Africa, North America, Russia lead 2019 LNG plant investment plans

Africa, North America, and Russia are taking the lead in the next phase of global LNG megaprojects, with 2019 expected to shatter previous investment records for the industry even as near-term market length grows.

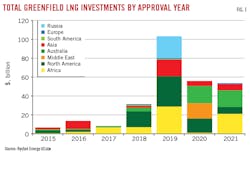

Rystad Energy forecasts that LNG greenfield investment in 2019 will reach nearly $103 billion, with more than a quarter of that in Africa. Mozambique’s Area 1 and Area 4 projects, the latter of which is expected to secure a final investment decision (FID) from operator ExxonMobil by the end-2019, are driving Africa’s LNG growth.

Anadarko’s June 2019 FID for the Area 1 LNG project marked “the beginning of a new phase for not only Mozambique and the African continent, but for the industry as a whole,” said Pranav Joshi, analyst on Rystad Energy’s upstream team. Greenfield capital expenditure (capex) for the Area 1 project is estimated at $15.6 billion, putting it in the same league as the major LNG developments in the US, Russia, and Australia. If ExxonMobil’s Area 4 reaches FID this year, it will represent another $14.7 billion in greenfield expenditure in Africa, bringing the yearly total to 28% of the global tally for approved investments in newly sanctioned LNG projects (Fig. 1).

“Area 1 is the largest LNG project that has been sanctioned in Africa to date and will also kick start the wave of sanctioning activity of other bigger LNG projects this year,” Joshi added.

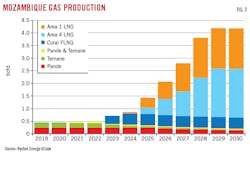

The Area 1 project—expected to start in 2024 and produce 12.88 million tonnes/year (tpy), according to Rystad—will transform Mozambique into a major LNG exporter (Fig. 2). Among the projects anticipated to reach FID in 2019, Area 1 is the third largest in terms of greenfield investment. The Arctic LNG 2 project has the largest greenfield capital investment at $25.75 billion, followed by each of Qatargas LNG’s $17.5 billion projects (Table 1).

Novatek plans three liquefaction trains at the 19.8-million tpy Arctic LNG 2 project near Russia’s Gydan Peninsula, with capacities of 6.6 million tpy each on gravity-based platforms. Gas will come from Utrenneye field.

Qatar Petroleum (QP) in May 2019 issued an invitation to tender for engineering, procurement, and construction (EPC) of additional LNG storage, loading, and export capacity for its North Field Expansion project. The tender package calls for EPC of three LNG storage tanks; compressors to recover tank boil off gas during storage and jetty boil off gas during LNG vessel loading; LNG rundown lines from the LNG trains to the LNG storage area; two additional LNG berths with an option for a third LNG berth; and loading and return lines from the LNG berths to the tanks. QP had previously awarded front-end engineering and design (FEED) for 23 million tpy of new liquefaction capacity to Chiyoda Corp.

ExxonMobil and QP in February 2019 made an FID to proceed with development of the Golden Pass LNG export project in Sabine Pass, Tex. The 16-million tpy project is expected to begin exports in 2024. Construction began in May 2019.

Tellurian Inc. and subsidiaries of Total SA in July 2019 finalized sales-and-purchase and direct investment agreements in the Driftwood LNG project. Tellurian president and chief executive officer Meg Gentle said the company intends “to finalize agreements with remaining partners and make an FID in 2019.”

Driftwood, near Lake Charles, La., would have 27.6 million tpy of export capacity. The plant and associated pipeline have received all necessary permits and licenses to begin construction.

The US Department of Energy (DOE) in March 2019 announced long-term authorization of LNG export by Venture Global’s Calcasieu Pass LNG, being built in Cameron Parish, La. Under the order, Calcasieu Pass will be able to export up to 1.7 bcfd of natural gas to countries that do not have a free trade agreement (FTA) with the US and are not prohibited from trading with the US. The Calcasieu Pass authorization brought the DOE-approved non-FTA export total 24.74 bcfd.

Venture Global in May 2019 received a $1.3 billion equity investment from Stonepeak Infrastructure Partners for Calcasieu Pass. The plant’s planned capacity is 10 million tpy.

In April 2019 Pieridae Energy said it would make an FID on its Goldboro LNG project in Nova Scotia, Canada, by midyear to begin construction before 2020. Pieridae expects Goldboro to begin exports by fourth-quarter 2023.

Goldboro will have a send-out capacity of 10 million tpy, loadable onto vessels as large as 250,000 cu m. The plant includes three 230,000 cu m storage tanks and will load 7-13 ships/month.

Woodside Petroleum Ltd., Perth, in January 2019 let a FEED contract to Bechtel for the Pluto LNG Train 2 project on Burrup Peninsula, Western Australia. The contract includes an option for Woodside to progress to a lump-sum EPC contract. This option is subject to many conditions including a positive FID expected in 2020. Woodside expects to bring the project on stream in 2024. Pluto Train 2 has a target capacity of 5 million tpy.

The natural gas agreement for the Papua LNG expansion (Elk-Antelope) project in the Eastern Highlands of Papua New Guinea was signed in April 2019. Each of the two new trains for the Papua LNG project will have 2.7-million tpy capacity.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.