Tell me again: Why are we still importing crude oil from OPEC?

GREG BARNETT, ENERCOM INC., DENVER

I'M NOT GOING TO SUGAR COAT IT - it's been a tough year. There have been family deaths, cancer scares, a heart attack, a huge Category 4 tornado that was too close for comfort, and a new granddaughter who needed surgery in January to fix a heart valve. Like I said, it's been a tough year.

So, let's talk about something more light-hearted. Like the price of a barrel of crude oil.

I'm on record saying that I have seen more cycles than the Tour de France since starting my work in the oil and gas business back in 1981. I'm not complaining. That's not what I do. I love the industry and the people that I work with who, like me, made the conscious choice to work in this great industry regardless of the ups and downs. In the up markets, we're on top of the world. In the down markets, we moonlight as piano players in the local ballet hall.

In 1982, George Mitchell began to experiment with completion techniques to crack open tight zones that he and his company, Mitchell Energy, believed contained economically producible volumes of natural gas. Mitchell is the recognized first mover pioneer who created the 21st century oil and gas company. By 2004, companies like Range Resources and Core Lab were drilling and evaluating tight sandstones and shales to extract crude oil and natural gas. The result of this work, which began in earnest in 2004, propelled the US into the number one position for oil and gas production by 2014.

In only 10 years, the US went from producing 13.9 million barrels of oil equivalent (boe) per day to 20.5 MMboe per day in 2014. In other words, the successful development of shale resources created a 47% increase in US oil production. Said another way, shale resource development increased domestic energy security by reducing OPEC oil imports to America, and that's a problem for the oil cartel. And they've made their problem our problem.

The US Bureau of Labor Statistics showed that the number of people employed in the oil and gas business expanded 62.3% between January 2005 and November 2014. Why did I stop measuring in November 2014? On Nov. 27, 2014, the then 12-member oil cartel known as OPEC, decided it would maintain its 30 MMb/d output quota originally set back in 2011. In doing so, OPEC noted, "The increase in oil and product stock levels in OECD countries, where days of forward cover are comfortably above the five-year average, coupled with the ongoing rise in non-OECD inventories, are indications of an extremely well-supplied market."

OPEC forecast oil demand growth in 2015 would be offset by an estimated increase of 1.6 MMb/d in non-OPEC supply. In other words, OPEC and more importantly, Saudi Arabia, were dropping their traditional role as the swing producer, and forcing America to take on that role. My colleague, James Constas, made this exact point last August in Denver, when he called the United States "Saudi America, the Unexpected Swing Producer."

Nov. 27, 2014, marked the start of the first global crude oil price war of the 21st century. Price wars, when executed well, help the consumer. And the companies that initiate the process can have a long-term profitable impact from gaining greater market share, so long as the product and/or the company possess certain positive characteristics. Consumers have benefited from price wars in many industries, including cell phones, brokerage fees, the cost of a round trip airline ticket to visit family during the holidays, and Lasik eye surgeries.

The current crude oil price war is helping the American consumer at the gas pump. The price of regular unleaded gasoline averaged $2.821 for the week of Nov. 24, 2014. For the week of Nov. 23, 2015, the average price was $2.094, a 26.3% decline. However, American industrial capacity utilization declined 0.5% in November 2015 to 77.0%, a rate that is 3.1% below its long-run (1972-2014) average, and down 1.2% year-over-year. The Board of Governors of the Federal Reserve directly attributes the drop "...to sizable declines for coal mining and for oil and gas well drilling and servicing."

It's been more than a year since OPEC elected as a group to keep daily production flat, with Saudi Arabia deciding to let America and its OECD allies figure out how to drill wells in a considerably lower commodity regime. OPEC, in its 168th meeting in Vienna on Dec. 4, 2015, announced its belief that the world will demand more, not less of its production: "These developments indicate the onset of a more balanced market in 2016, with demand for OPEC crude expected to rise by 1.2 million barrels per day to average 30.8 million barrels per day for the year." Au contraire, mon cheri!

