Permian gas midstream racing to stay ahead of production

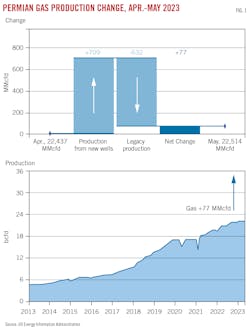

Mounting Permian basin midstream bottlenecks remain a significant concern for the industry, as natural gas production continues to grow despite persistently low prices and continued producer emphasis on capital restraint. The US Energy Information Administration (EIA) projects May 2023 production in the Permian to reach 22.514 bcfd, up 77 MMcfd from April.

Relatively high crude oil prices have played a large role in keeping natural gas production climbing, as producers seeking to maximize crude output end up pumping large volumes of associated gas as well. As of late 2022, associated gas production in the Permian averaged more than 15 bcfd, roughly two-thirds of total output.

In its first-quarter 2023 earnings call, ExxonMobil Corp. reaffirmed its end-2022 crude production growth target of 10% for the basin, with Chevron Corp. also having targeted double-digit output gains. Pioneer Natural Resources predicted a 5% uptick in liquids production and even higher gas production growth rates. ConocoPhillips Co.’s projections were similar to start the year.

Looking at longer-term indicators, the US rig count as reported by Baker Hughes Co. slipped to 755 at the end of first-quarter 2023, its first quarter-on-quarter decline since 2020 despite still being 12% above year-ago levels. Declines have continued since, the May 5 count coming in at 748, just 6% above the same timing for 2022.

Falling natural gas prices have done nothing to help the kind of long-term confidence decisions regarding rig deployment depend upon. By the end of first-quarter 2023 natural gas futures prices in the US had fallen to 30-month low below $2.00/MMbtu, driven by the combination of rising output and a mild winter. Henry Hub spot prices as of May 2 were $2.03/MMbtu, with natural gas production in the US having risen for 23 straight months. February 2023 production averaged 101.5 bcfd, according to EIA, 7.4% up from the same timing a year earlier and the highest level since the agency began tracking production in 1973.

In the Permian, physical spot prices were both low and very volatile. Multiple trips into negative pricing occurred at the Waha hub, most recently starting in mid-April 2023 when prices dropped to -$0.33/MMbtu. By the start of May prices had returned to above $1.60/MMbtu, but just a few days later (May 5) had shed nearly 50% of their value, hitting $0.83/MMbtu, and returned to negative May 10 when next-day Waha fixed-price futures closed at -$0.35/MMbtu.

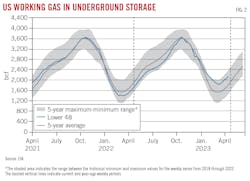

The severity of such price drops was driven largely by planned pipeline maintenance constricting outward transportation. But high storage levels in both the US and Europe following a mild winter are unlikely to reduce the potential for either future excursions into negative territory or continued price volatility for Permian natural gas.

Net withdrawals of natural gas from underground storage totaled 1.707 tcf during the 2022–23 heating season (November–March), according to EIA, the lowest on record since 2015–16. Working natural gas in Lower 48 underground storage totaled 1.83 tcf as of Mar. 31, 2023, exceeding the 5-year average by 294 bcf (19%), after entering the heating season at a 110 bcf (3%) deficit. As of May 5, working gas in storage’s gap over the 5-year average had expanded to 332 bcf, with total inventories of 2.14 tcf (Fig. 2).

This surplus is not uniform, however. Heating-degree days (HDD) were 23% above normal in the Pacific region and 12% above normal in the Mountain region. These below-normal temperatures left working gas stocks in the Pacific storage region at their lowest levels on record, totaling 73 bcf, 57% less than the 5-year average, EIA said. Any difficulties moving gas west to help replenish these inventories will further pressure Waha-basis pricing.

Most of the world’s LNG (97%, according to EIA) is consumed in the Northern Hemisphere, which experienced the fifth-warmest winter on record. European gas inventories as of Apr. 1, 2023, were 56% full—the highest level on record for the end of the heating season, according to data from Gas Storage Europe’s Aggregated Gas Storage Inventory. This year’s end-of-season stocks of 2.02 tcf exceeded the previous record of 1.98 tcf at the end of winter 2019–20 and were well above the 5-year average of 1.21 tcf.

Europe’s high storage levels are the result of the exceptionally warm winter, lower natural gas consumption resulting in part from a Europe-wide effort to conserve natural gas in light of the war in Ukraine, and record LNG imports. Europe’s demand for imported gas will continue, again providing an opportunity for Permian producers, but only if they can get their gas to market.

In Asia, key LNG-consuming countries reduced spot LNG imports, as natural gas consumption remained low and on-site LNG storage, which has limited capacity, remained full, according to EIA. Reduced demand for spot LNG in Asia led to record volumes of LNG being shipped to Europe.

Looking forward

Enterprise Products Partners is adding two new 300-MMcfd gas processing plants, one in Delaware basin and one in Midland basin. Targa Resources Corp., meanwhile, is adding five new plants with a combined capacity of 1.2 bcfd:

- Legacy II (Midland), second-quarter 2023.

- Midway (Delaware), second-quarter 2023.

- Greenwood (Midland), fourth-quarter 2023.

- Wildcat II (Delaware), first-quarter 2024.

- Roadrunner II (Delaware), second-quarter 2024.

