Mind the gap

Executive compensation in the energy sector

BRIAN CUMBERLAND AND J.D. IVY, ALVAREZ & MARSAL, DALLAS

THE DEPRESSED energy sector has experienced another turbulent year. Low crude oil and natural gas prices continue to pummel exploration and production (E&P) companies. With stock drops of 50% or more, companies are watching equity incentive values evaporate and finding themselves in a precarious balancing act with little time to act to restore equilibrium. While E&P companies are most obviously affected, related industries, such as chemicals, service and manufacturing whose share values are tied to commodity prices, are impacted as well.

Challenges with traditional executive compensation in today's energy sector

To motivate and retain executive talent, while simultaneously maximizing shareholder value, public company compensation committees are responsible for structuring competitive and reasonable total compensation packages for key executives. To assess competitiveness, most companies evaluate, among other things, the compensation arrangements at their peer companies. To be effective, compensation must function to retain and motivate executives over the short and long-term. The short-term is covered by salary and/or annual cash-based awards. To motivate executives to achieve set performance goals and align their interests with those of shareholders, executives are typically granted long-term incentives in the form of equity ownership, or awards based on equity value or total shareholder return. Under ordinary circumstances, this combination of short-term and long-term incentives works as intended.

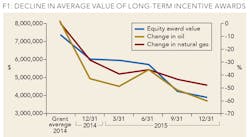

Over the last few years, however, energy companies have watched as market forces beyond their control, such as commodities prices, have decimated stock prices, and by extension, the total value of compensation arrangements. To underscore this point, the executive officers of the top 20 publicly traded E&P companies experienced a precipitous decline in the average value of long-term incentive awards, almost in lockstep with crude oil and natural gas prices (see Figure 1).

Under these circumstances, instead of equity functioning as a long-term incentive, it loses its value just when the executive's expertise and institutional knowledge are most needed.

Companies must act quickly to close the compensation gap in a downturn

For long-term awards tied to equity, the disparity between the value when granted and current market value can give rise to a substantial gap in total compensation. Closing these compensation gaps can stave off the departure of key executives and related business disruptions, but time is of the essence. The most flexible alternatives are only available before a company is forced to seek bankruptcy protection.

One of these options is to grant the additional equity needed to close the compensation gap. This approach, however, comes with three major drawbacks. First, other shareholders will be subject to a dilution in ownership. Second, the incentive plan authorizing the grant of such shares may not hold enough shares for this to be a long-term solution. In other words, the "burn rate" of shares in the plan would accelerate. Third, a sudden upward bounce in share prices could give executives an unintended windfall.

Because of the recent decline of E&P company stock prices, the number of shares needed to close the compensation gap for executives in 2015 and 2016 (expressed as a multiple of the aggregated value of 2014 awards) is staggering (see Figure 2). This, as expected, is not a popular option.

Instead, most distressed E&P companies employ one or more of the following strategies: (i) decrease overall equity award participation; (ii) convert long-term incentive arrangements from equity-based awards to cash-based incentives; (iii) modify performance metrics to focus on the reduction of expenditures or relevant costs and thus mitigate the impact of falling commodities prices; and (iv) implement retention programs for key employees and executives.

Companies should critically examine how the market forces are affecting their stock values and modify their executive incentive programs accordingly.

Companies anticipating a balance sheet restructuring or bankruptcy filing

If the time period during which a company can exercise flexibility has elapsed and a balance sheet restructuring or bankruptcy filing is under serious consideration, action should still be taken as soon as possible. Once a proceeding is filed with the court, stock values generally become worthless and the board loses autonomy over compensation decisions.

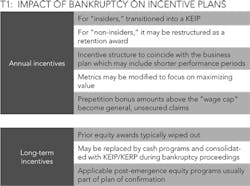

In the months leading up to a filing, many E&P companies convert existing stand-alone annual and long-term incentive programs into a single cash-based arrangement that authorizes consistent payments over shorter performance periods.

Once in the grasp of bankruptcy, however, different rules apply. Selecting performance criteria commonly used in bankruptcy, instead of benchmarking arrangements in place at peer companies, becomes the goal. Incentive compensation arrangements for top executives must comply with federal bankruptcy law pertaining to key employee incentive plans (KEIPs) and be approved by a bankruptcy court before any payments are made. Accordingly, companies should implement incentive plans with KEIP-like features in anticipation of a filing, if possible. By doing so, the plan can be easily converted to a KEIP that the court may be more inclined to approve.

Permissible compensation arrangements in bankruptcy

Bankruptcy courts acknowledge that executives play a valuable role in turnaround efforts, and retaining them with a competitive compensation arrangement is ultimately in the best interests of creditors. Due to perceived abuses, however, in 2005, the Bankruptcy Code was amended to disallow certain payments. Plans that authorize cash payments contingent on an executive remaining employed through a specified date, which are referred to as key employee retention plans (KERPs), are prohibited for insiders. Retention plans for non-insiders are, on the other hand, permitted.