In one year's time, OPEC, based on its 2014 decision to hold its collective production flat, has suffered from the self-flagellation to capture market share at the cost of social unrest. On Dec. 3, 2015, WTI was priced at $41.08 per barrel. By Dec. 18, WTI prices had plummeted to $34.73, a 15.5% drop in just 15 days.

China's importation of Russian spot crude oil is surpassing what it gets from Saudi Arabia. Russian President Vladimir Putin is faced with a falling ruble, unrest in former Russian satellite countries, and needs the hard currency that oil sales bring (since all oil is priced in dollars).

"Принести деньги на Vladimir" (rough translation: "Bring the money to Vladimir!"). China is forecast to import more crude oil in 2016 and signed a 2016 agreement with Saudi Aramco to deliver similar volumes next year as was delivered in 2014. But those volumes, on a market share basis, are now about 15%, not 20% as was the case back in 2012.

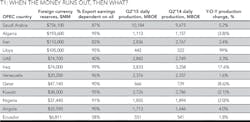

We do not believe OPEC's 2014 decision is achieving its stated goals. Some analysts peg the losses to the cartel at $500 billion, which is creating extreme stress on governments that are reliant on oil exports to fund their budgets. Algeria, Angola, Ecuador, Nigeria, and Venezuela are all suffering mightily, and the lost revenue has created intense divisions within the cartel. OPEC: Are you misinformed or are you engaged in predatory pricing?

Proving that an organization is engaged in predatory pricing that actually benefits the end-user, vis-à-vis the consumer of crude oil, is difficult because the conventional wisdom among antitrust experts has long been that predatory pricing - a monopolist selling goods below cost - is not a particularly serious problem. In fact, the courts regard predatory pricing as a so-called legal fiction. It's theoretically against the law but nearly impossible to prove.

The first to discredit the concept of predatory pricing were members of the free-market "Chicago School of Economists." About two decades ago, they conducted studies indicating that when companies tried to drive away competitors with predatory pricing, they generally lost a fortune by doing so and then surrendered any market-share gains as soon as they raised prices. Thomas Sowell, famed Chicago School economist said this about predatory pricing: "Obviously, predatory pricing pays off only if the surviving predator can then raise prices enough to recover the previous losses, making enough extra profit thereafter to justify the risks. These risks are not small."

We'll translate. We know in the oil and gas industry that the best remedy for low commodity prices is low commodity prices. Oil producers adjust their spending and their production practices to improve efficiencies, which helps boost returns and improve cash flow in the down market, and then consumer and industrial demand rises as a result of the lower prices and then WHAM! - there is an immediate shortage of production and commodity prices rise again.

We also know that when commodity prices rebound they do so sharply, as we witnessed during the late 2008 and 2009 period. We also know that the Nov. 27, 2014, OPEC decision to not be the swing producer is creating real pain for Saudi Arabia and its Gang of 12.

The conclusion here is that we're in a price war. But what ultimately happens in a price war?

The companies that are the most agile, best funded, and have the best technologies with the best assets will win. We believe that the US and Canadian producers will win. Why do we believe that? As profit-seeking enterprises, the US and Canadian oil producers do not have to produce crude oil to subsidize social programs, or provide stipends for its citizens to go to schools abroad, or subsidize the price of fuel its citizens must pay the government/royal family, or convert its production into cash to feed its citizens.

How will the US and Canadian producers win? By adopting forward-thinking, strategic intentions and capabilities that win in the current price environment, rather than hoping, as one friend quipped, for higher crude oil prices. Hope isn't a strategy. Here are steps that we know are either in place or in the works for US and Canadian producers:

- Right-sizing now for long-term benefits: 2016 capex programs are right-sized, production targets are managed, balance sheets are addressed and asset portfolios are rationalized.

- Competing on quality: companies are high-grading drilling programs and using technology to convert marginal assets into better tiered projects. Companies are utilizing the latest in technologies to generate the highest and best returns.

- Cooperating with stakeholders: E&P and OFS working better together to harmonize total returns.

- A little government help, in moderation please: Repeal the crude oil export ban? Check! Pass Keystone? Not yet. Reform Dodd-Frank? Not yet. Manage Fed policy and interest rates. A Work-in-Progress. Pass legislation reducing corporate tax rates? When pigs fly!

