Third-quarter 2025 earnings pressured by lower crude realizations

Key Highlights

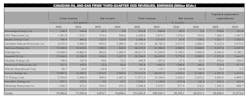

- US oil and gas companies' net income declined 4% year-on-year to $22.3 billion, despite record production reaching 13.76 million b/d.

- Refining margins in the US hit their highest levels of the year in the quarter, supported by stable crude prices and refinery utilization at 94.8%.

- Canadian oil and gas firms experienced a 41% drop in earnings, though production and refinery throughput reached record highs.

- Major US producers like ExxonMobil and Chevron reported revenue declines but continued to invest heavily in exploration and major projects.

US oil and gas companies in the Oil & Gas Journal sample posted lower earnings in third-quarter 2025 as weaker crude realizations more than offset record production and solid refining results.

Aggregate net income for the group slipped 4% year-on-year to $22.3 billion from $23.3 billion, while total revenue edged down 1% to $317.5 billion from $320.0 billion a year earlier. For the first 9 months, net income fell 15% to $63.8 billion from $75.4 billion on a 3% decline in revenue to $924.7 billion from $956.1 billion.

Benchmark crude prices remained below year-ago levels. Brent crude averaged about $69/bbl in the July–September quarter, more than 13% lower than in third-quarter 2024 as OPEC+ supply growth and slowing global demand weighed on prices. West Texas Intermediate (WTI) averaged about $65/bbl, down around $10/bbl from a year earlier. The weaker realized liquids prices compared with third-quarter 2024 more than offset the impact of higher volumes for many producers.

Looking for more detail from Oil & Gas Journal's second-quarter 2025 report on oil and gas producers and refiners for comparison? You can find it here.

US crude oil production reached record levels during the quarter, averaging 13.76 million b/d, compared with 13.27 million b/d in third-quarter 2024, according to data from the US Energy Information Administration (EIA). US natural gas liquids (NGL) production averaged 7.66 million b/d during the quarter, compared with 7.13 million b/d a year ago.

US commercial crude oil stock at the end of September was 420 million bbl, compared with 415 million bbl at the end of third-quarter 2024 and a 5-year average of 435.6 million bbl.

The US Strategic Petroleum Reserve (SPR) continued to rebuild from 2023 lows, reaching about 410 million bbl by late September, compared with 382 million bbl at the end of third-quarter 2024 and a 5-year average of 481.6 million bbl.

Total US oil product stock at end-September was 867 million bbl, compared with 852 million bbl for the same quarter a year ago and a 5-year average of 851.4 million bbl.

US refinery inputs were 17.19 million b/d in third-quarter 2025, compared with 16.92 million b/d in third-quarter 2024 and 16.97 million b/d for second-quarter 2025. Refinery utilization rate was 94.8% for the quarter, compared with 92.3% a year earlier and 93.6% in second-quarter 2025. As crude oil prices were relatively stable in third-quarter 2025, refinery margins increased to their highest levels so far this year.

Natural gas spot prices at Henry Hub averaged $3.03/MMbtu in third-quarter 2025, compared with $2.11/MMbtu a year earlier. US marketed gas production for the quarter increased to 119.78 bcfd from 113 bcfd in the previous year's third quarter, according to EIA data. Working natural gas stocks ended the quarter at 3,641 bcf, compared with a 5-year average of 3478.6 bcf.

US LNG exports continued to expand with new Gulf Coast liquefaction capacity, averaging 14.5 bcfd in third-quarter 2025, up by 3 bcfd from the previous year's third quarter.

Third-quarter 2025 earnings for Canadian oil and gas companies in the OGJ sample fell to $5.9 billion (Canadian dollar) from $10.0 billion a year earlier even as total revenue eased only slightly. For the first 9 months, group net income dipped to $26.2 billion from $26.9 billion on revenue of $213.6 billion compared with $205.0 billion. Heavy crude pricing remained relatively constructive, with the WTI–WCS discount near $11.40/bbl, down from $14/bbl a year ago. Improved egress supports better realizations for Canadian heavy barrels.

US oil and gas producers

ExxonMobil’s third-quarter 2025 revenue was $85.3 billion, down from $90.0 billion a year earlier, and net income declined to $7.55 billion from $8.61 billion. For the first 9 months, revenue fell to $249.9 billion from $266.2 billion and net income to $22.34 billion from $26.07 billion, while capital and exploration expenditures increased to $21.37 billion from $18.11 billion.

