Increased Appalachian gas production needs continued pipeline growth

Dry natural gas production from shale formations in Appalachian basin has been growing since its 2008 start, reaching 32.5 bcfd in December 2020 and averaging 31.9 bcfd during first-half 2021, the highest average for a six-month period yet recorded for the region. The basin’s two shale formations, Marcellus and Utica, accounted for 34% of all US dry natural gas production in first-half 2021. On its own, Appalachian basin would have been the third-largest natural gas producer in the world first-half 2021, behind Russia and the rest of the US.1

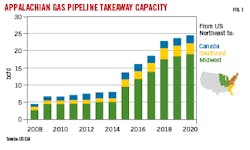

The record high first-half 2021 production was made possible by growth in pipeline takeaway capacity that allows natural gas produced in Appalachian basin to reach other markets. From 2008 to 2020, total pipeline takeaway capacity from the Northeast increased 20 bcfd to reach 24.5 bcfd, alleviating some congestion and supporting higher regional wholesale gas prices (Fig. 1).

Most of the increase in takeaway capacity, 16.5 bcfd, happened between 2014 and 2020 and was focused on shipping to the Midwest. Pipeline takeaway capacity from Appalachia to Canada and to the Southeast has also increased. Expansions of pipeline capacity in the latter direction have been driven by growth in US LNG exports.

Although natural gas pipeline capacity out of the Northeast has grown every year since 2014, the rate of increase has slowed and recently has not kept pace with growth in regional production. Supply bottlenecks such as this have contributed to 13-year highs in US natural gas prices and all-time high prices in other global markets.

The US Energy Information Administration’s (EIA) October Short-Term Energy Outlook, forecast that natural gas spot prices at the US benchmark Henry Hub will average $5.67/MMbtu between October and March, the highest winter price since 2007–08. The increase in prices reflects below-average storage levels heading into the winter heating season and strong demand for US LNG combined with relatively slow growth in US production. EIA expects Henry Hub prices will decrease after first-quarter 2022, as US production growth surpasses growth in LNG exports, and average $4.01/MMbtu for the year.2

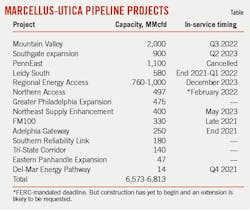

For this increased production to reach market, however, pipeline capacity will have to continue to expand. In Appalachia, roughly 6.8 bcfd of additional transmission capacity is in development, but only about 1.2 bcfd is expected to be available this heating season (see accompanying table).

Mountain Valley

EQM Midstream Partners LP. earlier this year delayed startup of its 2-bcfd Mountain Valley (MVP) natural gas pipeline (Fig. 2) to third-quarter 2022 due to requests from West Virginia and Virginia regulators for additional time to evaluate the Army Corps of Engineers’ water quality certification applications. On Aug. 25, 2021, the Virginia Department of Environmental Quality allowed draft certification to move forward but a ruling is still needed from West Virginia.

Work on the 303-mile line—a joint venture of EQM, NextEra Capital Holdings Inc., Con Edison Transmission Inc., WGL Midstream, and RGC Midstream LLC—began in 2018 and was expected to be complete the following year. The project is 92% built, but until review of the water quality applications is complete construction of remaining stream and wetlands crossings cannot occur (OGJ Online, Mar. 26, 2021).

Equitrans plans to start work on MVP’s Southgate extension in 2022 and place the 75-mile pipeline to North Carolina in service second-quarter 2023. The pipeline’s sole compressor station (CS), Lambert CS, will be built outside Chatham, Va.

Southgate can be expanded to carry as much as 900-MMcfd, with an initial 300-MMcfd of capacity backed by an offtake commitment from Dominion Energy North Carolina (OGJ Online, May 5, 2021). In August 2021, however, the Federal Energy Regulatory Commission (FERC) temporarily suspended Southgate’s eminent domain powers due to the uncertain status of permitting for the larger line.

Fig. 2 shows MVP in yellow and Southgate in orange. The East Tennessee Interconnect would be with Enbridge Inc.’s East Tennessee Natural Gas pipeline and the other two with Dominion.

Other projects

PennEast Pipeline Co. LLC in September 2021 cancelled development of its proposed 120-mile, 1.1-bcfd natural gas pipeline from Pennsylvania to New Jersey. The company cited outstanding permits—including a water quality certification from the State of New Jersey—as prompting the cancellation, which occurred despite the company having earlier in the year won a Supreme Court verdict allowing it to use eminent domain to seize state-controlled land in New Jersey for purposes of building the pipeline (OGJ Online, June 29, 2021).

