Hydrogen buildout requires sufficient demand, infrastructure

Adapted from Congressional Research Service Report R47289, “Hydrogen Hubs and Demonstrating the Hydrogen Energy Value Chain,” Oct. 24, 2022.

Economic development of hydrogen as an alternative energy source requires sufficient end-user demand. But meeting that demand will, in turn, require sufficient infrastructure.

Hydrogen hubs are emerging centers of activity involving hydrogen production, transport, delivery, and end-use to provide energy services, such as mobility, goods movement, and heat for manufacturing processes. The US Congress, in 2021’s Infrastructure Investment and Jobs Act (IIJA), authorized a program of regional clean hydrogen hubs. Congress appropriated $8 billion for the Department of Energy (DOE) to make awards to support at least four demonstration projects involving networks of clean hydrogen producers and consumers and the connecting infrastructure. Congress also created the Office of Clean Energy Demonstrations (OCED) to manage these and other non-hydrogen demonstration projects. DOE’s Hydrogen and Fuel Cell Technologies Office (HFTO) retains the role of overall lead for coordination of the department’s hydrogen programs.

A future economy using hydrogen as an energy carrier and fuel could offer an alternative method to providing the modern energy services associated with fossil fuels. In addition to providing a fuel for transportation—one of the larger applications envisaged—hydrogen could support industrial processes or building operations or become part of the energy infrastructure by storing energy. Demonstrations of hydrogen technology and value propositions based on hydrogen continue to emerge, ranging from one-off funded projects to public-private partnerships (P3s) with regional scope, both in the US and abroad.

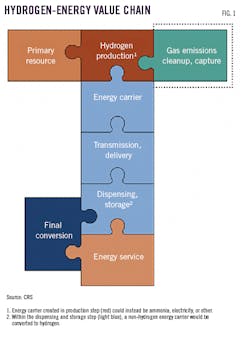

Many such projects investigate uses of hydrogen as fuel for personal transportation or industrial heat for manufacturing. The hydrogen-energy value chain spans resource extraction, production, storage, and final conversion and end-use. Although demonstrations have addressed portions of this value chain, DOE’s statements regarding regional clean hydrogen hubs envisage the full value chain, following the prescriptions of the IIJA.

DOE hydrogen programs

The DOE Hydrogen Program, led by the HFTO within the Office of Energy Efficiency and Renewable Energy (EERE) and including several other DOE offices, addresses the development of applications that use hydrogen in place of other fuels and technologies. The hydrogen program also considers hydrogen in its established role as a chemical feedstock. The hydrogen program includes more than 400 projects spanning research and development (R&D), systems integration, demonstrations, and initial deployment activities by universities, national laboratories, and industry.1

The essential purpose of demonstrations is to show technological feasibility. A demonstration project receiving government support also reduces risk to subsequent investors as the government assumes the role of first mover to some extent. Inserting a technology into a demonstration project allows testing in relative isolation so that any failures have limited consequences and do not cascade more widely, for example into an energy network such as an electric power grid.2

DOE has stated that the regional clean hydrogen hubs authorized in IIJA will yield insights and validate the claimed benefits (environmental and otherwise) of the hydrogen economy and will identify technology needs.3 Hydrogen demonstration projects have addressed portions of the full hydrogen energy value chain depicted in Fig. 1.

Regional clean hydrogen hubs

DOE launched an initial funding opportunity announcement in September 2022.4 The department plans to select six to ten regional clean hydrogen hubs with combined total funding of as much as $6-7 billion and a “preferred maximum” of $1.25 billion/hub. DOE states that the balance of the $8 billion appropriated for the hubs in the IIJA may be reserved for additional hubs or other supporting activities. The department is requiring a minimum 50% cost share from nonfederal sources and anticipates projects to be executed over 8-12 years.4

Concept papers were due Nov. 7, 2022, and full funding applications will be due by Apr. 7, 2023. DOE conducted initial consultations including a request for information on Feb. 16, 2022, and received more than 120 responses comprising more than 1,300 pages.5

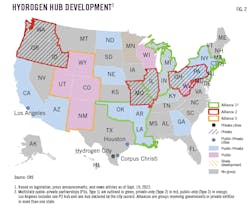

Based on state legislative activity, press releases, and news articles, it appears that state governments, many in combination with private-sector entities and one or more other states, have announced interest in more than 20 hydrogen hubs and stated their nonbinding intention to apply for funding for regional clean hydrogen hubs. At least four private alliances have also declared interest in pursuing regional clean hydrogen hubs.

