942 Mw were allocated 7.62 million standard cu m/day (MMscmd) of R-LNG via an e-auction. Power produced from these plants was sold at or below Rs 4.70/unit to local distribution companies for resale to end users from Apr. 1, 2016, to Sept. 30, 2016, via a reverse auction process that was expected to be renewed at the time of writing.

The price of power produced from gas plants typically varies in India depending on the gas source. Power produced from LNG would cost Rs. 7-9/unit depending on gas price and plant load factor. The lower price was an effort by the government to extend the benefits of lower gas costs to end users.

LNG sourcing

The Middle East and Africa dominated LNG shipments to India in 2015, with Qatar supplying 61% of the total, followed by Nigeria (14.7%), and 11 other countries dividing the remaining 24.3%.7

Long-term contracts with fixed-destination clauses dominated LNG trade for years, but changing trade patterns stemming from the accident at Japan's Fukushima nuclear power plant and the US shale-gas boom have allowed growth of shorter-term and gas-price based LNG trade. Depressed spot prices have motivated many LNG buyers to renegotiate supply contracts.

Petronet LNG Ltd. (PLL) renegotiated its 2004-2029 contract with RasGas for sourcing 7.5 million tpy to $6.50-7.00/MMbtu FOB from $12.50/MMbtu FOB (calculated at $96/bbl), effective Jan. 1, 2016.8 According to India's Petroleum Minister, the current applicable LNG price under this contract is less than $5.00/MMbtu FOB.9 A new agreement for an additional 1 million tpy from January 2016 to January 2028 was similarly based on market prices. RasGas and Petronet also agreed to reschedule the LNG not taken by the latter during 2015 to a future period, with RasGas waiving the contract's take-or-pay liability.

GAIL (India) Ltd. has signed long-term agreements with both Cheniere Energy Partners and Dominion Resources to source LNG from the US. The deal with Cheniere is for 3.5 million tpy from Sabine Pass Liquefaction (OGJ Online, Dec. 12, 2011), while the one with Dominion is for 2.3 million tpy (OGJ Online, Sept. 23, 2013). Supplies from these two deals will start in 2018.10 GAIL expects to swap 1-2 million tpy of the Cheniere supplies to save transportation costs.10

GAIL has also agreed to buy 2.5 million tpy from Gazprom for 20 years beginning 2018-2020.11 Gazprom wants to increase supplies to 3.5 million tpy and the agreement's duration to 25 years.12

The US contracts are priced on a Henry Hub basis. The EIA's Short-Term Energy Outlook predicts the Henry Hub spot price will rise from $2.00/MMbtu during first-quarter 2016 to $3.22/MMbtu in fourth-quarter 2017, potentially escalating GAIL's LNG import costs when the contracts come into play in 2018.

The LNG market is moving toward increased spot liquidity. Cargoes initially sold under long-term contracts now move into the spot market with renegotiated prices and without take-or-pay clauses so that LNG traders can get the best possible price for each cargo.

In March 2016 the delivered price of LNG into Japan was $6.80/MMbtu,13 62.8% lower than the $18.30/MMbtu paid in March 2014. Additional production from Australia, the US Gulf, and Angola is expected to drive spot prices down further,14 which would benefit Asian buyers including India.

LNG infrastructure

India has a total of four operational LNG terminals in Dahej, Hazira, Kochi, and Dabhol, with regasification capacity of 25 million tpy but currently running at 58%. A lack of supporting infrastructure,15 subdued R-LNG demand as a result of higher prices, and minimal pipeline connectivity between terminals and demand centers account for the low capacity utilization.

To meet future demand for natural gas, more than 65 million tpy of new regasification is planned (both brownfield and greenfield) by 2030, including both land-based LNG terminals and floating storage and regasification units (FSRU).

• Petronet signed a firm and binding term sheet for developing a land-based, 5-million tpy LNG terminal at Gangavaram port, Andhra Pradesh, on India's east coast with Gangavaram Port Ltd. (GPL).

• The upcoming LNG terminal in Ennore with an initial capacity of 5 million tpy and expandable to 10 million tpy could supply R-LNG to power plants and fertilizer units, other industrial customers, consumer end-users, and transportation buyers in Tamil Nadu.

• H-Energy Gateway Private Ltd. (HEGPL), an affiliate of H-Energy, is setting up an 8-million tpy onshore regasification terminal at Jaigarh, Ratnagiri district, Maharashtra, which would supply 29 MMscmd of regasified LNG to downstream markets.16

The accompanying table lists these and other upcoming LNG regasification terminals and FSRU.

Limiting factors

Ensuring cost-effective and reliable sourcing of LNG from sources relatively close to regasification terminals remains critically important to India. The Middle East and North Africa (MENA) region has historically been India's preferred LNG sources. But post-Fukushima (2011-14), India started to look beyond MENA. The sourcing destinations which emerged as alternatives were Australia, the US, and Russia.

In 2015 Australia exported 30.4 million tonnes of LNG and is expanding liquefaction capacity to 85 million tpy, expected to come on stream by 2020. Commercial production of shale gas changed the US natural gas supply-demand balance, prompting development of about 50 million tpy17 of LNG capacity expected to enter service by 2019.

The India-Australia LNG Sub-Working Group for Collaboration, supported by representatives of National Thermal Power Corp., GAIL, Petronet, and shipping companies, came together to take advantage of new opportunities to move Australian-sourced LNG to India.18 It remains to be seen, however, if this group can meet the challenge of developing mutually agreeable long-term fixed price contracts between suppliers and end users.

