Shell: Global LNG demand to rise 4-5%/year to 2030

Global demand for natural gas is expected to increase 2%/year between 2015 and 2030, with LNG demand expected to rise at twice that rate at 4-5%/year, according to Royal Dutch Shell PLC’s first LNG Outlook.

Shell inherited the outlook following its acquisition of BG Group PLC.

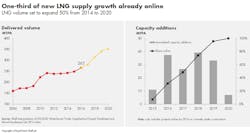

The report, which draws on a broad range of independent industry data and internal analysis, projects the size of the global LNG market to rise 50% between 2014 and 2020, mainly attributable to LNG facilities already under construction or recently completed.

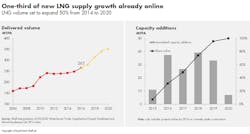

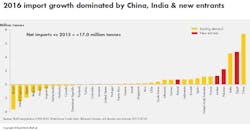

In 2016, global LNG demand reached 265 million tonnes, including an increase in net LNG imports of 17 million tonnes from a year earlier.

Shell notes many expected a strong increase in new LNG supplies would outpace demand growth during 2016. However, demand growth kept pace with supply as greater-than-expected demand in Asia and the Middle East absorbed the increase in supply from Australia.

China and India, which are set to continue driving a rise in demand, were two of the fastest-growing buyers in 2016, increasing their imports by a combined 11.9 million tonnes of LNG. This boosted China’s LNG imports in 2016 to 27 million tonnes and India’s to 20 million tonnes.

LNG demand has been bolstered by the addition of six new importing countries since 2015—Colombia, Egypt, Jamaica, Jordan, Pakistan, and Poland—bringing to 35 the number of LNG importers, up from about 10 at the start of the century. Egypt, Jordan, and Pakistan were among the fastest-growing LNG importers in the world in 2016. Due to local shortages in gas supplies, they imported a total of 13.9 million tonnes of LNG.

The bulk of the increase in LNG exports in 2016 came from Australia, where exports rose 15 million tonnes from a year earlier to a total of 44.3 million tonnes. The US also contributed the growth, with 2.9 million tonnes of LNG delivered from the Sabine Pass terminal in Louisiana.

Shell’s outlook forecasts LNG prices to continue to be determined by multiple factors, including oil prices, global LNG supply and demand dynamics, and the costs of new LNG facilities. In addition, the growth of LNG trade has evolved into helping meet demand when US gas markets face supply shortages.

LNG trade also is changing to meet the needs of buyers, including shorter-term and lower-volume contracts with greater degrees of flexibility, Shell says. Some emerging LNG buyers have more challenging credit ratings than traditional buyers.

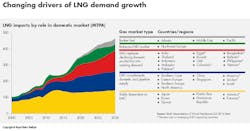

While the industry has been flexible in developing new demand, there has been a decrease in final investment decisions for new supply. Shell believes industry will have to make further investments to meet growing demand, most of which is set to come from Asia, after 2020.

A Chinese government target has been set for gas to make up 15% of the country’s energy mix by 2030, up from 5% in 2015. An additional 100 million tonnes/year of LNG demand from China would be equal to an increase of more than 20% in total global LNG demand in 2030.

Meanwhile, Southeast Asia is projected to become a net importer of LNG by 2035, a major transformation for a region that includes Malaysia and Indonesia, currently among the major LNG exporters in the world.