Shortages compel Asian upstream sector to focus on risk management

Oil and gas companies in the Asia Pacific region are streamlining business processes and emphasizing asset management to improve the bottom line.

Steve Cook, Welcom, Houston

Vik Subramaniam, ITX Solutions, Kuala Lumpur

The Asian oil and gas industry is facing difficult times, particularly in resource availability. The main problems are the steel shortage, experienced labor shortage (all levels), and even space in fabrication yards across the region.

These problems, coupled with reserves becoming more difficult to locate and more expensive to develop, have caused the industry to begin implementing detailed planning and risk management.

Today, Asian oil and gas companies are placing more emphasis on managing assets and streamlining business processes to maximize profitability. Although the price per barrel has increased dramatically in recent months, the industry remembers the downtimes in the ‘90s and is wary of the current high prices. Because of this, reserves in oil and money are being shored up.

Getting oil fields and equipment (onshore and offshore installations) working as fast as possible is important. With this in mind - and a strong risk management knowledge base - most Asian oil and gas companies are now practicing risk management at the highest professional levels. The main problem with risk management in the industry is the lack of tool usage to help in the automation of the risk processes being used.

This article will explore the current problems the Asian oil and gas industry are facing and how risk management is helping to solve those problems. It will also touch on the technology that can help managers automate the process of identifying and mitigating risk.

Asia Pacific oil and gas markets

The Asia Pacific region is now recognized as the major growth area for energy demand. Oil, gas, and electric power take center stage for investment in this growing and emerging market. This region has vastly inadequate local crude oil production relative to its expanding needs and will need increased imports from outside the region.

Coupled with governmental policy changes encouraging deregulation, privatization, and foreign investment, the future appears bright. Yet risk prevails. Deregulated markets bring competitive risks not previously experienced and energy risk management rises in importance dramatically changing market environments such as these.

Oil is still the key fuel of the industrial world. In the Asia Pacific region, the overriding concern has always been security of supply rather than price risk. In this environment, the use of energy risk management tools, particularly on futures exchanges, has repeatedly failed.

Risk avoidance - rather than risk management - has long been the operative word in Asian oil markets. That is about to change due to the twin engines of deregulation and privatization driving competition. Oil exhibits annualized price volatility of 40% to 50% per year, making it among the highest of any commodity.

Deregulation and globalization of energy markets are bringing the need for active management of risks. The markets are becoming more price sensitive with the rapid dissemination of price and market information. The need to automate risk management now exists out of competitive necessity. Fortunately, the effectiveness of available risk management tools is more established and the knowledge base wider.

Oil markets

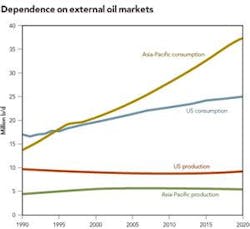

The importance of the Asia Pacific region in terms of world oil demand and refining cannot be understated. Since 1985, Asia has accounted for more than 70% of total world oil demand growth. This area has surpassed Europe and will soon eclipse North America as the primary region of world oil demand.

The Asia Pacific region continues to be the most dynamic oil market in the world with demand at 25.4 million b/d in 2005, with projections of 29.4 million b/d in 2010. Most of this increased consumption will be sourced from the Middle East from where over 70% of the supply currently originates.

It is estimated that 80% of Persian Gulf oil production will be exported to China, India, Japan, South Korea, Taiwan, and the Association of Southeast Asian Nations (ASEAN) countries by the year 2010. Growing commercial ties between Persian Gulf producers and Asian consumers seem inevitable, especially as the giant US market shifts away from the Middle East to a greater dependence on Latin American producers.

By 2006, Japan, South Korea, China, India, Taiwan, Thailand, and Singapore are expected to be importing oil at over one million b/d each. While some Atlantic Basin crude oil from West Africa and the North Sea may supply some of the older, less flexible Asian refineries that have an appetite for those sweet crudes, the key issue is the growing Asia Pacific dependency on Middle Eastern sources of crude.

