Energy Lender Price Survey: First quarter 2006 results: Tristone Capital lender price survey to be featured quarterly in OGFJ to be featured quarterly in OGFJ

Oil & Gas Financial Journal has teamed up with Tristone Capital Inc. to publish the firm’s energy lender price survey, a commodity pricing poll of energy reserve-based lenders. It will be published four times anually and is the product of substantial research by Tristone.

The survey of energy lenders’ price forecasts covers a broad spectrum of regional, national (United States), and international banks. All the participating banks engage in energy reserve-based lending. This survey includes information from a total of 39 participating banks.

The data provided by the participating banks for this survey shows an increasing disparity among base case lending policies, as can be expected with continued oil and gas price volatility.

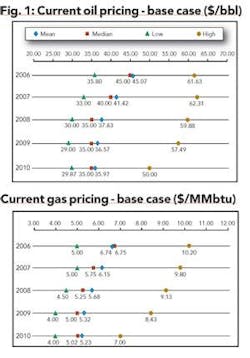

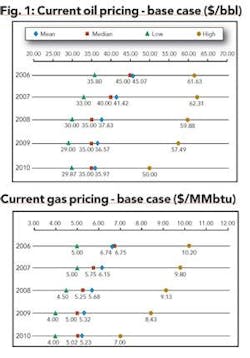

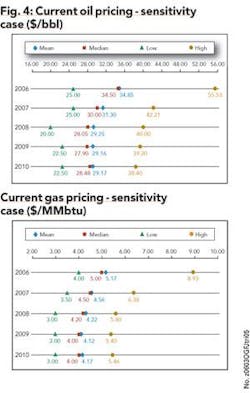

For 2006, the data indicates an average base case West Texas Intermediate oil price forecast of $45.07/bbl and an average base case Henry Hub gas price forecast of $6.74/MMbtu. The five-year trend shows a backward-dated forward price deck for both oil and gas, with average 2010 oil and gas price forecasts of $39.97/bbl and $5.23/MMbtu, respectively.

Modest escalation of both oil and gas prices after 2010 is common, but prices are capped at an average of $36.68/bbl and $5.30/MMbtu, respectively. The average discount rate used by participating banks is 9%. Operating costs on average are escalated 1% per year.

As shown in the charts above, the median base case survey results are lower than the mean base case results due to high-side outliers provided by a few of the 39 participating banks. Therefore, it could be argued that the median base case is more representative of typical lending policies than the mean base case.

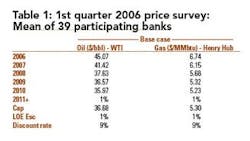

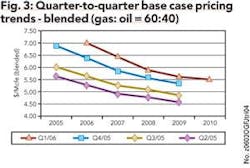

Using a 60/40 blended gas/oil weighting, we compared the average base case against NYMEX futures pricing as of Jan. 26, 2005, as shown below. When compared with NYMEX futures pricing, the average base case results were 71% of NYMEX futures in 2006, gradually trending downward to 59% by 2010.

Since Tristone’s first price survey in Q2/05, the participating banks’ oil and gas price decks have increased by 36% and 33%, respectively, based on 2006 pricing. Consequently, the resulting significant upward borrowing base adjustments throughout the industry would indicate greater access to senior bank debt. Over the same period, NYMEX oil and gas prices increased by 32% and 25%, respectively.

Compared to the fourth quarter of 2005, significant across-the-board increases for both oil and gas base case price decks are being used by the participating banks, beginning with remainder 2006 price increases of 11% and 10% for oil and gas, respectively. By 2009, increases of 5% were noted for oil and gas. The oil and gas base case price caps have increased from Q4/05 to Q1/06 by 7% and 5%, respectively.

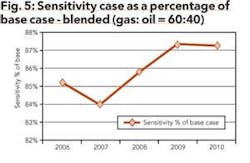

This survey also includes a sensitivity case, which represents the lenders’ low or conservative price decks. Of the 39 participating banks, 32 banks provided a sensitivity case, which averaged a 15% deduction to base case lending policies for both oil and gas for 2006.

Sensitivity case results from 32 participating banks and current oil and gas pricing, as shown above.

Tristone Capital (www.Tristonecapital.com) is a global full-service energy investment banking firm. Tristone provides transaction related services relating to Investment Banking, Acquisition and Divestitures (A&D), and Capital Markets and has over 100 E&P technical professionals in Houston, Calgary, and London to support its global business. Although the information contained herein has been obtained from sources that Tristone believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. The information contained herein is for information purposes only.