Financial Update: Independent producer earnings grew 130% in fourth quarter

It’s beginning to sound like a stuck record, but the financial performance of energy companies continues to climb dramatically and is showing no immediate signs of abatement. A snapshot of the upstream oil and gas industry taken after the fourth quarter results from last year shows that earnings for 28 independent energy companies surveyed in this report grew 130% in the fourth quarter of 2005 (Q405) over earnings in the fourth quarter of 2004 (Q404) - see Table 1.

The Energy Information Administration (EIA) measures the financial performance of these companies after the close of each quarter to report recent trends in the financial performance of the independent energy companies, which are typically smaller than the majors and do not have integrated production and refining operations.

The information is compiled from companies’ quarterly reports and press releases. All three types of energy companies included in this report - independent oil and natural gas producers, oil field service companies, and refiner/marketers - had increased income over the year-ago quarter, as crude oil prices, natural gas prices, and gross refining margins all increased (see Table 2).

In addition, each of the companies included in this report had positive earnings for both the fourth quarter and for the 2005 year. All three groups also showed growth in their yearly total earnings, as net income grew 118% for the 28 companies from 2004 to 2005.

Price increases boost earnings

Increases in both natural gas and crude oil prices boost independent producers’ earnings. Net income of the independent oil and gas producers included in this report rose 94% between Q404 and Q405, as revenues rose 41% (see Table 1).

Independent oil and gas producer earnings were boosted by a 32% increase in the price of crude oil and a 72% increase in the price of natural gas over year-ago prices (see Table 2).

Yearly total earnings showed a similar pattern, growing 78% from $1.7 billion in 2004 to $3.0 billion in 2005.

Higher rig count impacting revenue

Oilfield companies’ revenue and earnings increase with higher drilling rig counts. Net income of US oilfield service companies included in this report jumped 143%, as revenues rose 22% (see Table 1).

US oilfield service company earnings were strengthened by an increase in the worldwide rig count of 18% from 2,531 in Q404 to 2,979 in Q405, according to Baker Hughes data.

Higher rig counts and the resulting higher demand for rig services directly increased the demand for the equipment and services supplied by oil field companies. This increase in demand raised day rates on equipment and margins on overall operations, thereby increasing companies’ profits.

The ODS-Petrodata Day Rate Indices were sharply higher in Q405 from Q404, as well as the yearly average for 2005 compared to 2004. Yearly total earnings reflected this with growth of 139% in 2005. Helping to drive this was the 15% increase in the worldwide rig count.

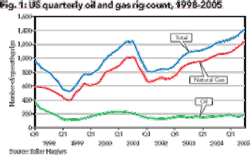

The rig count growth rate over the year-ago quarter of 18% for the United States matched the worldwide growth rate of 18% (see Figure 1). Decomposing the total US rig count into its components, the natural gas rig count grew 15% while the oil rig count grew 35% over the period.

The natural gas rig count has now increased for 12 consecutive quarters relative to its year-earlier level. For the year as a whole, the average natural gas rig count grew 16% from 1,025 in 2004 to 1,186 in 2005, while the oil rig count grew 18% from 165 in 2004 to 194 in 2005.

Breaking down overall (oil plus natural gas) rig counts on a regional basis shows that while rig counts grew 18% in the United States from Q404 to Q405, they jumped 36% in Canada and grew 8% in the rest of the world.

Yearly total rig counts followed a similar pattern, with 16% growth in the United States from 2004 to 2005, 24% in Canada, and 9% in the rest of the world.

Refiner earnings rise

Refiner earnings were up sharply with higher margins in the fourth quarter. Earnings of the independent refiners included in this report increased from $38 million in Q404 to $134 million in Q405 (see Table 1).

Driving this earnings growth was an increase in average refining margins of 60% from Q404 to Q405 (see Table 2). (The average refining margin is the difference between the composite wholesale refined petroleum product price and the composite refiner acquisition cost of crude oil.)

Refining margins increased because the increase in refined product prices (calculated from Table 2 by adding the price of crude oil and the gross refining margin) of $21.03 more than offset the $12.84 increase in the price of crude oil. Yearly total earnings also showed strong growth, increasing from $236 million in 2004 to $566 million in 2005.OGFJ