Determining which employees are insiders is not a simple task. While not an exhaustive list, insiders generally include directors, officers, persons in control or general partners of the debtor, and partnerships in which the debtor is a general partner. Because they are not specifically defined by statute, the terms "director" and "officer" are open to interpretation. Due to the distinction between insiders and non-insiders, companies should not issue retention payments until all employees have been properly classified.

Court-approved KEIPs are the only incentive compensation arrangement available for insiders. A plan will meet the stringent KEIP requirements if awards are payable only upon the attainment of performance-based goals designated in advance by the company and approved by the court.

Performance metrics must be reasonable and appropriate given the applicable facts and circumstances. Courts have previously approved, as reasonable and appropriate, the following performance metrics for energy sector KEIPs: (i) realizing specified production targets; (ii) meeting identified worker safety metrics; (iii) reducing expenses incurred for lease operating or general and administrative expenses; (iv) achieving designated financial metrics (i.e., EBITDA or EBITDAR); (v) satisfying time-based performance targets, including confirmation of a plan of reorganization, or emergence from bankruptcy, by a specified date; and (vi) reaching designated monetary targets, such as the amount of proceeds realized from the sale of the company or selected assets.

Further, courts have disallowed plans incorporating performance metrics that do not pose a legitimate challenge for achievement, do not correlate to the company's business plan or objectives, or are satisfied before the court receives the motion requesting KEIP approval.

Companies must also obtain approval of the periods over which performance is measured, with a quarter of a year being the most common, and the timing of associated payments. Potential payouts should be in an amount sufficiently motivating to an executive, but still be reasonable and consistent with amounts previously approved by the bankruptcy court. Designing an incentive plan that satisfies all of these requirements increases the likelihood of a shorter, less contentious approval process.

The loss of autonomy, working with third parties and implementation

When making changes to executive compensation arrangements in anticipation of a bankruptcy filing, it is important to remember that once under the jurisdiction of the bankruptcy court, board members are no longer the sole decision makers regarding executive compensation. The representative for the company's creditors, the US Trustee, and the bankruptcy court will all participate in the approval process.

The US Trustee tends to be most concerned with the performance criteria and amounts of potential payments. A creditors' committee usually focuses on the company's cash flow and profit. Both expect to negotiate the KEIP's terms. If a company has the support of the creditors' committee and US Trustee, courts are more inclined to give the debtor substantial deference and approve a KEIP.

Debtors who file bankruptcy proceedings without having restructuring agreements in place with their major stakeholders should be prepared for extensive revisions to their incentive compensation programs. In prepackaged bankruptcies, on the other hand, debtors negotiate with and obtain approval from their creditors in advance of a filing. Doing so allows a debtor to exert more control over the design of its incentive plans. Either way, compensation committees should be prepared to work alongside third parties in the modification of their incentive plans (see Table 1).

Executive incentive and retention following emergence from bankruptcy

Because creditors typically hold a considerable portion of shares in the post-emergence entity, as part of the confirmation plan, their representatives on the creditors committee work with the company to identify which employees are vital to the company's future success. As an incentive to remain, these employees can be granted equity in the post-emergence entity. These awards are referred to as emergence grants.

Prior to the awards being granted, the following decisions should be made: (i) the percentage of the new company's equity to be reserved for employee equity awards; (ii) the fraction of the equity pool to be granted at emergence; (iii) employees eligible for emergence grants (officers, middle management, all employees); and (iv) the form of the emergence grants (i.e., size and type of award, vesting, etc.).

Most companies emerging from bankruptcy set aside a reserve of shares for emergence grants. While the size of the reserve depends on company size, smaller companies tend to reserve more shares, as a percentage of total shares, than their larger counterparts. Stock options and restricted stock are the most common forms of emergence grants, followed by performance shares. As with traditional equity grants, emergence awards can be structured as a retention vehicle (by vesting the awards over time), an incentive vehicle (by vesting based on performance) or a combination of both.

Conclusion

Motivating and retaining key executive talent is essential no matter the circumstances. For entities in financial distress, however, the hurdles are higher. Compensation committees are advised to remain vigilant and proactive, anticipating how volatile market forces can damage the company's ability to retain and motivate essential executive talent. Bridging compensation gaps is not an insurmountable challenge, but companies have more flexibility before bankruptcy to modify current executive compensation and retain control over their executive compensation arrangements during the bankruptcy process. The time to act to reduce the impact of falling stock prices is now.

ABOUT THE AUTHORS

Brian Cumberland is a managing director with Alvarez & Marsal in Dallas, where he leads the Executive Compensation & Benefit Practice. With more than 25 years of experience, he provides executive compensation advice to corporate clients. In addition to advising healthy companies on executive compensation matters, he has assisted over 60 bankruptcy companies with compensation planning, benchmarking and expert witness testimony.

J.D. Ivy is a managing director with Alvarez & Marsal in Dallas, advising clients on compensation and benefits issues. Ivy works with clients on executive compensation matters, including issues related to stock options, restricted stock, non-qualified retirement plans, deferred compensation, global compensation strategies, golden parachute rules and the one-million deduction limitation. Ivy also assists companies headed toward bankruptcy with implementing KERPs and KEIPs.