Shale's response to low oil price environment

A SUMMARY OF 2015 AND 2016 OUTLOOK

PER MAGNUS NYSVEEN AND LESLIE WEI, RYSTAD ENERGY

OIL PRICES continued to drop during the fourth quarter as global oil supply and demand trends point to a continued over-supplied market in 2016. As operators begin to report the 2016 capital budget, total shale investments are expected to decline by an additional 20% next year and production is expected to remain flat.

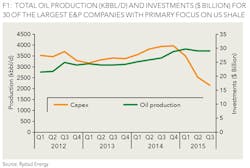

To further analyze the impact of lower oil prices on North American shale production, a peer group of ~30 companies has been created. The companies are selected based on the following criteria: US focused, oil focused, and size/level of shale activities. The peer group* accounts for 50% of current US shale investment activity as well as 50% of current shale oil production. Figure 1 compares the aggregated quarterly oil production to the quarterly capital expenditures. For the peer group, capital expenditures peaked in Q4 2014 with spending of $31 billion. Since then, investments have dropped by 46% to $17 billion in Q3 2015. Over the same time period, the reported oil production has stayed relatively flat at 3.7 million bbl/d. The year-over-year oil production growth in Q3 2015 was 300 kbbl/d, while the quarter-over-quarter production was down 10 kbbl/d. To reiterate previous articles, strong production figures can be attributed to reduced DUC inventory (see "Reexamining shale as a swing producer," OGFJ, October 2015), better well results (see "Eagle Ford, Bakken, and Permian," OGFJ, December 2015) and high grading of crews, equipment, and locations.

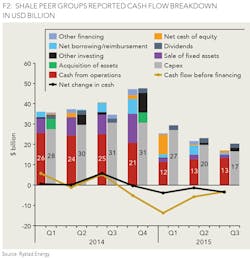

Balancing cash flows is a priority for US shale companies. Figure 2 shows the reported quarterly cash flow breakdown for the peer group on a corporate level for 2014 and 2015. During the first quarter of 2015, operations generated cash flows of $12 billion for the peer group, while investments were $27 billion. The deficit in this period was primarily covered by raising cash through equity. Since then the companies have worked to improve cash flow, primarily by reducing activity. Capex has dropped from $27 billion in Q1 2015 to $17 billion in Q3 2015, a reduction of roughly 40%. In Q3 2015 Cash Flow before Financing was -$3 billion and the "funding gap" was not closed entirely by financing. The companies raised $1.9 billion cash in the form of equity and debt.

Companies will continue to struggle balancing the cash flow in 2016 if the oil price remains low. Table 1 shows the total North American 2016 production and capex growth highlighting the main plays. Rystad Energy's 2016 estimates indicate a drop in total spending of 20%. The Eagle Ford and the Bakken are expected to fall the most in terms of activity, while the Permian Delaware will be more resilient. As a result of the lower activity, the strong production growth from the last five years is expected to come to a halt in 2016.

*The peer group consists of: Anadarko, Antero Resources, Chesapeake Energy, Cimarex Energy, Concho Resources, ConocoPhillips, Continental Resources, Devon Energy, Encana, EOG Resources, EQT Corporation, Halcón Resources, Laredo Petroleum, Marathon Oil, Murphy Oil, Newfield Exploration, Noble Energy, Oasis Petroleum, Oxy, Parsley Energy, Pioneer Natural Resources, QEP Resources, Sandridge Energy, Southwestern Energy, Whiting Petroleum, Carrizo Oil & Gas, EP Energy, Sanchez Energy, SM Energy and WPX Energy.

ABOUT THE AUTHORS

Per Magnus Nysveen is senior partner and head of analysis for Rystad Energy. He joined the company in 2004. He is responsible for valuation analysis of unconventional activities and is in charge of North American shale analysis. Nysveen has developed comprehensive models for production profile estimations and financial modeling for oil and gas fields. He has 20 years of experience within risk management and financial analysis, primarily from DNV. He holds an MSc degree from the Norwegian University of Science and Technology and an MBA from INSEAD in France.

Leslie Wei is an analyst at Rystad Energy. Her main responsibility is analysis of unconventional activities in North America. She holds an MA in economics from the UC Santa Barbara and a BA in economics from the Pennsylvania State University.