Leidy South is a proposed 582-MMcfd expansion of William’s Cos.’ Transcontinental Gas Pipe Line’s (Transco) existing Pennsylvania system, designed to move gas from Marcellus and Utica shales to the Atlantic Coast by the 2021-22 heating season. The expansion includes:

- Replacement of 6.3 miles of Transco’s existing 24-in. OD Leidy Line A with 36-in. pipe in Clinton County, Pa. (Hensel Replacement).

- 2.4 miles of 36-in. pipeline loop in Clinton County, Pa. (Hilltop Loop).

- 3.5 miles of 42-in. pipeline loop in Lycoming County, Pa. (Benton Loop).

- CS 605 – Uprate two existing electric motor-driven compressors from 15,000 hp to 21,000 hp each at Transco’s existing CS 605 in Wyoming County, Pa.

- Greenfield CS 607 – Install two turbine-driven compressor units (46,930-hp total) and cooling in Luzerne County, Pa.

- CS 610 – Add one 31,871-hp turbine-driven compressor unit and cooling at Transco’s existing CS 610 in Columbia County, Pa.

- Greenfield CS 620 – Install one 31,871-hp turbine-driven compressor unit in Schuylkill County, Pa.

Cabot Oil & Gas Corp. and Seneca Resources Co. LLC both plan to increase gas production in conjunction with Leidy South’s anticipated startup this winter. Supply for the project is fully subscribed under 15-year contracts with Seneca, Cabot, and UGI Corp. (OGJ Online, July 20, 2020).

Transco is also building its 13.8-mile, 42-in. OD Effort Loop, extending Leidy Line D in Monroe County, Pa. Transco expects construction to start third-quarter 2022 to meet a Dec. 1, 2023, in-service date.

Further expansions to Transco’s Pennsylvania operations include the 22-mile, 32-in. OD Regional Energy Lateral in Luzerne County. Combined with Effort Loop, a new 11,500-hp CS 201 in Gloucester County, NJ, installation of up to 16,000 hp of additional compression at CS 505 in Somerset County, NJ, and installation of a 31,871-hp gas turbine compressor at existing CS 515 in Luzerne County, these projects comprise Transco’s Regional Energy Access Expansion, adding between 760 MMcfd and 1 bcfd to its capacity.

National Fuel Gas Co. (NFGC) continues to pursue its 497-MMcfd Northern Access project. Subsidiary National Fuel Gas Supply Corp. plans to build 96.49 miles of 24-in. OD pipeline from Sergeant Township, McKean County, Pa., to its existing Porterville CS in Elma, Erie County, NY, adding 5,350 hp to the station. Northern Access will interconnect with Kinder Morgan Inc.’s Tennessee Gas Pipeline in Wales, Erie County. Fellow NFGC subsidiary Empire Pipeline Inc. will build a 22,214-hp compressor station and about 2 miles of 16-24 in. pipe in Pendleton, Niagara County, NY.

The project, approved by FERC in 2017, will move gas from National Fuel affiliate Seneca Resources Co. LLC wells in northwest Pennsylvania to western New York, Canada, and the US Midwest. It has faced multiple regulatory delays, but earlier this year received a favorable ruling from the US Second Circuit Court of Appeals. The court cited missed deadlines in ruling against a New York State Department of Environmental Conservation (DEC) and Sierra Club effort to block the pipeline. FERC said in 2018 that the DEC had waived its certification authority on the project by failing to act within 1 year (OGJ Online, Aug. 7, 2018). DEC and Sierra Club then contested this decision in court, but the court sided with FERC (OGJ Online, Mar. 24, 2021).

National Fuel now has until February 2022 to begin operating the pipeline. It has yet to start construction, however, and requests for an additional extension are anticipated. The line was originally required to be complete in February 2019.

Spectra Energy Partners LP’s proposed 475-MMcfd Greater Philadelphia Expansion of its Texas Eastern Transmission system also originally had a 2019 in-service date, but appears to have fallen by the wayside. The expansion would replace existing pipe with larger diameter line and add looping, but was not included in an Aug. 4, 2021, update to Enbridge Inc.’s infrastructure projects. Enbridge is Spectra’s parent company.