Fig. 2 shows states with entities that appear to have expressed interest in IIJA funding for hydrogen hubs. The Congressional Research Service (CRS) found hydrogen hub activities in various stages of planning, with some groups having a declared geography and others not specifying a location. Groups also are soliciting additional participants.

Requirements

Regional clean hydrogen hubs must “demonstrate the production, processing, delivery, storage, and end-use of clean hydrogen.”6 Criteria that must be used are:

- Feedstock diversity. At least one hub shall demonstrate the production of clean hydrogen from fossil fuels, one hub from renewable energy, and one hub from nuclear energy.

- End-use diversity. At least one hub shall demonstrate the end-use of clean hydrogen in electric power generation, one in the industrial sector, one in residential and commercial heating, and one in transportation.

- Geographic diversity. Each regional clean hydrogen hub shall be in a different region of the country and shall use energy resources abundant in that region.

- Hubs in natural gas-producing regions. At least two regional clean hydrogen hubs shall be in regions of the US with the greatest natural gas resources.

- Employment. DOE shall give priority to regional clean hydrogen hubs likely to create opportunities for skilled training and long-term employment to the greatest number of residents in the region.

- Additional criteria. DOE may take into consideration other criteria necessary or appropriate to carrying out the regional clean hydrogen hubs program.

Early deployment

Industrial processes that use hydrogen already occur at large scale, such as petroleum refining or production of ammonia to make urea for fertilizer. Demonstrations of additional industrial uses of hydrogen are being developed in cement, ceramics, and glass manufacturing, substituting hydrogen for operations that currently use other fuels.7

The customer-facing hydrogen technologies now available to retail consumers include hydrogen refueling stations and fuel-cell electric vehicle (FCEV) cars. Overall, FCEVs comprised slightly fewer than 1 in every 20,000 cars in the US at end-2021.8

DOE has identified other applications in early deployment. These include more than 50,000 fork lifts used for logistical operations—known as material handling equipment (MHE)—and hydrogen back-up power devices totaling more than 500-Mw.1 The two applications together received roughly $40 million from the 2009 American Recovery and Reinvestment Act.

Though early in its project-execution phase, Advanced Clean Energy Storage, a hydrogen and energy storage site, received a $504-million DOE loan guarantee in June 2022 to build 220 Mw of electrolyzers in Delta, Utah, paired with underground caverns to store the hydrogen. The project’s estimated storage capacity is 150 Gw-hr. The end-user of the stored hydrogen plans to fuel a hydrogen-capable gas turbine supplied by project partner Mitsubishi Power Americas Inc. to generate electricity.

An informal DOE survey identified a number of perceived barriers to hydrogen market adoption, including the cost to the end-user of hydrogen technologies; need for sufficient hydrogen infrastructure; and public awareness and understanding.1 Addressing this perceived need for sufficient infrastructure, and the cost involved, the California Air Resources Board modeled a year-by-year build-out of hydrogen refueling stations and estimated that 1,000 refueling stations would be needed for an assumed 1 million FCEV,9 at an estimated cost of $1.9 million (in 2016 dollars) per station based on early experience.10

International experience

Demonstration and early deployment of the hydrogen value chain outside the US includes planned and nascent activities similar to regional clean hydrogen hubs. A European Commission (EC)-sponsored project conducts global surveillance of selected hydrogen activities in deployment phase that are large-scale, have a clear geographic center, cover multiple steps in the value chain, and provide supply to multiple end-uses, calling these “hydrogen valleys.”11 The hydrogen valleys are a similar idea to IIJA’s regional clean hydrogen hubs.

The EC project follows 33 hydrogen valleys worldwide, including two in the US. It identified permitting as the number one policy barrier during a survey of participants. Respondents noted that local permitting authorities were not familiar with hydrogen. The survey included 28 locations either planning (90%) or having implemented (10%) large-scale, full hydrogen value-chain systems with multiple end-user in a defined geography.