This increased dependency on oil presages an era of continued price volatility and the growing need for additional risk management instruments to be developed and utilized in the Asian markets. China became a net oil importer during 1993 and its needs will continue to grow. Indonesia, an OPEC member and current oil exporter, seems to be slipping from being a global supplier to being a net user of petroleum.

With about half of world oil growth projected to continue to be in the Asia Pacific region, rising product demand and tightening fuel quality standards driven by rising environmental awareness, the need for managing energy price risk seems poised for explosive growth over the next several years. However, it has taken an inordinately long time to get started in the region compared to the North American and European experiences, particularly because of the more protectionist Asian economies.

Asia will need more imported crude oil in the coming years as output declines in Indonesia and only some oil production increases in China, despite the expected short-term increases in output from Australia, Malaysia, Papua New Guinea, and Vietnam. Sour crude barrels will come from Mexico and the United States. Moreover, product import dependency is also rising at an astounding rate. Changing markets and oil trade patterns presage rising price volatility.

Deregulation as a market driver

In addition to the increased consumption of oil and the growing electric power needs in the Asian markets, several other factors are creating change in the Asian energy markets. These include changing petroleum product specification standards because of more stringent environmental laws; a movement to the just-in-time (JIT) oil inventories now popular in US oil markets; and the entry of new competitors into the energy markets. These changes will add to more price volatility in the coming years as government protection is removed in the energy markets.

The most significant political driver of the market in Asia is the deregulation effort underway in the energy sector in most countries. This movement to freer competitive markets will mean that risk will increasingly be shifted to energy companies and away from government protection.

While each country has its own unique timetable towards deregulation, the movement towards freer markets with more competitors and international price impact should bring more risk management activity to the petroleum, natural gas, and electric power markets.

While many derivatives players continue to look towards China as their next market for growth, commodity exchanges will take time to develop there. Occasionally, opportunities for using risk management tools are quite evident.

China remains a wild card in the Asian energy markets since its demographics can change supply and demand needs very significantly on its road to economic development and industrialization. Moreover, the longer-term derivatives markets should develop with the use of commodity indexed loans to oil, used to finance large projects in oil and gas exploration and production, refining, and electric power generation.

Fundamental changes in Asian oil markets

For refiners and traders, petroleum storage requirements are another area affected by deregulation and are a growing area for risk management. Many storage expansions have been announced throughout the region.

Singapore, as an active regional transshipment center, has already undergone more storage capacity increases. Subic Bay in the Philippines is another strategic location. China, India, South Korea, and Thailand have all announced that large-scale storage projects are underway. These and other projects are an attempt to reduce the transshipment costs of Singapore facilities.

Another reason is the need for strategic stockpiling of oil and products for energy security reasons, which is still a dominant part of the Asian energy puzzle. In fact, regional storage seems to be taking hold as evidenced by Chinese oil stockpiling this year.

The role of storage is changing as well. The use of strategic product storage for both oil security issues and to arbitrage physical market movements for petroleum products with paper instruments will become more pronounced. Changing fuel quality specifications requiring more blending for clean products as well as growing oil demand is influencing the need for more storage.

Challenges to change

One of the biggest issues facing the development of the markets involves credit worthiness, which can hamper the development of longer-term deals. The financial collapse of one major player can affect the market significantly. Therefore, counter-party risk must be closely monitored and the financial strength of companies assessed routinely. This is not an insurmountable obstacle but will take time to overcome.

In addition, the proliferation of state-owned oil companies (NOCs) and state-owned utilities inhibits competition. However, the status quo is changing. The privatization and deregulation of these energy markets that will be coming in the next few years should hasten the development of more trading in Asia.

At present, many of the market makers are said to be chasing the same business. This is true of many immature markets, such as the electricity trading business in the United States.

