SPECIAL REPORT: Capital budgets grow in US, drop in Canada

Capital spending for oil and gas projects in the US will increase this year, buoyed by growth in upstream, midstream, and downstream developments and maintenance. The growth rates of US upstream and downstream spending will exceed those of last year.

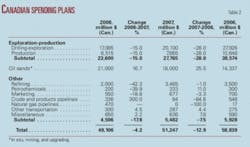

In Canada, total project spending will decline but by a smaller margin than it did a year ago. While oil sands expenditures will increase, outlays for most other types of projects will shrink.

Capital budgets will be pulled by higher costs for materials, equipment, and labor, all of which are in high demand. Labor cost pressures are especially strong in Alberta.

Total budgets for capital spending in the US this year are estimated at $197 billion, up from $175 billion last year. Two years ago total spending was almost $169 billion.

Total spending in Canada will be $49 billion (Can.) this year, down from $51 billion last year and nearly $59 billion 2 years ago.

Spending outside the US and Canada will remain strong with upstream and downstream projects progressing.

OGJ’s upstream capital spending forecast is based on estimates of drilling activity and costs, past expenditures, and companies’ 2008 budgets. Downstream spending is estimated from the capital budgets of refiners, petrochemical manufacturers, pipeline companies, and others, in addition to individual project announcements.

US upstream spending

Oil and gas exploration, drilling, and production spending in the US this year will increase nearly 6% to $160.2 billion (Table 1).

This forecast is based on OGJ’s annual drilling forecast, which projected that the total number of well completions in the US this year will be 49,012 (OGJ, Jan. 21, 2008, p. 35).

Drilling and exploration expenditures will total $130.2 billion, including $17 billion for geological and geophysical costs. Outlays for production will total $24.75 billion, up 4% from a year ago.

Upstream activity in the deep water of the Gulf of Mexico is reflected by the amount of bonus payments the Minerals Management Service (MMS) collects from lease sales related to the Outer Continental Shelf. OCS bonus payments in 2008 will jump 88%.

In 2006, OCS lease bonus payments totaled $914 million following two sales: one in the Central Gulf of Mexico and one in the Western Gulf of Mexico.

Last year, the MMS held another two sales offering tracts in these areas. These sales resulted in OCS payments of $2.8 billion.

The MMS has scheduled three lease sales for this year, from which OGJ forecasts that bonus payments will total $5.25 billion.

The next proposed lease sale, scheduled for Aug. 20, will include about 3,400 blocks covering 18 million acres in the Western Gulf of Mexico area off Texas. MMS estimates this lease sale could result in the production of 242-423 million bbl of oil and 1.64-2.64 tcf of natural gas.

Offshore E&P activity continues to move into deeper waters. In a February 2008 report on deepwater activity, WoodMackenzie said: “The lower level of exploration activity during 2007 is in part due to higher levels of appraisal and development drilling activity coupled with the tight rig market. We expect exploration drilling to pick up in 2008, driven by a combination of factors. Increased rig availability, further prospect identification from ongoing seismic analysis, and the acquisition of large amounts of acreage in 2007 will all encourage exploration.”

US refining

Capital expenditures for transportation, downstream projects, and corporate spending in the US this year will total $36.7 billion, according to OGJ’s forecast. This is up from $23.9 billion last year and $20.2 billion in 2006. Leading the spending growth are pipeline, refining, and LNG projects.

A few large expansion projects will boost spending to $13 billion at refineries this year. In 2007, refining capital outlays declined 8% to $8.3 billion.

Among current projects is Motiva’s Port Arthur refinery expansion, which will bring total crude distillation capacity to 600,000 b/d. The additional 325,000 b/d of capacity will be online in 2010.

Encana and ConocoPhillips are expanding the heavy-oil processing capacity of the 306,000-b/d Wood River refinery in Illinois, which they operate via their WRB Refining LLC partnership. ConocoPhillips has allocated about $1.6 billion for capital spending at its US refineries this year, focusing on reliability, energy efficiency, capital maintenance, and regulatory compliance. The company also said work continues at a number of its refineries to increase crude capacity, expand conversion capability, and increase clean product yield.

In February, Total announced a project to build a 50,000 b/d coker, a desulfurization unit, a vacuum distillation unit, and related units at its Port Arthur, Tex., refinery. The project, scheduled for commissioning in 2011, will cost $2.2 billion.

The new units at Port Arthur will increase the refinery’s deep-conversion capacity and expand its ability to process heavy and sour crude, and the project will add 3 million tonnes/year of ultralow-sulfur diesel to the refinery’s current output.

Petrochemicals, pipelines

OGJ forecasts that 2008 US petrochemical spending will total $1 billion. This is up from last year. The majority of petrochemical investment, however, has shifted toward growth opportunities in the Middle East and Asia. Spending at petrochemical plants in the US this year will be directed toward maintenance as well as health, safety, and environmental improvements.

US pipeline spending will surge this year to $12 billion, up from $6 billion last year and $2 billion a year earlier.

Expenditures for crude and products pipelines will be $6.6 billion, as plans call for construction of almost 2,900 miles this year (OGJ, Feb. 18, 2008, p. 46).

Projects getting under way this year include the US portion of the Keystone pipeline to transport crude to the US Midwest from Canada. This project’s total cost is estimated at $5.2 billion.