Transco earlier this year was granted a 2-year extension for putting its 400-MMcfd Northeast Supply Enhancement (NESE) project into service. The new date is May 3, 2023. The New York State DEC and New Jersey Department of Environmental Protection last year denied NESE’s water quality permits. Transco, however, intends to refile, thus requesting the FERC extension.

NESE is a 26-in. OD, 37-mile pipeline project designed to transport gas from Pennsylvania through New Jersey, traveling underwater in Raritan Bay and Lower New York Bay to about 3 miles offshore the Rockaway Peninsula, where a connection to the existing Rockaway Delivery Lateral will move gas to Queens, NY.

National Fuel Gas Supply Corp.’s 330-MMcfd FM100 project modifies its system in northwestern Pennsylvania’s Cameron, Clearfield, Elk, McKean, Potter and Clinton counties. The company in February 2021 received FERC approval to begin construction with a target in-service date of late 2021. Specific components include:

- Installation of 29.5 miles of new 20-in. OD pipeline in Sergeant, Norwich, and Liberty townships in McKean County, and Roulette, Pleasant Valley, Clara and Hebron townships in Potter County.

- Installation of the new 15,165-hp Marvindale CS in Sergeant Township, McKean County.

- Installation of a new interconnect adjacent to Marvindale (Marvindale Interconnection).

- Installation of up to 1.41 miles of new 24-in. pipeline looping the existing National Fuel Line YM224 in Allegany and Hebron townships, Potter County, Pa.

- Installation of 0.4 miles of 12-in. steel pipeline (extension of existing Line KL pipeline) in Sergeant Township.

- Installation of a new over-pressure protection (OPP) station in Hebron Township (Carpenter Hollow OPP Station).

- Installation of the new 22,220-hp Tamarack CS in Leidy Township, Clinton County.

- Modification of the existing Leidy Interconnection with Transco at the Leidy M&R Station in Leidy Township.

NJR Midstream Holdings Corp.’s 250-MMcfd Adelphia Gateway received FERC notice to proceed with construction in May 2021, targeting end-2021 startup. The project involves converting the southern 50 miles of its existing 84-mile pipeline from oil to natural gas service, supplying constrained markets in southeastern Pennsylvania. This section of the pipeline is in Delaware, Chester, Bucks and Montgomery counties. The northern 34 miles of the pipeline, which extend from western Bucks County to the Martins Creek terminal in Northampton County, has delivered natural gas since 1996.

New Jersey Natural Gas’s (NJNG) 30-mile, 30-in. OD Southern Reliability Link (SRL) will supply 180 MMcfd of gas to NJNG customers via an interconnect with Transco in Burlington County, offering sourcing diversity to the southern end of the state. A court challenge to SRL was dismissed in April 2021.

EQM Midstream Partners’ 140-MMcfd Tri-State Corridor project is designed to supply gas to a power plant being developed by ESC Brooke County Power I LLC in West Virginia’s northern panhandle, via an interconnection with Energy Transfer Partners LP’s Rover pipeline. The 16-in. OD line would be the plant’s sole fuel source. Development of the plant, however, has slowed.

TC Energy Corp.’s 47-MMcfd Eastern Panhandle Expansion project will deliver to Mountaineer Gas in the eastern panhandle region of West Virginia. TC Energy has put the 3.5-mile, 8-in. OD pipeline on hold until further notice.

Eastern Shore Natural Gas’s Del-Mar Energy Pathway runs 19 miles through parts of both Delaware and Maryland. The 8, 10, and 16-in. OD, 14.3-MMcfd project includes meter and delivery stations in Wicomico and Somerset Counties, Md., and Sussex and Kent Counties, Del. Work in Kent County includes 4.9 miles of 16-in. loop (Woodside Loop), with an 8-in., 7.39-mile extension in Sussex County (East Sussex Extension), and a 10-in., 6.83-mile extension in Maryland (Somerset Extension). Construction was more than 60% complete as of May 2021, with Eastern Shore targeting a fourth-quarter 2021 in-service date.

References

- Ricker, C. and Wilczewski, W., “Shale natural gas production in Appalachian Basin set records in first half of 2021,” Today In Energy, US EIA, Sept. 1, 2021.

- Ricker, C., “US natural gas prices likely to remain elevated through winter,” Today in Energy, US EIA, Oct. 14, 2021.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.