The company reported total production of about 4.8 million boe/d, driven by record output from the Permian basin and Guyana. Permian production rose to roughly 1.7 MMboe/d and Guyana volumes exceeded 700,000 b/d with early startup of the Yellowtail development. Operating cash flow reached about $14.8 billion and free cash flow $6.3 billion, and the company returned $9.4 billion to shareholders through dividends and share repurchases.

Chevron’s third-quarter 2025 revenue decreased slightly to $49.73 billion from $50.67 billion, and net income fell to $3.54 billion from $4.49 billion. Nine-month revenue declined to $142.2 billion from $150.6 billion, while net income dropped to $9.53 billion from $14.42 billion; capital and exploration spending held roughly flat at $12.81 billion versus $12.66 billion.

The company reported record production of about 4.1 MMboe/d, up 21% year-on-year, reflecting the Hess Corp. acquisition and higher Permian basin volumes. Cash flow from operations was about $9.9 billion and free cash flow about $4.9 billion. The company returned $6.0 billion of cash to shareholders during the quarter, including share repurchases of $2.6 billion and dividends of $3.4 billion. Major projects such as Tengiz in Kazakhstan and Anchor in the US Gulf of Mexico continued to advance. Chevron reported strong downstream performance, driven by higher refinery utilization, improved margins, and lower operating expenses in the US.

ConocoPhillips’ third-quarter 2025 revenue increased to $15.52 billion from $13.60 billion, though net income decreased to $1.73 billion from $2.06 billion. Nine-month revenue rose to $47.36 billion from $42.22 billion, while net income eased to $6.55 billion from $6.94 billion; capital expenditures climbed to $9.80 billion from $9.09 billion.

Companywide production averaged 2.40 MMboe/d, up 482,000 boe/d year-on-year, led by higher Lower 48 output. Cash flow from operations was about $5.9 billion, leaving significant free cash flow after capital spending, and the company distributed over $2.2 billion to shareholders, including $1.3 billion through share repurchases and $1.0 billion through the ordinary dividend.

At the Willow project in Alaska, the company updated project capital guidance to $8.5-9.0 billion, primarily due to general inflation and localized North Slope and marine cost escalation. With Willow nearing 50% completion and the key milestones achieved to date, the company has narrowed expected first oil to early 2029. Meantime, ConocoPhillips continues to progress three LNG projects: North Field East (NFE) and North Field South (NFS) in Qatar and PALNG on the US Gulf Coast.

Occidental’s third-quarter 2025 revenue declined to $6.72 billion from $7.15 billion, and net income fell to $661 million from $964 million. Nine-month revenue was stable at $20 billion, while net income decreased to $1.72 billion from $2.67 billion. Companywide production averaged about 1.47 MMboe/d, with strong performance in the Permian basin, the Rockies, and the Gulf of Mexico. The company’s chemical segment, OxyChem, is being sold to Berkshire Hathaway.

EOG Resources’ third-quarter 2025 revenue declined to $5.85 billion from $5.97 billion, while net income fell to $1.47 billion from $1.67 billion. Nine-month revenue decreased to $16.99 billion from $18.11 billion and net income to $4.28 billion from $5.15 billion. Production averaged about 1.3 MMboe/d, above the midpoint of guidance. EOG's foundational assets, the Delaware basin, Eagle Ford, and Utica, delivered strong returns.

EOG generated about $1.4 billion of free cash flow and returned cash to shareholders through dividends and share repurchases. The company closed on the acquisition of Encino for $5.7 billion, subject to post–closing adjustments.

Devon Energy’s third-quarter 2025 revenue increased to $4.33 billion from $4.02 billion, while net income fell to $687 million from $812 million. Nine-month revenue rose to $13.07 billion from $11.54 billion, while net income slipped to $2.08 billion from $2.25 billion; capital and exploration spending remained broadly steady. Company production averaged about 853,000 boe/d in the quarter, with oil at roughly 390,000 b/d, driven by high-productivity wells in the Delaware basin and sustained performance in other core areas. For 2026, the company aims to maintain production at about 835,000-855,000 boe/d while reducing capital requirements by $100 million from 2025 levels.