India's LNG ship-building sector is at a nascent stage of its development and needs domestic and foreign investment to mature. A fully developed LNG shipping sector in India would not only help meet domestic requirements but also would serve global markets.

GAIL initially postponed a nine-vessel $7-billion LNG ship tender by 1 month. Each vessel would carry 150,000-180,000 cu m of LNG to India, primarily from Sabine Pass and Cove Point in the US.19 The delay was largely due to changed market dynamics stemming from the fall in the gas prices. Top Japanese fleet owners and one non-Japanese company, GasLog, ended up filling the tender, with three ships to be built at local Indian yards.20

Domestic shipbuilders Cochin Shipyard Ltd. and Pipavav Offshore Engineering showed interest in teaming up with international ship builders like Samsung Heavy Industries and Daewoo Shipbuilding & Marine Engineering to build LNG carriers in India. But Cochin was the only Indian yard that met the eligibility criteria set by GAIL for building the ships locally. State-run Shipping Corp. of India Ltd. (SCI) and GAIL have a step-in right to take 26% and 10% stakes respectively in each of the nine LNG carriers hired by GAIL.

India's LNG value chain lacks a sufficient gas pipeline network connecting terminals with customers in demand centers. Underutilization of Kochi LNG terminal is a good example of this underutilization due to lack of pipeline connectivity.

Future investment

Investing in foreign oil and gas, especially gas assets in Russia, Iran, and Mozambique, could be critical to meeting domestic Indian demand. The same is true regarding investment in overseas liquefaction projects. Japanese and Chinese companies have already invested in liquefaction plants in Australia.

Indian companies should continue to proactively invest in liquefaction in countries like the US, Australia, Iran, Mozambique, Nigeria, and Algeria. India's existing natural gas infrastructure also needs expansion and upgrade.

References

1. The International Group of Liquefied Natural Gas Importers, Annual Report 2016.

2. LNG World News, "India Boosts February LNG Imports," Mar. 30, 2016.

3. Petroleum Planning & Analysis Cell, "Monthly Report on Natural Gas Production, Availability, and Consumption," March 2016.

4. Press Information Bureau, Government of India (PIB), "Approval to Innovative Mechanism for Utilization of Stranded-gas Based Generation Capacity," Mar. 25, 2015.

5. PIB, "Pooling of Gas in Fertilizer (Urea) Sector," Mar. 31, 2015.

6. PIB, "Nine Plants Emerged as Preferred Bidders and Allocated 7.62 MMscmd e-bid RLNG," Mar. 20, 2016.

7. Kar, S.K. and Vaid, M., "How Importing LNG can Secure India's Energy Future," The Financial Express, Apr. 12, 2016.

8. ICRA Ltd., "Revision in Price Formula of RasGas LNG: Credit Positive for LNG Marketers, Regasification Segment," January 2016.

9. Press Trust of India (PTI), "Revised Qatar LNG Deal Cuts Gas Price Below $5/MMbtu: Dharmendra Pradhan," The Economic Times, May 3, 2016.

10. PTI, GAIL India to Swap US LNG," Economic Times, Apr. 21, 2016.

11. Fineren, D., "Gazprom, India's GAIL Agree 20-yr LNG Sales Deal," Reuters, Oct. 1, 2012.

12. Abreu, A., "Gazprom Mulls Increased LNG Supplies to India by 2020: official," Platts, Feb. 9, 2015.

13. Ministry of Economy, Trade, and Industry, Government of Japan, "Spot LNG Prices Statistics," http://www.meti.go.jp/english/statistics/sho/slng/

14. Kazmin, R., "Global Spot LNG Prices Begin to Converge," ICIS, Mar. 4, 2016.

15. Chakraborty, D. and Singh, R.K., "India's GAIL Gets Biggest LNG Cargo in Dabhol to Restart Plant," Bloomberg, Oct. 13, 2015.

16. Petroleum & Natural Gas Regulatory Board, Government of India, Public Notice No.: EOI/NG/13/2015, May 13, 2015.

17. Timera Energy, "The Mountain of New LNG Supply," Mar. 16, 2015.

18. PIB, "India Exploring Australian Gas Supplies for Clean Affordable Power," Feb. 8, 2016.

19. PTI, "GAIL India Postpones $7-billion LNG Ship Tender by One Month," The Economic Times, Mar. 2, 2016.

20. Venunath, M., "Two Bids for GAIL LNG Shipping Tender," Fairplay, Apr. 1, 2016.

The authors

Sanjay Kumar Kar ([email protected]) is assistant professor and head of the department of management studies, Rajiv Gandhi Institute of Petroleum Technology, Uttar Pradesh, India. He has also served as assistant professor at School of Petroleum Management, Gandhinagar, and as an academic associate at Indian Institute of Management, Ahmedabad. Kar holds a Ph.D in management from Utkal University, Bhubaneswar, India. He is a regular contributor to national and international journals in the areas of energy policy, distribution of oil and gas, market structure, and marketing.

Manish Vaid ([email protected]) is junior fellow at Observer Research Foundation, New Delhi. He has also served as accounts executive at other companies. Vaid holds an executive post-graduate diploma in petroleum management (2010) from Pandit Deendayal Petroleum University, Gandhinagar, Gujarat.