We know that the US doesn't produce enough of its own crude oil to satisfy 100% of its demand, but every now and then we are reminded that we are importing from members of the same cartel that believes gaining market share is more important than generating an economic return with each drilled well.

We interpret this to mean that the US subsidizes an organization (OPEC) that started the price war! Only in the oil business can a supplier treat its customers so bad and get away with it. Actually, we're not so sure, the airlines aren't exactly known for great customer service.

Table 2 shows the US imported 2.75 MMb/d of crude oil from six of the 13 OPEC nations (Indonesia's resumption of its full membership was approved on Dec. 4), or 34.8% of the weekly import of 7.9 MMb/d in a select period in December 2015. That represents $770 million (using $40/oil) of hard-earned US cash leaving the country instead of being invested and spent in America (aka the "home-grown spending on our own" strategy).

The current US administration is fighting corporate inversions (we are a country that was founded on the belief that taxation without representation is a basis for revolution), but it isn't fighting cash flowing out of the US like water through a sieve to pay for a product that its own US-based companies can produce. Does this cash outflow represent a form of subsidy by the US for certain OPEC nations to fight ISIS? Or to curry favors? Canada is our closest ally. Crude oil imports from our maple-leaf buddy have held steady year-over year. But we don't worry about being blind-sided by Canada's 10 provinces and three territories.

An illustration how much progress America has made in improving its energy security is the level of current oil imports compared to less than a decade. In January 2008, the US imported 6.41 MMb/d from OPEC, but thanks to the US shale revolution, OPEC's market share exporting to the US has dropped 57.1% in nearly eight years.

For 2015, the US consumed more crude oil, in the form of gasoline. Total US liquid fuels consumption is projected to increase by 290,000 b/d (1.5%) in 2015, higher than the 140,000 b/d (0.8%) increase in 2014. The EIA forecasts 2016 US liquid fuels consumption to grow 160,000 b/d. US car and light duty truck sales are forecast to reach 17.5 million units in 2015, an all-time high.

The Federal Highway Administration in June 2015 forecast higher miles driven for all classes of vehicles for the period of 2013 through 2030. Boeing Corporation says that "over the next 20 years, we are forecasting a need for 38,050 airplanes valued at more than $5.6 trillion. Aviation is becoming more diverse, with approximately 40% of all new airplanes being delivered to airlines based in the Asia Pacific region. An additional 20% will be delivered to airlines in Europe and North America, with the remaining 20% to be delivered to the Middle East, Latin America, the Commonwealth of Independent States, and Africa."

OPEC is forecasting global crude oil demand to average 94.13 MMb/d in 2016, a 1.3% increase compared to 2015. They are basing their forecasted growth to coincide with demand growth from non-OECD countries (read, third world countries with real world problems subsidized by OEDC countries). Paris-based IEA forecast global oil demand in 2016 to average 95.8 MMB per day.

Part of the IEA's forecast hinges on rising Chinese demand for gasoline. As the Chinese middle class expands, they are expected to adopt Western middle-class lifestyles. Notwithstanding the unbreathable air in China, cars will be purchased and driven, rather than bicycles.

Okay, what is in store for the industry in 2016? Drillers gonna drill. Bankers gonna bank. Investors gonna invest. The low-cost producers will drive marginal costs down in 2016. By August companies will start hiring again. The spring banking redetermination season will shock everyone because (a) nothing happened or (b) mergers happened that no one predicted. There will be a few more bankruptcy filings, but not 41 like we saw in 2015.

We believe corporate value is still hidden in assets that are held by companies but those assets are only ancillary to the overall strategy. As a result, M&A and A&D teams will be busier in 2016 than in 2015.

In a December survey conducted by Oil & Gas 360®, two-thirds of the operators who responded predicted that crude oil would average $40 to $50 per barrel in 2016. Almost 60% of the investors who responded are thinking crude oil will average $40 to $50 per barrel. With apologies to the fine flick Trading Places: "Advise our clients interested in crude oil to buy below $40. Mr. Oil & Gas 360 has set the price."

