The Value of Seismic Information

Stephen Pickering, WesternGeco - Houston

J. Eric Bickel, PhD, Texas A&M University - College Station, Tex

A challenge that all asset managers face is when and how much to invest in new information (e.g., seismic or well log data) to gain a more detailed image or knowledge of their reservoir. This can be a particularly vexing question in late field life when revenues are declining and there is a need to boost production through further infill drilling. Yet it is precisely in this situation, where there is great uncertainly about whether to drill and where to drill, that more detailed knowledge of the reservoir can contribute the most value.

In this article we review the influences on the value of seismic information (VoS) and explain how decision analysis and Bayes’ Rule can determine the VoS prior to acquisition. The second part of the article discusses a time-lapse seismic survey on a notional field where the reservoir may either be oil saturated or flushed (swept) by water to calculate the value of information.

Technical, business, and economic success

The seismic industry is continuously evolving through the development of new technologies, such as single-sensor seismic recording (e.g. Q-Marine technology) for repeatable time-lapse seismic or new depth imaging techniques in the Gulf of Mexico.

The benefits of these technology developments are observed in the seismic data in the form of improved resolution of thin beds, better imaging beneath salt and basalt horizon, and, in the case of time-lapse seismic, snapshots of reservoir production, to name but a few examples.

Figure 1 shows the improvement in a 4D time-lapse response from single-sensor technology (right panel) compared to that using a conventional baseline survey (left panel). The right panel clearly shows changes in production (red), injection (blue) and a time-lapse ghost (green) caused by changes in the reservoir zone due to injection. In the left panel these changes are obscured due to differences in survey positioning.

The interpretation is more likely to be correct in the right panel and the drilling risk correspondingly lower, due to the higher repeatability of the single-sensor seismic technology, which employs steerable streamers. The magnitude of seismic improvements in data quality in terms of signal to noise, repeatability, bandwidth, and quality of well ties can be quantified.

Figure 2 displays time-lapse seismic repeatability metrics (Normalized RMS versus Predictability). Higher repeatability plots to top left, with lower noise (NRMS) and greater similarity between equivalent traces indicated by higher predictability. Red data points correspond with the more repeatable single-sensor data from Figure 1, more reliable estimate of saturation change and correspondingly more valuable information. The blue data points are indicative of low time-lapse repeatability and poorer quality information.

If time-lapse survey objectives can be achieved in terms of pre-determined repeatability then the survey can be considered a technical success. However, even though the survey may be a technical success, it is not always known whether the seismic information resulted in a business or economic impact with more success in exploration drilling, or higher productivity of development wells.

Figure 3 shows the results of mapping change in reservoir saturation, and corresponds to the same single-sensor dataset shown in Figure 1. The area swept in the time interval between the base and repeat surveys is identified as a blue geobody beneath the horizontal well section.

The originally planned well path (black) was raised to the revised well location. The well was subsequently drilled and produced 30,000 bo/d without water cut. The seismic data has, in this circumstance, a business impact because it has changed the proposed well trajectory and lowered the associated drilling risk.

The seismic results have also had an economic impact on asset operations. The economic value includes avoiding drilling a sidetrack to the original well path, which might have been drilled if the original well encountered water.

Additional value results from the added production resulting from the optimal well positioning and the ability of the operator to better understand the drainage pattern in the field and subsequently optimize recovery strategies. In this case, these benefits are significantly greater than the cost of the seismic information.

Although this new information may result in more oil production or fewer but smarter wells drilled, this does not in itself deliver economic value to the asset. If the cost of the seismic is very high and well costs are relatively low, or production per well is low as often happens onshore, then the business case for seismic may be more tenuous.

For instance, an onshore reservoir monitoring project may have been lauded as delivering outstanding technical success, and almost certainly will result in an impact on the business strategy of exploiting the field in terms of well positioning. However, the incremental NPV of the project may be much less than for a small offshore mature field nearing the end of its economic life, when the cost of the seismic data is taken into consideration. In this type of situation it is more important to fully assess the potential economic benefit prior to acquiring additional information.

The value of information

What are the drivers of information value? There are three criteria that any information gathering opportunity must meet, if it is to add value.

1. Relevant. You must be uncertain about something that is important to your decision and the information must offer the possibility of learning about this uncertainty. For example, you may be uncertain about the potential of a well location. If you are not uncertain then you already have prefect information and further information gathering is not worthwhile. If you are uncertain, then the information must offer the possibility of changing your beliefs about the uncertainty. For example, the information might lead you to believe that a well location will be productive or unproductive. If this is the case, then the information is relevant.