While the Asia Pacific oil trade is still centered on security of supply rather than price risk management, the Asia Pacific markets are just beginning to emerge as the next opportunity for growth for the markets in energy. Fed by growing oil demand in the region and the growing interest in making Singapore the energy derivatives center for Asia, it seems likely that this is the beginning of the change to a more financial rather than physical orientation in energy trading. As they move towards deregulation, political changes in Asian countries should bring increased trade activity in both futures and derivatives.

The highly publicized financial debacles in recent years, such as Enron, WorldCom, and others, have focused attention on risk management, creating more interest in hedging and the use of energy risk management tools.

New risks need to be intelligently managed. Consequently, risk management is now a key management tool. Once considered a peripheral concept, effective risk management can be essential to achieving industry leadership.

In the Asia Pacific markets, there is actually less uncertainty than previously on the regulatory side as countries are making their deregulation plans known. Nonetheless, market, credit, and operational risks remain pervasive in the Asian markets. Most importantly, a company’s risk tolerance must be identified, particularly since oil, gas and power are the most volatile commodities traded.

The objective of using risk management tools is simply to achieve corporate goals. There is no cookie cutter approach of “one size fits all.” These goals can include lower fuel costs, securing market share, reducing earnings volatility or increasing margins. The key is reduction of risk, not risk elimination (since that is impossible).

While Asian energy companies have been slow to adopt these tools, the tools are more finely developed and the knowledge base wider than when they were accepted in the United States and Europe over a decade ago. Thus, the Asian markets may have some advantages in using more sophisticated risk management software and having a more developed control structure.

Process-driven tools

To help companies in the Asia Pacific region, risk management tools should be process driven. This would be the fastest way to help companies jump start the discipline of risk management.

Risk management tool usage in the US and Europe is fairly advanced and many risk managers in the oil and gas industry already have the maturity to stitch products together into a solution that can be used effectively. However, in the Asia Pacific region risk consultants are increasingly getting into the technology game playing a secondary (and sometimes primary) role of a systems consultant for risk management tool implementation across the separate processes.

The silver lining is that there is standardization occurring across the region of the risk management process. Many companies are implementing the process prior to the tools. This is partly due to the adoption of the Project Management Institute’s PMBOK Guide as a project management standard. Risk management is outlined in Chapter 11 of the PMBOK Guide.

Conclusion

What is most important in the Asia Pacific region is the security of oil and gas supplies. This continues to dominate Asian risk management strategies, which continue to focus on short-term trading and hedging. There is a lack in long-term risk planning especially in the area of resources such as labor, material, and equipment.

This is, in effect, a supply balancing system. However, rising oil demand in the region, coupled with increased price volatility and followed by the rise of a global LNG market, will begin to change that type of thinking as more sophisticated hedging and a longer-term orientation begin to change management thinking.

Finally, the integration of both physical and financial trading, which is more advanced in Western Europe and North America, will begin to influence supply logistics systems implementation and energy risk management in the Asia Pacific region. This will create a greater need for Asia Pacific oil and gas companies to adopt formalized risk management practices aided by the software tools that can automate the processes to ensure the most positive outcomes possible.OGFJ

Bibliography

• Asia Pacific Oil Markets: Why Oil Trading and Paper Markets Are Different In This Region by Peter C. Fusaro

• Energy Information Administration (US Department of Energy) - International Outlook

The authors

Steve Cook [[email protected]] is president and co-founder of Welcom [www.welcom.com], a global provider of project portfolio management solutions based in Houston. Welcom’s project management suite includes WelcomRisk, a qualitative risk management software that allows business managers to model both threats and opportunities in a project. Cook has a BS degree in chemical engineering from the University of Birmingham in England.

Vik Subramaniam [[email protected]] is managing director of ITX Solutions (M) Sdn Bhd in Kuala Lumpur, Malaysia. He has implemented enterprise project management solutions, taught risk management, and consulted in portfolio management for oil and gas companies throughout the Asia-Pacific region and the Middle East. He is a member of the Project Management Institute and the Association of the Advancement of Cost Engineering.