We believe the ability to export crude oil will not immediately impact the differential between WTI and Dated Brent, and uplift the US benchmark until WTI gains more traction with exports. We are hearing that certain US management teams are working on new supply contracts with overseas buyers at prices that are higher than the WTI strip. This is based on the US being a politically stable source of oil supply, having the best oil laws, the best delivery system for transporting crude, and the biggest inventory of sustainable and profitable crude oil projects. In other words, growing economies prefer to buy oil from a reliable supplier. These North American advantages are a big part of the reason Saudi Arabia initiated the price war and continues to pursue it, even at the cost of extreme financial pain.

Exports of natural gas volumes will begin. We're unsure yet if these volumes will command a significantly higher price per unit, but Western Europe is desperately seeking an alternative to Russian natural gas, given that Putin and his oligarchs have proven more than once they are willing to use the commodity as an economic weapon.

We anticipate that once LNG exports to Europe commence, Putin will work day and nyet to make sure he gets his cut. He does not control the open waters, so he cannot keep US tankers from docking in Europe or China, but he has a network of established pipelines and can offer other sources of value that an America cannot.

Based on the five-year average of natural gas injections (normalcy bias can really screw up a forecast), we're worried that natural gas storage will be at an all-time high come March 2016. Where is the three-month Polar Vortex when you need it?

County and municipality ad valorem tax rolls will start to feel the pinch in 2016, then will come a baseball-bat-to-the-forehead as property valuations drop because of the lack of oil industry spending and the drop in revenues per well. Alaska's state government is already talking about instituting an income tax on residents, as low oil prices have crippled the budget.

We'd be shocked if an OPEC Spring doesn't happen in Venezuela or Colombia or Ecuador. As the river of cash from the government subsidies turns into a trickle, social and political unrest is just around the corner. For Saudi Arabia, which is substantially increasing military spending to fight an Iranian-backed insurgency in neighboring Yemen, their self-created price war could not have come at a worst time.

What's the call on the bottom? 600 rigs, 125 for natural gas and the rest for everything else. We're at 700. The efficiency of drilling and completing an unconventional well is unmatched in the history of the industry. For certain, the drilling of the Drake well back in August 1859 was ground breaking. But it ain't like drilling a horizontal well and staying in zone at 11,000 feet using a steerable drill motor for more than two miles, and then fracking the entire zone to discover 30 bcf of natural gas rather than 1 bcf from a 125-foot zone with a vertical well. Comparing today's drilling and completion technology to that of just 20 years ago is akin to comparing the space shuttle to the crude airplane the Wright Brothers first flew at Kitty Hawk.

Stop drilling for crude oil and we'll be importing more OPEC production and sending more American cash overseas. The Big Five Basins - Permian, Appalachian, Williston, Eagle Ford, and Gulf of Mexico - will have ebbs and flows with the rig count, but these are the basins that are expected to keep the US lights on and the industrial complex working. Mid-Continent, Haynesville, California, and Alaska will be challenged, not by ideas, but rather by the expense of doing business. Put 50 rigs to work in the Haynesville and even a recovering accountant can negotiate reasonable terms for an ongoing drilling program.

Isn't it time that someone other than Harold Hamm embrace the "Produced Here in America by Americans for Americans" campaign? Or has that 1980s cargo tanker sailed and the consumer is so engrossed in binge watching Netflix with their Frappuccino with no fracking whip to give a care where their energy really comes from? $770 million of cash sailing away each week from the US should be cause enough to say, "Dammit, I'm tired of this and I won't stand for it anymore."

ABOUT THE AUTHOR

Greg Barnett is president of EnerCom Inc., a company he founded in 1994. EnerCom provides management consulting services to a global client base of upstream, midstream, oilfield services, and capital markets companies. Barnett has more than 34 years of oil industry and business experience and began his career as an oil and gas accountant in 1981 with the First National Bank of Dallas. He is a member of the board of directors of the National Association of Petroleum Investment Analysts. He holds a BBA from the University of Texas, Arlington and an MBA from the University of Denver.