INDEPENDENT RESEARCH firm IHS Markit has provided OGFJ with updated production data for the OGFJ100P periodic ranking of US-based private E&P companies. The rankings are based on operated production only within the US.

Top 10

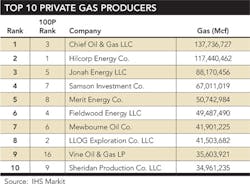

With this installment of the OGFJ100P, we kick off the aggregation of year-to-date 2016 data, shaking up the rankings all the way to the top. Fieldwood Energy LLC entered the October list at No. 2 in private liquids producers, No. 6 in private gas producers, and No. 4 overall by BOE. Fieldwood Energy was formed in early 2013 as a portfolio company of Riverstone Holdings LLC. The Houston, TX-based company established itself in September 2013 with its inaugural acquisition of Apache's Gulf of Mexico Shelf business, followed by the acquisition of SandRidge's Gulf of Mexico and Gulf Coast business units in early 2014. Since that time, Fieldwood has completed several smaller and bolt-on transactions. An update of ownership records has caught up with the company's position as the largest operator in the Gulf of Mexico.

Another big move into the Top 10 lists was that by Denver, CO-based Jonah Energy LLC. The company comes in at No. 3 in the top private gas producers list and No. 5 by overall BOE. The company was formed by TPG in early 2014 to acquire and operate $1.8 billion in Jonah field operations from EnCana Oil & Gas (USA) Inc., a wholly owned subsidiary of EnCana Corp.

Moving into the Top 10 in private gas producers is Vine Oil & Gas LP, where the company now sits at No. 9. The Dallas, TX-based shale driller formed in 2014 by Blackstone Group LP is ranked No. 16 by overall BOE.

M&A

We start our M&A snapshot with a deal involving an OGFJ100P Old Reliable-Yates Petroleum Corp. Down three spots from its previous No. 7 rank by overall BOE, No. 10-ranked Yates agreed to be merged into EOG Resources in a transaction valued at $2.5 billion. Under the terms of the private, negotiated transaction, EOG will issue 26.06 million shares of common stock valued at $2.3 billion and pay $37 million in cash, subject to certain closing adjustments and lock-up provisions. EOG will assume and repay at closing $245 million of Yates debt offset by $131 million of anticipated cash from Yates, subject also to certain closing adjustments.

With the deal, EOG is acquiring 186,000 net acres in the Delaware Basin, 138,000 net acres in the Northwest Shelf, and 200,000 net acres in the Powder River Basin. EOG plans to commence drilling on the Yates acreage in late 2016 with additional rigs added in 2017. The deal also adds 29.6 Mboe/d (48% oil) to EOG's overall production (adds ~5% to output) and 44 MMBoe of proved developed reserves.

"This transaction combines the companies' existing large, premier, stacked-pay acreage positions in the heart of the Delaware and Powder River basins, paving the way for years of high-return drilling and production growth," said William R. "Bill" Thomas, chairman and CEO of EOG.

A deal with the privately-held legacy Permian producer was long sought after by the industry, said Jefferies Inc. analysts in a report following the announcement. EOG's "superior development track record and its related ability to use shares as currency" are why the company prevailed-and with an attractive deal, they noted.

"Assuming $25k per flowing, the production is worth ~$750 MM. This values the 186k Delaware acres at $9.4k per acre and assumes no value beyond producing for the NW Shelf, which is cheaper than recent deals. We see the NW Shelf and PRB acreage as representing low-cost upside but see a bigger potential impact from Delaware development (Bone Spring, Leonard, Wolfcamp)," Jefferies said.

Wells Fargo Securities LLC acted as exclusive financial and technical advisor to Yates Petroleum, Abo Petroleum, and MYCO Industries for the transaction. Thompson & Knight LLP, Modrall Sperling Law Firm and Kemp Smith LLP acted as legal advisors to Yates Petroleum, Abo Petroleum, and MYCO Industries Inc., respectively. Akin Gump Strauss Hauer & Feld LLP acted as legal advisor to EOG. Closing is anticipated in early October 2016, subject to customary closing conditions.

In another deal involving the Permian Basin, privately-held Reliance Energy agreed to sell approximately 40,000 net acres in the Midland Bain to Concho Resources Inc. With the deal, No. 32-ranked Reliance Energy will rake in $1.625 billion for its average 99% working interest in the assets that include approximately 10 MBoepd (67% oil) of production from 326 vertical wells and 44 horizontal wells, only one of which was completed in 2016. The present value of this stable production base at current NYMEX strip pricing is approximately $0.5 billion, with the remaining $1.1 billion of the purchase price attributable to 40,000 undeveloped acres.

Estimated proved reserves attributable to the acquisition total approximately 43 million boe. Proved developed reserves represent approximately 69% of the total proved reserves. The estimate of proved reserves is based on the company's internal estimates as of June 30, 2016, and utilizes the Securities and Exchange Commission's reserve recognition standards and pricing assumptions based on the trailing 12-month average first-day-of-the-month prices of $39.63 per bbl of oil and $2.24 per MMBtu of natural gas.

Consideration in the transaction includes approximately $1.1 billion of cash and 3.96 million shares of Concho's common stock. In a note dated August 15, Stifel analysts said "the PV10 of $0.5B for production ($50M/Boe/d) implies a price of $28M/acre for undeveloped acreage in Andrews, Martin, and Ector Counties, TX. The purchase price is comparable to recent Midland Basin transactions completed by SM (~$32M/acre for 25M net acres in Howard County, TX), FANG (~$28M/acre for 12M net acres in Howard County), and PE (~$42M/acre for 10M net acres in Glasscock County, TX)."

Continuing, Stifel said that, "like most 2016 Midland Basin transactions, this acquisition was not cheap. However, the properties appear to be underdeveloped and located in the heart of one of the best shale plays in the US. We suspect that projected returns from 530 acquired locations rank near the top of CXO's drilling inventory."

Vinson & Elkins LLP acted as legal advisor and Evercore acted as financial advisor to Concho on the acquisition. Sidley Austin LLP acted as legal advisor to Reliance Energy. The acquisition is expected to close in October 2016, and is subject to customary closing conditions.

On August 26, 2016, Finley Resources Inc. completed the sale of its Howard County assets in the Midland Basin to Sabalo Energy LLC, a portfolio company of EnCap Investments LP. Privately held Finley Resources is a Fort Worth, TX-based E&P operator established in 1999 which owns, manages, and develops approximately 2,500 oil and gas properties in eight states. Sabalo Energy is a privately held Corpus Christi, Texas-based independent oil and gas company focused on the exploration and exploitation of oil and gas properties in various onshore US basins. Simmons & Company International | Energy Specialists of Piper Jaffray served as exclusive financial advisor to Finley Resources.

Click here to download pdf of the "2016 Year-to-date production - alphabetical listing"

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.