US LNG exports

Looking back at the regulatory developments in 2015

KIRSTIN GIBBS, BRACEWELL, WASHINGTON, DC

TY JOHNSON, BRACEWELL, SEATTLE

In 2015, much like the previous few years, the Department of Energy ("DOE") and the Federal Energy Regulatory Commission ("FERC") continued their methodical regulatory review of the numerous proposals to export LNG and to construct new liquefaction and export terminals. The key difference in 2015 was the clouding of the regulatory progress with a darkening commercial picture, which threatens to curtail significantly the near-term prospects of many proposed LNG export projects.

The global LNG pricing picture suffered a major decrease in late 2014 with the precipitous drop in crude oil prices, to which LNG prices are roughly linked. Yet, other factors, such as decelerating economic growth in Asia, the restarting of Japanese nuclear reactors following the Fukushima disaster, and the growing supply of worldwide LNG production capacity are all contributing to the lower LNG pricing. Prior to this difficult commercial climate, the first wave of major US LNG exports projects were able to secure off-takers, but, with so many supply options now available, including secondary capacity from existing off-takers, LNG buyers have an array of options. These options put new construction projects at a disadvantage. Thus, key to the success of a new large-scale LNG export project is its ability to be cost-competitive in the current market conditions or to be able to hold off until a possible second wave of LNG export activity emerges post 2020.

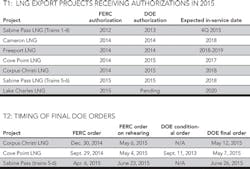

Several winners emerged in 2015, including major US LNG export projects that cleared FERC and DOE regulatory hurdles and which either commenced or continued construction. As summarized in Table 1, such projects include Freeport LNG, Corpus Christi LNG, Cameron LNG, Cove Point LNG, and Lake Charles LNG.

Other winners from 2015 include several small-scale liquefaction projects that have proposed exports via ISO containers to smaller buyers. DOE's final orders authorizing these smaller-scale exports cleared a regulatory hurdle allowing them to fill a niche unmet by the massive Gulf coast LNG export projects.

DOE regulatory developments

DOE is responsible for reviewing applications to export natural gas and LNG to Free Trade Agreement ("FTA") and non-FTA countries under the Natural Gas Act and is tasked with determining whether the export of LNG is "not inconsistent" with the public interest. By statute, exports to FTA countries are deemed to meet this standard while exports to non-FTA countries are subject to a more rigorous review by the agency. In 2014, DOE revised the process by which it conducts a public interest review, and now DOE awaits FERC's completion of its review of a project before issuing a final order authorizing commodity exports to non-FTA countries.

While DOE revised its processing procedures perhaps to blunt criticism that its review process was the principal delay in securing the regulatory approvals for LNG export terminals, these revisions have been effective in prioritizing FERC's review of a project and minimizing regulatory delay by DOE. For instance, in 2015, DOE's final non-FTA export authorization orders came within mere days of FERC issuing a rehearing order authorizing the LNG export project, as summarized in Table 2.

In 2015, DOE also responded and denied requests for rehearing of two of its final orders authorizing new LNG exports to non-FTA countries (Cameron LNG on September 25, 2015, and for Freeport LNG on December 4, 2015). Both orders denying rehearing addressed arguments related to DOE's compliance with the National Environmental Policy Act ("NEPA"), and in particular, whether DOE appropriately excluded the impacts associated with natural gas production activities induced by a project's demand and whether DOE properly analyzed climate change impacts associated with the proposed exports. Parties did not seek judicial review of the DOE order denying rehearing for Cameron LNG, but DOE's orders for Freeport LNG are now pending review at the US Court of Appeals for the District of Columbia Circuit.

Aside from the major LNG export projects, DOE granted final non-FTA export authorizations to several small-scale LNG exporters, including Carib Energy, American LNG, Air Flow, and Floridian, as summarized in Table 3. These exporters are contemplating exports via ISO containers, likely to Caribbean buyers.

DOE typically authorizes the LNG terminal or liquefaction facility to be the holder of an export authorization, usually with the ability to act as the export agent of its customers. But, in an unusual twist, DOE authorized Carib Energy, a proposed off-taker from the contemplated Floridian facility, to be the exporter of the entire capacity of the facility. Subsequently, DOE authorized Floridian to export the same quantity, subject to a deduction for any amount exported by Carib Energy.

In what was perhaps the most notable development at DOE in 2015, the agency published a long-awaited economic study. By way of background, in 2012 DOE commissioned two studies, one by the Energy Information Administration, and a second by NERA Consulting, to analyze the economic impacts of LNG exports on the US markets. These studies analyzed the impacts assuming exports of up to 12 bcf/d. In 2014, DOE issued a notice stating that it was commissioning a second round of studies to analyze the economic impacts associated with higher levels of LNG exports, 12-20 bcf/d. EIA published an updated study with the 12-20 bcf/d assumptions in October 2014.

On December 29, 2015, DOE announced publication of the long-awaited second portion of the updated study examining the macroeconomic impacts of LNG exports in the 12-20 bcf/d range. The study was performed by the Center for Energy Studies at Rice University's Baker Institute and Oxford Economics (the "Rice-Oxford Study").