Another study reported on emerging “hydrogen clusters,” not unlike hydrogen hubs, in the Netherlands, Chile, Spain, and the UK. In the Netherlands, the study identified three ports with plans for green and blue hydrogen aided by proximity to demand from existing refineries and ammonia and steel plants. These locations allow for integration; for example, the oxygen by-product from electrolysis of water is being repurposed for use in basic oxygen furnaces for steelmaking.12 The study identified further opportunities for clusters to include activities at transport hubs and ports.

Hydrogen produced via electrolyzers is generally referred to as “green hydrogen” if the source of electricity is renewable. “Blue hydrogen” results when the carbon released from steam reforming of natural gas is captured and stored (i.e., carbon capture, utilization, and storage). Blue hydrogen is sometimes referred to as “carbon neutral” since the emissions are not dispersed in the atmosphere.

Future hydrogen hubs

Studies have speculated on the size, scope, and scale of future hydrogen hubs. One study noted the advantages and economies of co-location of various industries, as this might allow integration between energy requirements and chemical byproducts and suggested that this might be a driver for the formation of hydrogen hubs.12 The study considered four characteristic scenarios for hydrogen hubs built around the following demand centers: a city, a port, fertilizer manufacture and petroleum refining, and steelmaking.

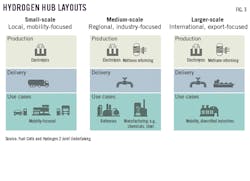

Another study surveyed existing and emerging hydrogen hubs in an international context and determined these and future hubs might evolve from existing infrastructure or existing plans for new infastructure. Fig. 3 shows the layout of such hubs. The scale of production increases left-to-right in the figure; the geographic orientation ranges from local to regional to international, also left-to-right. The left-most hub concept, mobility, is envisaged as a public-private partnership, while the other two hub concepts are envisaged as wholly private sector. The studies do not exhaust all possibilities.

Other concepts for hydrogen hubs might combine different applications, scales of production, and off-takers. For example, DOE’s Hydrogen Shot program—which supports making hydrogen commercially available at a cost of $1/kg in 1 decade—noted emerging “clusters” in the US based on other industries and geographies.13 DOE differentiated the clusters according to resources; influences such as population, policy, or pollution; and end-users.

Sufficient off-takers

Hydrogen consumption is focused in a relatively concentrated set of end-users. Almost all is consumed by the oil industry or chemical industry either after onsite production or via delivery through dedicated pipelines from large merchant producers. The hydrogen hubs and the additional supply of hydrogen they aim to create will need to be matched to new sources of demand in order to be economically feasible. DOE specifically addresses this problem in its February 2022 RFI and developed Hydrogen Matchmaker to connect hydrogen supplies with users.14

Global experience with hydrogen hubs underscores the urgency for finding off-takers, with one EU-funded study identifying it as one of the largest financial barriers to realizing such projects.15 At a February 2022 hearing of the Senate Energy and Natural Resources Committee, Chairman Joe Manchin (D-W. Va.) noted that, if new hydrogen demand were to arise from converting today’s end-use applications to hydrogen, it would require large investment from both public and private sectors.

Hydrogen pipeline regulation

DOE’s 2020 Hydrogen Program Plan identified rights-of-way and permitting for hydrogen pipelines as two of the problems to be overcome for hydrogen delivery infrastructure.16 Key policy issues that Congress may examine include the regulation of pipeline siting—including potential federal-state jurisdictional conflicts—and the regulation of pipeline rates and terms of service.

For example, some hydrogen proponents have suggested that Congress establish federal siting authority for interstate hydrogen pipelines analogous to the Federal Energy Regulatory Commission natural gas siting authority under the Natural Gas Act.17 Preempting state authority in this way could simplify the siting process, but would not necessarily ensure such pipelines would be built and might raise concerns from affected states.

