Neste progresses with renewable fuels expansions

Matt Leuck

Neste US Inc.

Houston

Neste Corp.—already the largest global producer of renewable diesel (RD) and sustainable aviation fuel (SAF)—will use its proprietary next generation biomass-to-liquids (NEXTBL) technology to increase overall production of renewable products to 5.5 million tonnes/year (tpy) by yearend 2024.

Global demand for RD—which, as a direct drop-in fuel, can play a key role in decarbonizing hard-to-abate sectors such as heavy transport, marine shipping, agriculture, and rail—is set to grow rapidly, particularly in North America, already the fuel’s largest market.

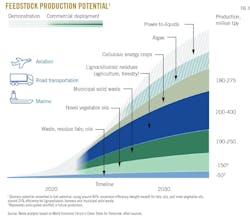

Despite estimates of up to 40 million tpy of waste and residue becoming available for renewable-fuel production by 2030, feedstock supply will remain insufficient to meet long-term forecasted demand, forcing producers to explore alternative options for feed beyond the waste animal fat, used cooking oil, and other materials used today.

In addition to presenting an overview of RD and an in-depth look at the NEXBTL process, this article explores other renewable-fuel production pathways that—though still in the early stages of commercialization—show promise in helping expand the raw-materials pool.

RD vs. biodiesel

While RD and biodiesel are both derived from organic, or renewable, raw materials, their production processes and chemical characteristics differ.

Biodiesel is produced via transesterification, where triglycerides are reacted with an alcohol in the presence of a catalyst. Compared with fossil diesel, biodiesel—also known as fatty acid methyl esters (FAME)—has a higher viscosity and a different cetane number, which can affect fuel-injection system and engine performance. Higher blends (>20%) are typically not approved by original equipment manufacturers (OEM), as they may lead to deposit formation, filter plugging, oil dilution, and other operational issues. Biodiesel also tends to gel at higher temperatures than petroleum-based diesel, which can lead to fuel solidification in cold ambient conditions.

RD—or hydrotreated vegetable oil—is produced via hydrotreating, which involves treating triglycerides with hydrogen in a process that removes oxygen molecules and produces hydrocarbons chemically comparable to those in fossil diesel. An important difference, however, is that RD typically has a lower fuel density than its fossil-based counterpart, which impacts the maximum power output of engines and their volumetric fuel consumption. This is due to diesel’s heating value remaining quite constant per mass for various fossil diesel fuel grades when they are inside a certain range of aromatic content. If density is reduced, the heating value per volume is decreased as a function of density. With a lower volumetric heating value, the engine receives less energy at full throttle and needs more fuel volume to provide the same energy output.

Because of its similarities, RD can be used as a drop-in replacement (neat or blended) in any diesel engine without modifications and meets ASTM D975 and EN 15940 standards. It can also be distributed through existing fueling infrastructure, making it versatile in terms of logistics and application.

RD’s rate of greenhouse gas (GHG) emission reduction varies based on the feedstock used to manufacture the product for each market and regional legislation outlining GHG-calculation methodology. Taking into account selection of renewable feedstock, the production method, transportation along the value chain, and end-of-life emissions, however, RD’s GHG emissions are generally up to 75% lower than those of fossil diesel from a cradle-to-gate perspective.

Since RD is produced by maximizing use of naturally occurring carbon stored in the renewable raw materials, when the fuel is combusted, the carbon dioxide emitted is not calculated as new carbon added to the atmosphere. Emissions of nitrous oxides, sulfuric oxide, and particulate matter from RD can also be notably lower than fossil diesel depending on engine make and year.

RD hydrotreating process

Hydrotreating, the most widely used RD production pathway, is the basis of Neste’s NEXBTL technology (Fig. 1).

The first step in the process is pretreatment. Like other raw materials, biogenic fats and oils contain elements undesirable in fuels, such as oxygen and metals. Before hydrotreating, these impurities must be removed. In the case of metals, inefficient removal can lead to degradation of the hydrotreating catalyst, as well as damage to engine and exhaust aftertreatment components in vehicles and equipment if present in end-product fuel. Biodiesel fuels require an additional distillation step to strip out metals.

Another byproduct of the hydrotreating process is renewable propane. The propane can either be recycled back into the refinery for heating—further reducing the overall carbon footprint of the process—or captured and sold commercially.

The specific catalyst used and reaction conditions (e.g., temperature, pressure, etc.) are crucial for optimizing the hydrotreating process. High temperatures and pressures, along with an excess of hydrogen, are generally favorable for achieving high-conversion rates. These conditions also require substantial energy inputs that can affect the overall sustainability and cost-effectiveness of the process.

The final step in the RD production process is isomerization, which is required to enhance the fuel's cold-flow properties (i.e., cloud point) and overall performance, as RD resulting from the hydrotreating process consists of straight-chain paraffinic hydrocarbons. While these hydrocarbons contribute to very high-cetane numbers, they also have poor cold-flow properties. At lower temperatures, the fuel can become too viscous or even solidify, which would pose problems for storage, transportation, and end use.

Isomerization addresses this issue by rearranging the molecular structure of these straight-chain hydrocarbons into branched-chain hydrocarbons (isoparaffins). The branched structures have lower melting points and better flow properties at lower temperatures, making the fuel more versatile and suitable for use in a wider range of climates without the need for blending with fossil diesel.

One of the byproducts of isomerization is renewable naphtha, which can be separated out and sold commercially.

