Rough sailing for energy sector supply vessels

Overview and current market dynamics

ESBEN CHRISTENSEN, JON LABOVITZ, CATHERINE CHAK AND JOB CHAN, ALIXPARTNERS, NEW YORK

ONE OF THE MANY industries impacted by the severe decline in oil prices this year is the offshore supply vessels (OSVs) industry. OSVs are efficient and vital components of the oil and gas industry. They provide logistical support for offshore drilling platforms-from logistics to rescue services-and form a maritime-industry subsector that generates more than $25 billion in annual revenues. Many different types of vessels make up the OSV market, which is now at a low point caused by a plunge in oil prices and excess industry capacity. Companies, including those comprising the major segments-platform supply vessels (PSVs) and anchor-handling tug supply (AHTS) craft-face serious challenges and have to respond to radically altered economic conditions.

Shipping fleets mark nearly every week with press releases announcing layoffs, the stacking of vessels, and delays in the commencement of new ship construction. The AlixPartners 2015 Offshore Supply Vessel Study of 33 major companies in the OSV sector shows rising debt burdens that will add to the struggle of those companies to maintain positive balance sheets as their earnings likely decline. The industry faces grave financial pressure as demand has receded, mirroring the slide in oil prices.

Oil prices dropped from more than $100 a barrel in January 2014 to less than $45 a barrel in November 2015, and exploration and production (E&P) companies have cut growth plans for offshore rig counts. In parallel, demand for service vessels and crews has also slowed, which puts pressure on vessel usage and day rates, curbs growth plans, and reduces revenues. According to Clarksons Research, OSV day rates are down around 40% from early 2014.

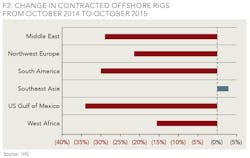

Rig counts ultimately dictate the fortunes of the OSV market, and the lower the price of oil, the fewer the number of rigs required. And, in turn, fewer active rigs mean fewer AHTS vessels and, further, cuts in the growth of rig installations have crimped demand for PSVs. Meanwhile, at the same time demand has been dropping, competition and capacity has been rising, as Chinese shipyards and easy credit helped drive up vessel counts. According to RS Platou, OSV fleet growth globally in 2015 and 2016 will be almost 18%. Therefore, the industry will have seen the vessel-to-rig-count ratio increase by 35% since the January 2008 peak. Looking at it another way, as of June 30, 2015, OSV inventory increased 38% since January 2008, whereas rig counts increased only 5%. Additionally, as of October 2015, rig usage is down more than 18% worldwide from a year ago across all six major global regions. See Figures 1 and 2.

All of these factors prompted major cuts by global and national E&P companies, which drove down oil companies' average offshore project costs by about 15% in 2015. Oil companies slashed spending across the board, and they continue to push for reductions in service costs and vessel day-rates. Also, cheaper, onshore oil projects are expected to take a share of the OSV services market from the more expensive offshore plays. At the same time, high fleet growth in most segments continues to shrink contract pricing and margins.

Regional review - Brazil, Middle East and Southeast Asia

Brazil, which had been a source of stable long-term charters, is currently one of the least attractive markets. Petrobras has substantially reduced capital expenditures and activity levels in response to the drop in oil prices but the contraction has been further exacerbated by the company's involvement in a corruption scandal. Several charter contracts have been cancelled or re-negotiated. In addition, Brazilian-flagged vessels have been asserting their rights to challenge existing charters of non-Brazilian flagged vessels, which has placed the owners of the latter in difficult financial and legal positions.

In contrast, the Middle East is one of the brighter spots on the demand side driven by OPEC requirements to protect market share. Saudi Aramco and Abu Dhabi National Oil Company have committed to ambitious five-year capital expenditures plans to raise production capacity. The OSV market continues to benefit with reports of tendering activity. However, as the market is highly competitive and owners from other regions, particularly Southeast Asia, have been mobilizing vessels into the area, rates would likely be fixed at a discount from prevailing levels. In addition, the market is relatively open to foreign players but there are strict registration and qualification requirements, which owners must meet before they can compete for contracts.