Sufficient infrastructure

Hydrogen in its current uses has a dedicated infrastructure, but one that is small compared with natural gas. There are 1,600 miles of hydrogen pipelines in the US compared with 300,000 miles of natural gas transmission pipelines.18 More than 90%, by mile of pipeline, of hydrogen pipelines are in Texas and Louisiana with 10 other states having fewer than 35 miles each.19

The layout of these pipelines provides service to a relatively concentrated set of end-users, with most hydrogen pipelines owned by merchant hydrogen producers who sell their hydrogen to industry in bulk. To service a fleet of numerous and relatively small hydrogen refueling stations for FCEVs, for example, will require a different hydrogen delivery infrastructure. This might include additional pipelines and delivery trucks loaded with liquid or compressed hydrogen gas, or onsite hydrogen production from electricity or natural gas.

References

- Satyapal, S., “2022 AMR Plenary Session,” June 6, 2022, https://www.energy.gov/sites/default/files/2022-06/hfto-amr-plenary-satyapal-2022-1.pdf.

- Hart, D.M., “Beyond the Technology Pork Barrel? An Assessment of the Obama Administration’s Energy Demonstration Projects,” Energy Policy, Vol. 119, August 2018, pp. 367-376.

- Satyapal, S., testimony during US Congress, Senate Energy and Natural Resources, Clean Hydrogen, hearing, 117th Congress, 2nd Session, Feb. 10, 2022.

- US Department of Energy, “Bipartisan Infrastructure Law: Additional Clean Hydrogen Programs (Section 40314): Regional Clean Hydrogen Hubs Funding Opportunity Announcement,” DE-FOA-0002779, Sept. 22, 2022.

- US Department of Energy, “Hydrogen and Fuel Cell Technologies Office Funding Opportunities,” at https://www.energy.gov/eere/fuelcells/hydrogen-and-fuel-cell-technologies-office-funding-opportunities.

- 42 U.S.C. §16161a.

- International Energy Agency, “Global Hydrogen Review 2021,” Paris, October 2021, p. 6.

- Samsun, R.C., Rex, M., Antoni, L., and Stolten, D., “Deployment of Fuel Cell Vehicles and Hydrogen Refueling Station Infrastructure: A Global Overview and Perspectives,” Energies, Vol. 15, No. 4975, July 7, 2022, p. 5.

- California Fuel Cell Partnership, “The California Fuel Cell Revolution: A Vision for Advancing Economic, Social, and Environmental Priorities,” July 2018, p. 14.

- Koleva, M., and Melaina, M., “DOE Hydrogen Program Record: Hydrogen Fueling Stations Cost,” US Department of Energy, Record 21002, Nov. 2, 2020.

- Fuel Cells and Hydrogen 2 Joint Undertaking (FCH 2 JU), “Hydrogen Valleys as a Stepping Stone Towards the New Hydrogen Economy,” Luxembourg, 2021, p. 13.

- Energy Transitions Commission, “Making the Hydrogen Economy Possible: Accelerating Clean Hydrogen in an Electrified Economy,” Version 1.2, April 2021, p. 67.

- US Department of Energy, Hydrogen and Fuel Cell Technologies Office, “DOE Update on Hydrogen Shot, RFI Results, and Summary of Hydrogen Provisions in the Bipartisan Infrastructure Law,” Dec. 9, 2021.

- US Department of Energy, Hydrogen and Fuel Cell Technologies Office, “H2 Matchmaker,” at https://www.energy.gov/eere/fuelcells/h2-matchmaker.

- Weichenhain, U., Kaufmann, M., Benz, A., and Gomez, G.M., Hydrogen Valleys: Insights into the Emerging Hydrogen Economies Around the World, Fuel Cells and Hydrogen 2 Joint Undertaking, Luxembourg, 2021, p. 39.

- US Department of Energy, “Hydrogen Program Plan,” DOE/EE-2128, Washington, DC, November 2020, p. 6.

- Bowe, J. and Rice, W. “Building the Hydrogen Sector Will Require New Laws, Regs,” Law360, Jan. 13, 2021.

- US Department of Transportation: Pipeline and Hazardous Materials Safety Administration, “Annual Report Mileage for Natural Gas Transmission & Gathering Systems,” May 2, 2022.

- US Department of Energy, Hydrogen and Fuel Cell Technologies Office, “Hydrogen Pipelines,” at https://www.energy.gov/eere/fuelcells/hydrogen-pipelines.