Energy Transfer LP in December 2022 placed its 200-MMcfd Grey Wolf processing plant into service in Delaware basin and is building its second 200-MMcfd Permian plant, Bear, with plans for second-quarter 2023 start up. The company said that “significant producer demand” was prompting it to evaluate the need for and timing of another processing plant in the Permian basin.

Western Midstream Partners LP and WTG Gas Processing LP are also adding Permian gas processing capacity between now and mid-2024.

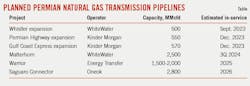

As previously mentioned, constraints on pipelines out of West Texas have led to Waha basis spot pricing occasionally turning negative since fourth-quarter 2022. Pipeline operators are adding more than 4 bcfd of eastbound Permian gas takeaway capacity by third-quarter 2024, with at least one sizeable westbound project awaiting final investment decision (FID).

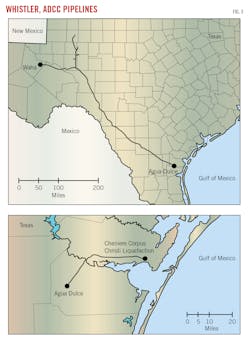

MPLX LP’s 500-MMcfd Whistler pipeline expansion will bring the line’s capacity to 2.5 bcfd in September 2023 by installing three new compressor stations. Whistler runs 450 miles from the Waha header to Agua Dulce hub, providing access to South Texas end-users and LNG infrastructure. MPLX owns Whistler with WhiteWater Midstream LLC and a joint venture of Stonepeak Infrastructure Partners LP and West Texas Gas Inc.

WhiteWater and subsidiaries of Whistler Pipeline LLC and Cheniere Energy Inc. agreed last year to move forward with construction of the 42-in. OD Agua Dulce-Corpus Christi (ADCC) pipeline, expected to extend 43 miles from Whistler’s terminus to Cheniere’s 15-million tonne/year Corpus Christi liquefaction plant. ADCC—designed to transport up to 1.7 bcfd of natural gas, expandable to 2.5 bcfd—is expected to be in service in 2024.

The in-service date for Kinder Morgan Inc.’s (KMI) 550-MMcfd expansion of the Permian Highway (PHP) natural gas pipeline slipped earlier this year to December 2023, with KMI attributing the delay to supply-chain constraints. The 2.1-bcfd PHP, owned by KMI, Kinetik Holdings Inc., and ExxonMobil Corp., ships gas 430 miles from the Waha area in the Permian basin to the US Gulf Coast. The expansion was originally expected to have entered service Nov. 1, 2023

KMI’s 570,000-MMcfd Gulf Coast Express pipeline expansion would increase the line’s capacity between the Permian and South Texas to 2.55 bcfd by December 2023. As recently as March 2023, however, partner Kinetic Holdings Inc. (16%) was downplaying the project in its quarterly earnings call, saying that producers were more interested in greenfield projects such as Matterhorn Express and Warrior. As of May 2023, the expansion also was not listed on the projects tab of KMI’s website, unlike Permian Highway. Gulf Coast Express’ ownership is completed by DCP Midstream LP (25%) and ArcLight Capital Partners LLC (25%).

Of the two greenfield projects, the 2.5-bcfd Matterhorn Express is the more firmly established, with landowner negotiations underway in February 2023. Owned by a joint venture of WhiteWater, EnLink Midstream Partners LP, Devon Energy Corp. (also an anchor shipper), and MPLX, the 490-mile, 42-in. OD line would carry Permian basin gas from the Waha hub to Katy, Tex., and is expected to enter service third-quarter 2024.

WhiteWater also plans to build the 48-in. OD, 193-mile Blackfin pipeline between Colorado County and Jasper, Tex., north of Beaumont. A construction application approved by the Railroad Commission of Texas on Mar. 8, 2023, named Matterhorn Express Pipeline as Blackfin’s economic operator and the pipeline would increase Permian delivery optionality out of Katy.

Energy Transfer’s 260-mile Warrior pipeline (1.5-2 bcfd) would carry gas along a more northerly route towards interconnects southwest of Ft. Worth, Tex., with its own infrastructure for continued transport to the Gulf Coast. Warrior’s plans include a combination of repurposing underutilized pipe and building loops within existing right-of-way.

The company noted in its first-quarter 2023 earnings call that it has signed 25-30% of its FID target volumes and that it is in negotiations with holders of more than 2 bcfd of additional interest. Given the proposed route and its ability to use existing assets, Energy Transfer says it could complete construction within 2 years of reaching FID.

Looking westward, Oneok Inc. has proposed the 2.8-bcfd Saguaro Connector pipeline and is targeting an early second-half 2023 FID. The 155-mile, 48-in. OD pipeline would run from the Waha hub to a border crossing in Hudspeth County, Tex., connecting there with a new pipeline under development in Mexico for gas delivery to Mexico Pacific Ltd. LLC’s 14.1 million tonne/year (tpy) Saguaro Energia LNG plant, under development in Puerto Libertad, Sonora, Mexico.

Mexico Pacific expects to start receiving gas in 2026 and is targeting first LNG exports in 2027. It has signed two 20-year sales agreements with ExxonMobil LNG Asia Pacific for a combined 2 million tpy (OGJ Online, Feb. 8, 2023). The company also has deals in place with Shell PLC for 3.7 million tpy and Guangzhou Development Group Inc. for 2 million tpy. Mexico Pacific said earlier this year that it had “reached a critical point on contract volumes required for FID” on its first two 4.7-million tpy trains.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.