2. Material. Information only has value if it offers the potential to change decisions. How much would you pay for information that, no matter what that information said, you would take the same action? Zero! If the information has the potential to change decisions then it is material and it has value. For example, you might be facing a decision of drilling or not drilling a well in a particular location. If this decision is contingent upon information you could obtain, then the information is material.

3. Economic. Even if the information is relevant and material, it still has to be a good investment. For example, a test that perfectly reveals reservoir properties is relevant and probably material, however, it is still possible that it is too costly.

The influences on value

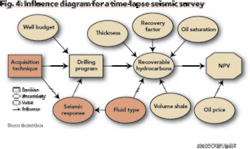

An influence diagram for a time-lapse seismic survey is shown in Figure 4. In this model the objective is to understand how time-lapse seismic influences the ultimate value, in a situation in which the seismic indicates whether the reservoir is swept by water or unswept and contains hydrocarbons.

The value is most obviously influenced by the oil price and the volume of hydrocarbons recovered. The latter is influenced by a number of factors including recovery factor, porosity, the gross rock volume of the reserve and fluid type - there being no value in finding water.

The amount of recovered hydrocarbon is also influenced by the number of wells to be drilled, and this in turn, by the drilling budget. If, for instance, there is a portfolio of 12 potential drilling targets but only one well in the budget, then the entire value of the portfolio can not be realized, should more than one target contain hydrocarbons.

The drilling program is influenced on the availability of seismic data. For example, if a company is forced to drill blind without seismic information, it may choose not to drill any wells.

Seismic data enables the identification and characterization of drilling targets (either exploration or development wells). However, if only a sparse 2D seismic grid is available rather than a high resolution 3D survey, potential drilling objectives may be missed.

Long offset data may identify hydrocarbons through AVO (amplitude variation with offset) and reduce the risk in drilling at a particular location. In addition, different time-lapse seismic acquisition technologies may impact the clarity of the final image and hence the assessment of drilling risks (Figure 1).

To summarize, the value of the information is dependent on:

• the reservoir properties and is thus unique to each reservoir;

• the number of drilling opportunities identified and subsequently drilled;

• the quality (or type) of the seismic measurement that influences the seismic response, the decision to drill, and the ultimate value.

Decision analysis and Bayes’ Rule

So the asset team is often faced with perplexing problems: should they drill a well or not; or should they gather more information about the reservoir from seismic before deciding? Many teams in this situation use a simple process based on experience and single point estimates without knowing all the facts - they gamble on success. But there is an alternate method known as decision analysis.

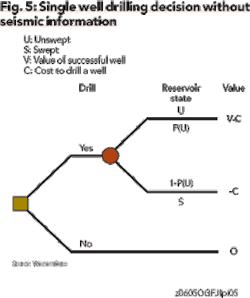

For any project a decision tree can be constructed to determine whether or not to drill in the cases whether or not there is access to seismic information. Figure 5 represents a decision to drill a single well without the benefit of seismic information.

P(U) is the probability the reservoir is unswept. The best drilling alternative can be determined by solving this tree, which yields the value without seismic information (VwoS). For example, if the best alternative is to drill then VwoS = P(U) * V - C.

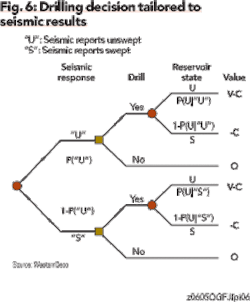

If a seismic survey can be commissioned before drilling, then the drilling decision can be tailored to the seismic results. This is captured in Figure 6.

If the seismic test is material then the decision to drill is made if the survey reports unswept and not to drill otherwise. P(U|"U") is the probability the reservoir is unswept given the survey reports unswept and P(U|"S") is the probability the reservoir is unswept given the survey reports swept. Solving this tree yields the value with seismic information (VwS). The value of seismic information (VoS) is equal to the value with seismic information less the value without seismic information, VoS = VwS - VwoS.

So how is P(U|"U") and P(U|"S") determined? The answer can be obtained through the use of Bayes’ Rule shown below.

A key input into Bayes’ Rule is the accuracy or reliability of the seismic information, which is captured in P("U"|U) and P("S"|S). That is, how likely the survey is to report unswept (swept) if the reservoir is really unswept (swept).