US independent refiners

Marathon Petroleum’s third-quarter 2025 revenue rose to $35.85 billion from $35.37 billion, and net income surged to $1.37 billion from $622 million. For the first 9 months, revenue decreased to $101.8 billion from $106.9 billion, while net income fell to $2.51 billion from $3.07 billion; capital and exploration expenditures increased to $2.31 billion from $1.72 billion.

Refining and marketing throughput averaged about 3.0 million b/d in the quarter with utilization around 95%. The company’s blended refining and marketing margin increased to about $17.60/bbl, up from $14.63/bbl for third-quarter 2024, supported by stronger gasoline and distillate cracks. Meantime, the company’s midstream segment is expanding its Permian-to-Gulf-Coast integrated value chain, progressing long-haul pipeline growth projects to support expected increased producer activity, and investing in Permian basin and Marcellus processing capacity in response to producer demand.

Valero Energy’s third-quarter 2025 revenue slipped to $32.17 billion from $32.88 billion, but net income rose to $1.10 billion from $364 million. Nine-month revenue decreased to $92.32 billion from $99.13 billion, while net income fell to $1.21 billion from $2.49 billion. Valero’s refining segment operating income rose sharply from the year-ago level. Refinery throughput averaged about 3.1 million b/d with utilization near 97%, including record volumes at key Gulf Coast and North Atlantic refineries.

Strong gasoline and distillate margins supported refining earnings, while ethanol and renewable diesel segments contributed stable results. Valero continues to make progress on the FCC Unit optimization project at the St. Charles Refinery that will enhance the refinery’s ability to produce high-value products. The $230 million project is expected to begin operations in second-half 2026.

Phillips 66’s third-quarter 2025 revenue decreased to $34.98 billion from $36.16 billion, and net income fell to $133 million from $346 million. For the first 9 months, revenue declined to $100.23 billion from $111.51 billion, while net income dropped to $1.50 billion from $2.11 billion; capital expenditures increased to $1.55 billion from $1.35 billion.

In refining, the company ran at about 99% utilization with a clean product yield near 86%, capturing a realized refining margin of $12.15/bbl, roughly 46% higher than a year earlier. Midstream adjusted earnings improved from a year ago on higher NGL transport and fractionation volumes, while marketing and specialties generated steady cash flow.

Canadian oil and gas companies

All financial figures are presented in Canadian dollars unless noted otherwise.

Suncor’s third-quarter 2025 revenue fell to $12.67 billion from $13.06 billion, and net income declined to $1.62 billion from $2.02 billion. For the first 9 months, revenue decreased to $37.01 billion from $38.63 billion, while net income fell to $4.44 billion from $5.20 billion.

Suncor’s upstream production reached a record 870,000 b/d in the quarter, 41,000 b/d higher than third-quarter 2024. Total Oil Sands bitumen production increased to 958,300 b/d, the highest quarter in company history, compared with 909,600 b/d in the prior year quarter, and included record quarterly production at Fort Hills and record third-quarter production at Firebag. Suncor also reported record refinery throughput of roughly 492,000 b/d and record refined product sales of about 647,000 b/d, with utilization at 106%.

Cenovus Energy’s third-quarter 2025 revenue fell to $13.20 billion from $13.82 billion, but net income increased to $1.29 billion from $820 million, driven by record oil sands production and near-full refinery utilization that helped offset weaker crude prices. For the first 9 months, revenue declined to $38.81 billion from $41.46 billion, while net income was unchanged at $3 billion.

Companywide production reached a record 832,900 boe/d in the quarter, led by higher oil sands volumes at Foster Creek and Christina Lake. Refining throughput also hit a record 710,700 b/d, with high utilization at 99% and lower per-barrel costs y-o-y. Cenovus continued to progress oil sands growth projects and the West White Rose offshore development.

Canadian Natural Resources’ third-quarter 2025 revenue increased to $9.52 billion from $8.89 billion, but net income declined to $600 million from $2.27 billion a year earlier. Adjusted net earnings was at $1.8 billion in the quarter, compared with $2.1 billion for third-quarter 2024. The company reported record production of about 1.62 MMboe/d, including records for both liquids and natural gas at 1.17 million b/d and 2.67 bcfd respectively. Oil Sands Mining and Upgrading assets continue to achieve strong operational performance with utilization of 104%.

Imperial Oil’s upstream production averaged about 462,000 boe/d, a quarterly record over 3 decades, with Kearl oil sands output reaching new highs following reliability and debottlenecking work. Downstream operations remained strong, with refinery utilization at 98% and solid product sales.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.