To compensate for RD’s typically lower fuel density, production of RD from the NEXBTL process—or Neste MY RD—features a higher-per-mass energy content than its petroleum-based counterpart. This largely results from increased hydrogen content in Neste MY RD, which is about 15.2 wt% compared with about 13.5 wt% for standard diesel fuel. The RD delivers the same high performance and range as fossil diesel, but with cleaner combustion and without impurities like sulfur, oxygen, or aromatic compounds.

Neste’s RD, SAF production

Neste currently produces about 3.3 million tpy of renewable products at manufacturing sites in Finland, the Netherlands, Singapore, and the US. By yearend 2024, an expansion of its Singapore renewables refinery alongside ramp-up of the company’s 50-50 Martinez Renewables LLC joint venture with Marathon Petroleum Corp. at the latter’s repurposed, former conventional refinery in Martinez, Calif., will increase Neste’s total renewable production capacity to 5.5 million tpy.

Initially entering operations in April 2023 after roughly 4 years of construction, the €1.6-billion Singapore expansion project increases the refinery’s total production capacity to 2.6 million tpy—including up to 1 million tpy of SAF—and equips the site with enhanced pretreatment capabilities to enable processing of more difficult wastes and residue raw materials (Fig. 2).

Formally commissioned in its first phase in early 2023, the Martinez renewables refinery initially produced 60 million gal/year of RD using one hydrotreating unit. In November 2023, two additional hydrotreaters reached startup to bring the site to its full nameplate capacity of 730 million gal/year.

In 2023, Neste also completed a strategic study launched in September 2022 aimed at gradually transforming its existing 10-million tpy conventional refinery in Porvoo, Finland, into a leading renewable and circular solutions refining hub by the mid-2030s. Formally announced in December 2023, Porvoo’s planned transformation will proceed in phases and, upon completion, will equip the site with a long-term capacity potential of about 3 million tpy for renewable and circular products.

Additionally, an ongoing 1.3-million tpy expansion of the current 1.4-million tpy renewables refinery in Rotterdam scheduled for completion during first-half 2026 will increase the site’s total production of renewable fuels to 2.7 million tpy, bringing Neste’s overall supply of renewable fuels to 6.8 million tpy.

Future feedstock, production pathways

With demand for renewable fuels slated to escalate substantially in the coming years, uncertainty continues to grow about the long-term supply of fats, oils, and grease currently used as feedstock in the production process.

Neste is continuing to work towards increasing the availability of these renewable raw materials, while also developing technologies to diversify supply with new, scalable materials (Fig. 3). This includes low-quality waste and residue such as acid oils and wastewater-derived grease (i.e., brown grease). The company is also exploring novel vegetable oils produced with regenerative agricultural practices, as well as algae and lignocellulosic waste from forestry.

While supplies of these raw materials are less constrained than fats, oils, and greases, they also are more difficult to convert to RD and other products like SAF due to the presence of long organic-polymer chains. Breaking the polymers down often requires complex pretreatment before processing.

Several different renewable fuel production pathways are in the early stages of commercialization with the potential to open opportunities for non-conventional renewable raw materials. Some of these include:

- Fischer-Tropsch (FT) synthesis, which involves converting a mixture of carbon monoxide and hydrogen (syngas) into liquid hydrocarbons through a chemical reaction using a catalyst. Syngas can be produced from a variety of biomass sources like wood, agricultural residues, or municipal solid waste. A highly versatile process, FT synthesis can be used to produce RD as well as other paraffins like naphtha and wax.

- Hydrothermal liquefaction (HTL), which entails converting biomass into a bio-crude oil under high temperature and pressure in the presence of water. This bio-crude can then be upgraded to RD through hydrotreating. HTL is particularly suited for wet-biomass resources such as algae, sludge, and other aquatic biomass, all of which are difficult to process through other methods.

- Pyrolysis, or the thermal decomposition of biomass in the absence of oxygen to produce bio-oil, syngas, and biochar. The bio-oil can be further upgraded to RD and other fuels via hydrotreating.

Accelerating adoption

Limited availability and price remain the two biggest hurdles preventing widescale adoption of renewable fuels like RD and SAF.

Most RD in the US is consumed at the US West Coast (USWC), where producers can take advantage of renewable identification number (RINs) credits under the Renewable Fuel Standard (RFS) program, along with state-level credits in California, Oregon, and Washington. The USWC also remains the largest RD importer in the US, which is likely to remain the case even as new domestic RD production sites start up.

While continued technology development and increased supply will accelerate renewable fuel adoption over time, in the near term, supportive policy is crucial to maintaining industry momentum. For producers, long-term, stable incentive programs like the US RFS and Canada’s Clean Fuel Regulation—which mirrors US state-level low-carbon fuel standard programs—are generally preferable to shorter-term, more-limited tax credits. In addition to government support, the private sector can do its part to create synergies that foster renewable fuel procurement and generate more public awareness of the benefits related to RD and SAF.

The author

Matt Leuck ([email protected]) is the technical manager for Neste US Inc. in Houston, where he acts as principal technical point of contact for the renewable road transport team and provides expertise to stakeholders about renewable fuel’s position in the larger energy picture as a solution to fighting climate change. He previously served as an application engineer and technical sales manager at Cummins Inc. He holds a BS (2007) in engineering technology from Texas Tech University and an MS (2016) in global energy management from the University of Colorado. He is a member of the Transportation Energy Institute, the Society of Automotive Engineers, Diesel Technology Forum, and Young Professionals in Energy.