This equation can be used to calculate the probability of success resulting from the acquisition of time-lapse seismic information in the case of a simplified decision tree in Figure 6. In this instance, it is assumed the prior probability of success (unswept) without seismic information is P(U) = 75%, and the accuracy or reliability of the seismic information is P("U"|U) = P("S"|S) = 75%. In this instance, the probability that the well is successful (unswept) given that the seismic says the target is unswept increases to 90%.

On the other hand, if the survey reports that the target is swept, the probability the target is unswept falls to 50%. The revised probabilities can be used in the decision tree (Figure 6) to calculate value of the information.

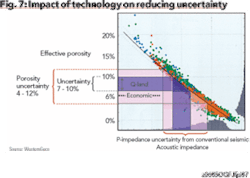

But how is seismic accuracy assessed? An assessment of technical performance (Figure 2) to determine the probability of seismic success using differing acquisition or processing techniques can be employed. Another approach is to assess the ability of different seismic techniques to reduce uncertainty in predicting reservoir properties given a particular seismic measurement in different geologic environments (Figure 7).

The value of information - an example

Seldom is only a single well drilled following a seismic survey-especially a development 3D or a 4D time-lapse survey. So a calculation for multiple drilling targets is needed. The math for this is more complex, but the principles as described above for a single target are the same.

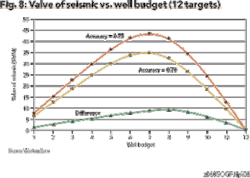

Lets consider a notional development of small oilfield containing 12 identical targets, where the incremental NPV per successful well is $50 million, well costs $5 million and the prior probability of drilling success (without new information) is 75%. What would be the value of a time-lapse survey using two different technologies with accuracies of 70% and 75%, respectively?

As shown in Figure 8, seismic information is worth more up to a point when more wells are drilled,then it begins to decline. Seismic does not have any value in this particular example when all 12 targets can be drilled. Figure 8 also shows that slight changes in seismic accuracy can create significant value. For example, the VoS peaks in this case at approximately $35 million for an accuracy of 70%, when we can drill seven wells. Increasing the accuracy of seismic to 75% increases its value by $10 million to $45 million.

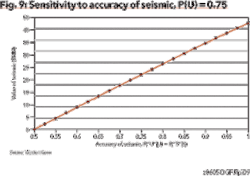

Figure 9 highlights the sensitivity of seismic value to its accuracy. In this case 12 targets and a well budget of six wells are considered. At an accuracy of 75%, VoS at $45 million is obtained. Perfect information (accuracy of 1) is worth about $85 million and, of course, seismic with an accuracy of 50% is worthless. Again, as can be seen in the graphic, small changes in accuracy can be very valuable. In fact, over the range considered here, every 1% increase in accuracy is worth approximately $1.7 million.

null

Summary

To justify gathering new information, the information must have the potential to change a decision you would otherwise make. When faced with a budget constraint (e.g., capital, rigs, etc.) and uncertainty regarding the success of individual wells, seismic data can add significant value. The actual value added is dependent upon the particular reservoir economics and the quality of the seismic measurements.

In most cases, better measurements add more value, and even modest increases in accuracy could be worth millions of dollars. Decision analysis can be used to determine the value of seismic information before the survey is acquired.OGFJ

The authors

Stephen Pickering is a principal geoscientist and 4D and reservoir seismic services marketing manager for WesternGeco, based in Gatwick, England. He joined Western Geophysical in 1973 as a seismic data analyst. In 1981 he joined Hamilton Oil as interpreter and subsequently chief geophysicist. From 1989 through 1995, he was UK and Europe exploration manager for Hamilton Oil. After a move to BHP Petroleum, he assumed the role of manager of exploration technology. He rejoined Western Geophysical (now WesternGeco) in 1999. Pickering received a BS degree in geology and an MS degree in stratigraphy from London University, and an MBA degree from Open University in Milton Keynes.

Dr. J. Eric Bickel is an assistant professor in the department of industrial and systems engineering at Texas A&M University and director of the decision analysis systems lab. Prior to joining Texas A&M, Bickel was a senior engagement manager for Strategic Decisions Group, where he applied decision analysis to corporate strategy. He has consulted around the world in a range of industries. Bickel holds an MS and PhD in engineering-economic systems from Stanford University.