The Rice-Oxford Study reached several key findings that are generally supportive of LNG exports:

- Overall macroeconomic impacts of higher LNG exports are marginally positive, even over a range of assumptions and scenarios;

- Rising LNG exports are associated with a net increase in domestic gas production, not reductions in domestic demand;

- As exports increase, domestic US prices and international index prices converge, with the majority of the price movement occurring in Asia, though the spread remains large enough to support the flow of trade;

- Increasing LNG exports will result in small declines in output at the margin for some energy-intensive, trade-exposed industries, such as cement, concrete, and glass, although the impact is expected to be very small compared to expected growth; and

- Negative impacts in energy-intensive sectors are offset by positive impacts elsewhere, such as the gas production and supply industry.

DOE will take comments on the Rice-Oxford and the 2014 EIA study and include an analysis of these studies when acting upon applications to export LNG to non-FTA countries in excess of 12 bcf/d.

The issuance of the Rice-Oxford Study is important for most pending applications to export LNG to non-FTA countries. At the conclusion of 2015, DOE had authorized LNG exports to non-FTA countries in the amount of 10.008 bcf/d and thus was approaching the upper limit examined in the 2012 studies. Arguably, this 12 bcf/d limit could be construed as a cap on the amount of LNG that DOE can authorize for exports to non-FTA countries because without the completed second round of studies it would be without strong footing to support its public interest analysis. Lakes Charles-likely the next LNG export terminal to receive DOE authorization and which is seeking authorization to export 2.0 bcf/d-would consume the remaining available export capacity under the 12 bcf/d threshold. The queue of export projects likely following Lake Charles LNG is reviewed in Table 4.

In effect, the pending non-FTA export applications were at risk of further delay in their DOE review due to the need for completed updated studies analyzing impacts above 12 bcf/d. However, with the issuance of the Rice-Oxford Study and initiation of the public comment period, DOE may be able to complete its analysis of the 12-20 bcf/d studies before the next non-FTA export application is ripe for DOE review.

The publication of the Rice-Oxford study also has implications for several Canadian projects. For instance, two proposed LNG export projects in eastern Canada, Pieridae Energy (USA) Ltd. and Bear Head LNG Corp., have sought authorization from DOE to export natural gas to Canada in part for subsequent export to non-FTA countries. DOE has decided to evaluate the Canadian projects' exports to non-FTA countries under the same standards as US LNG exports to non-FTA countries, meaning these to applications may also be delayed by the 12 bcf/d threshold.

FERC regulatory developments

FERC spent much of 2015 working through the environmental reviews of various LNG export projects but issued only two initial orders granting authorizations under the Natural Gas Act for construction of LNG terminal facilities. These authorizations were for Sabine Pass and for Lake Charles LNG. FERC also denied rehearing of its orders for Corpus Christi LNG, Cove Point LNG, and Sabine Pass.

Importantly, however, several fights over FERC's orders authorizing LNG terminals have moved to the US Court of Appeals for the District of Columbia Circuit. For example, regarding the Freeport LNG export project, parties argued that FERC failed to consider foreseeable indirect impacts from the project, including the effects of induced increases in gas production and increases in coal consumption resulting from higher gas prices. Similarly, regarding the Cove Point LNG export project, parties claimed that FERC arbitrarily and capriciously refused to consider the effects that the project would have on inducing greater gas production, that FERC failed to consider adequately the project's climate impacts, and that FERC improperly minimized the impacts of ballast water discharges, among other arguments. Cove Point also faces allegations of undue discrimination over its decisions to terminate early a proprietary, non-open access contract. Finally, regarding the Corpus Christi LNG project, parties have claimed that FERC failed to consider the indirect and cumulative effects of its action, including the impacts associated with induced natural gas production activities, that FERC failed to consider the effects of higher domestic natural gas prices and a possible shift to coal-fired generation, that FERC failed to examine adequately the alternative of using electric motors for the proposed gas-fired turbines, and that FERC violated NEPA by failing to discuss the impact of the Corpus Christi LNG project greenhouse gas emissions.

The court has not yet issued rulings in any of the foregoing cases (except to deny an emergency motion to stay FERC's orders in the Cove Point proceeding), but the eventual opinions from the court promise to be pivotal in shaping the battleground for future energy infrastructure projects.

In sum, 2015 saw maturation of the regulatory processes for reviewing LNG exports and LNG terminals, and hopefully in 2016 the courts will resolve the primary challenges to FERC's and DOE's orders. Of course, the importance of these and future regulatory decisions will be determined largely by the health of the global LNG market in the both the immediate and long term.

ABOUT THE AUTHORS

Kirstin Gibbs is a partner in the Washington, DC office of Bracewell LLP where she advises energy companies on a variety of regulatory and transactional matters involving the production and transportation of natural gas and oil, including matters involving LNG export projects.

Ty Johnson, a member of Bracewell's energy regulatory practice in Seattle, counsels domestic and foreign energy-industry clients on regulatory matters before the Federal Energy Regulatory Commission and the Department of Energy.