The OSV market in Southeast Asia is currently very weak with low utilization levels and rates due to reduced vessel demand against a significant oversupply of vessels. Demand in the region is primarily driven by Malaysia and Indonesia, which also have cabotage rules to prioritize domestic-flagged vessels. Offshore activities are still ongoing; however, exploration has been scaled back leaving production to provide a reduced level of demand. The competition for utilization in the market where operating costs are relatively low for the operators based in the region has resulted in equally low rates. Given the competition, some owners have mobilized their vessels to the Middle East and other parts of the world where rates are more robust. The oversupply issue could be mitigated with scrapping or exiting of older and un-economic vessels. However, scrapping levels have not been significant as shipbreakers generally prefer large tonnage and owners have little financial incentive as scrap values of OSVs, particularly for smaller types, can be limited.

How OSV fleets can navigate choppy waters

Summing up all these factors, companies in the OSV market face many strong undercurrents. The AlixPartners 2015 Offshore Supply Vessel Study indicates financial preparation will play a major role in determining which companies thrive and which may falter or fall prey to consolidation. Among the 33 companies studied-which averaged $445 million in revenue in the 12 months through June 2015-overall debt load is up 16% from 2011's peak, totaling $22 billion-a $3 billion increase over four years.

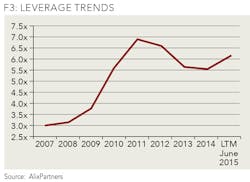

Levels of debt to EBITDA-a.k.a., leverage-ballooned to more than 130% from 2007 to 2011-the vessel-to-rig-ratio trough-to-peak time frame-but then dropped 20% from 2011 levels as rising oil prices then boosted earnings (see Figure 3). However, since 2011, leverage has increased again, rising 11% in the 12 months prior to June 2015, putting it at 6.2x. As revenues continue to shrink-and because of lower EBITDA levels-OSVs will likely struggle to make interest and amortization payments. In addition, an AlixPartners Altman Z-score analysis for these companies shows that 17 had a score less than 1.8 at the end of 2014, which means there is a high probability they could be headed toward bankruptcy absent aggressive intervention.

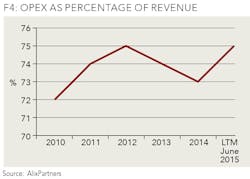

That leaves OSV operators with little choice but to trim operating expenses wherever they can. Operating expenses have risen as a percentage of revenue, growing from 72% in 2010 to 75% in the 12 months ended June 2015 (see Figure 4). One would expect that, facing declining revenues and shrinking balance sheets, companies would be more aggressive about cutting operating expenses, but such expenses have only continued to increase.

The situation is precarious to say the least. To navigate the current environment, OSV operators should take steps to reduce overhead costs to align with market realities.

Maximize fleet utilization: Even though day-rates have declined, locking in contracts for longer time periods could bring some stability to OSV companies' top lines. The E&P companies leasing these vessels require stability as they calculate their own costs. As long as marginal costs get covered, remaining cash flows can be used to service and reduce debt. Each potential charter needs to be evaluated and reviewed against the options of stacking or selling the vessel in question.

Cut nonessential capital spending and projects: In the same way that oil companies have taken a scalpel-and sometimes an ax-to capital spending, OSV operators should identify and rank their own projects to eliminate any spending that will not generate sufficient cash-on-cash returns.

Work with service-company providers to achieve lower rates: Management teams should determine where there is slack and inefficiencies in their supply chains, and then reduce costs to remain competitive.

In addition, certain positive trends could help companies that use them to their best advantage. While falling oil prices have plunged the OSV industry into rough seas, diesel fuel is also now cheaper and fuel hedges can be used effectively to lock in lower costs for smoother sailing. Also, given that deepwater E&P projects can't shed their infrastructures as quickly as can a small producer in, for example, North Dakota, any upswing in oil prices may sustain oil-company projects that would otherwise be costly to terminate. Therefore, OSV vessels with the best technology would be in high demand, so the most-modern fleets will likely have a more robust outlook.

Finally, according to many experts, the long-term outlook for oil prices remains positive. That means future OSV success stories will feature companies that do all of the above to make it through today's rough seas, as they also continue to develop and nurture long-term relationships with blue-chip customers, while standardizing vessel designs for great efficiency. Such companies will also look to take further advantage of operations in cabotage areas where foreign vessels can enjoy certain supply protections when transporting between two ports in the same country.

OSV management teams should keep all these items in mind as they navigate an otherwise treacherous and uncertain business seascape.

ABOUT THE AUTHORS

Esben Christensen and Jon Labovitz are directors at AlixPartners LLP, a global business advisory firm. Catherine Chak is a vice president and Job Chan is an analyst at AlixPartners LLP.

The opinions expressed are those of the authors and do not necessarily reflect the views of AlixPartners LLP, its affiliates, or any of its or their respective other professionals or clients.