This year’s natural gas pipeline projects will cost $5.7 billion, with nearly all the lines larger than 22 in. in diameter. Last year’s US gas pipeline spending was $4.4 billion, double such 2006 expenditures.

OGJ also forecasts capital spending increases of about 20% for other transportation projects, marketing, mining, and other energy outlays.

All remaining US capital expenditures will total $5 billion this year. Half of this is allocated to new LNG receiving terminals and expansions at existing terminals. Other expenditures in this category include spending for natural gas liquids plants and corporate costs.

Spending in Canada

The expected 4% decline in Canadian expenditures this year will come mainly in conventional oil and gas categories.

Putting a damper on conventional oil and gas investment is Alberta’s new royalty structure. The royalty increase, which begins next year, is widely expected to discourage drilling, especially for natural gas. Earlier this month, the government announced that it will ease the terms for production from deep oil and gas wells, citing unintended consequences (OGJ, Apr. 21, 2008, Newsletter).

OGJ’s forecast estimated the number of 2008 well completions in Canada at 15,713, down from 18,535 last year. In 2006, there were 25,811 well completions in Canada, according to the Canadian Association of Petroleum Producers.

This year’s conventional E&P spending in Canada will total $23.6 billion (Can.), down 15%. This follows a 28% decline last year.

Oil sands spending for in situ, mining, and upgrading activity will climb almost 17% to $21 billion. A year ago such spending surged more than 25%.

Strongly affecting all oil and gas development in Canada is the growing need for workers. A construction labor shortage will last through 2009, according to a November 2007 report from the Construction Owners Association of Alberta.

Suncor Energy Inc. announced a $7.5 billion (Can.) capital spending plan for this year. About 80% of the total capital budget will target growth, primarily oil sands projects. The budget also includes about $275 million to increase natural gas production, and the remainder is planned for sustaining existing operations company-wide.

All other spending in Canada this year will decline 18% from last year. Spending reductions for refining, petrochemicals, and marketing will overcome increases in pipeline, other transportation, and miscellaneous capital expenditures.

Refining outlays will post the largest percentage decline: 42%. Most of the refining projects in Canada this year will be new and expanded heavy oil upgraders, and this spending is included in the oil sands figures in Table 2.

Among the few current conventional oil refinery projects are Petro-Canada’s Edmonton refinery conversion, to be completed this year, and a new coker at its Montreal refinery, to be completed in 2010.

Petrochemicals spending will decline 40% this year in Canada. Last year such expenditures grew 11%.

Nova Chemicals is making operational improvements to increase capacity at its polyethylene plant in Joffre. The expansion, to be completed next year, will increase capacity about 100 million lb/year to 1 billion lb/year.

Nova also will continue a series of polyethylene plant modernization and expansion projects in Ontario. The projects will add a total of up to 250 million lb/yr of polyethylene capacity in stages over the next 2 years.

Crude and products pipeline spending will increase 300% this year, with plans for 416 miles of construction planned in Canada. Plans also call for the construction of 241 miles of gas lines, compared to none last year.

Miscellaneous spending in Canada, including corporate costs and LNG, will be $650 million, up slightly from last year.

Current LNG projects in Canada include the Canaport LNG receiving and regasification terminal in Saint John, NB, scheduled to begin operations late this year. Initial send-out capacity will be 1 bcfd.

There have been plans for other LNG terminals in Canada, including the Kitimat LNG terminal in Beese Creek, BC, and a Petro-Canada terminal in Quebec.

Construction of Petro-Canada’s planned terminal in Gros Cacouna, Que., is uncertain. On Feb. 7, Gazprom decided not to pursue its proposed Baltic LNG project, the potential anchor supply for the Cacouna terminal.

Petro-Canada said supply shortages, capital cost pressures, excess North American regasification capacity, and worldwide natural gas economics have put a strain on the development of LNG import projects in North America.

Spending elsewhere

Outside the US and Canada, capital spending will remain strong.

In its most recent spending outlook, Lehman Bros. reported that such E&P expenditures will rise 16% this year to $267 billion.

Pemex has announced spending plans for 2008 of $19.4 billion, with 83% dedicated to upstream operations, focusing on maintaining oil production.

During a Mar. 26 conference call on Mexico’s reserves, Carlos Morales, head of E&P at Pemex, said that although the country’s oil production during the first 2 months of this year averaged 2.9 million b/d, the company expects output for the year to average 3-3.1 million b/d.

On Mar. 30, Pemex released a report detailing 13 years of production expectations, with output declines from Cantarell field plus a declining reserves base in Mexico.

George Baker of Baker & Associates, Houston, commented on the report: “Pemex, in its diagnostic report, reveals determination to develop fields in deep water, fully realizing the value of experience in the selection and timing of technology. The document stops short, however, of advocating the long-awaited strategic alliances of [international oil companies].”

Total downstream spending outside North America includes large petrochemical projects in China, India, Qatar, Singapore, and Saudi Arabia, as detailed in OGJ’s most recent worldwide construction update (OGJ, Apr. 7, 2008, p. 24).

LNG spending outside the US and Canada will mostly go toward liquefaction capacity in the Middle East, Africa, and Australia.