Hully Gully in the Permian Basin

HIGHLIGHTS OF RECENT M&A / A&D ACTIVITY IN THE HOTTEST BASIN IN THE OIL PATCH

JOHN WHITE, ROTH CAPITAL PARTNERS, HOUSTON

DURING OUR RECENT VISIT to Midland, Texas, we were invited by our good friend and colleague, Larry Oldham, to lunch at the Midland Petroleum Club. We were seated at Mr. Oldham's regular table and joined by several of his regular dining friends, all of course, in the oil business.

After the dishes were cleared and coffee was served, a bowl of pennies was passed around, and we were each instructed to take three for a game of Hully Gully. It goes like this: you hold between zero to three coins in a closed hand on the table in front of you. Each person offers an estimate of how many total coins everyone is holding. The estimates are documented and the coins are displayed and counted. Exactly how one wins/loses was lost on us due to its complexity.

Photo by John White

During the summer of 2016, a different version of Hully Gully was played in the Permian Basin. It goes like this: E&P companies, together with private equity investors and bank lenders, try to estimate the amount of proved developed reserves, proved undeveloped reserves, and the probable and possible reserves attributable to certain companies and/or spreads of acreage. They then decide what to pay for it and subsequently finance the transaction.

Given the absolute tsunami of Permian Basin M&A/A&D activity during the summer of 2016, we had to get out to Midland and talk to our contacts to get some first-hand accounts and opinions. Thus, we spent all of August 24th and 25th and a portion of the 26th in Midland in meetings with Diamondback Energy (FANG-Rated Buy as of Sept. 30) and Clayton Williams Energy (CWEI-Rated Neutral as of Sept. 30). We also met with four private E&P companies, four consulting geologists, two petroleum landmen, and a lender to the sector.

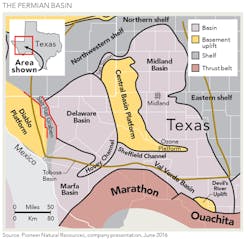

Here is how we see it: The Permian Basin: 13 Weeks, 20 Deals, $12.5 billion. This all kicked off on June 15th with Devon's (DVN-NC) two divestitures of non-core properties, one in the northern Midland Basin, and one in the southern Midland Basin. Activity shifted into high gear with the June 21st announcement from QEP Resources Inc. (QEP-NC) of its $600 million acquisition of Permian assets from privately owned RK Petroleum Corp. Then the cascade of deals really got going, as shown in Table 1.

What were the catalysts that prompted this string of transactions at this point in time? What we heard in our meetings in Midland confirmed much of our own thinking: 1) a consensus has formed that "the lows for crude oil prices are in," looking back at the dreadful $28/bbl we saw at the beginning of 2016, 2) crude oil prices have displayed some stability over the last several months, in the $40/bbl to $50/bbl range, 3) in both the Midland and Delaware basins, the industry experienced a large decrease in completed well costs and gained expertise and efficiency in applying much larger frac jobs, both of which greatly improved well economics, 4) the timing was right for a number of E&P companies, most backed by private equity investors, to exit and sell.

With the $/acre metric crossing the $30,000/acre threshold and, in the case of the QEP Resources-RK Petroleum deal, crossing the $50,000/acre threshold, many in the industry have wondered aloud and in print whether or not all of these deals will be profitable (Source: 1Derrick, ROTH Capital Partners).

In our conversations in Midland and in Houston, the transaction that received plenty of criticism was that of QEP Resources-RK Petroleum because of the $58,315/acre metric. Sure, we get it, it is a sky high $/acre figure. But look at the acreage location and its features: it is a contiguous acreage position in the core of the northern Midland Basin right square on the Martin County/Andrews County line where well results have been strongly positive. The properties are about 10 miles east of existing QEP operations, providing ease of integration with existing operations. The package has approximately 9,400 net acres, with 98% of acreage held by production (HBP) to the base of Wolfcamp formation or deeper. And, this is one of the recent slew of Permian deals that actually has proved reserves. QEP's internal proved reserve report pegs them at 76 million BOE.

This round of transactions was a real watershed for the southern Delaware Basin with lots of properties in Reeves, Culbertson, Ward, and Pecos Counties. How will development in the southern Delaware fare going forward? We think, as do our comrades in Midland, it will develop pretty much like all the previous shale plays. There will be "sweet spots" discovered and there will be acreage in the play that is condemned due to drilling difficulties or more likely, poor rock quality as you move west-southwest from FANG's acreage along the Pecos River in Reeves County.

Sometimes, despite all the sophisticated metrics, the complex geology and reservoir engineering, it all gets boiled down in much more simple fashion. We were meeting with a private equity backed E&P in Midland and hotly debating the pros and cons of these big deals in the conference room with the top four members of the management team of a private equity backed oil and gas company. Then, one of them, with 20-plus years of experience in the Permian Basin, said "in the Permian Basin, if you have HBP acreage, and hold on long enough, you will eventually make money. You will either experience: 1) higher oil and gas prices than when you made the acquisition, 2) be graced with geological serendipity, or 3) an advancement in technology will improve reserve recoveries and or lower well costs." So there you have it.

WHERE IS THE NEXT PLAY?

We think this question was answered by EOG Resources (EOG-NC) with its announcement on September 6 of its acquisition of the Yates family of companies. On the conference call elaborating on the deal, Bill Thomas, EOG's chairman and CEO, said, "This combination substantially increases EOG's position in the Delaware Basin, and establishes a large position and new potential resource plays on the Northwest Shelf in New Mexico."

The Northwest Shelf is, not surprisingly, a structural feature just northwest of the Delaware Basin. It lies entirely in New Mexico, primarily in Eddy, Lea, and Chaves Counties. Target formations on the Northwest Shelf include the Yeso, Abo, Wolfcamp, and Cisco formations, which are all platform carbonates. These formations are found at shallower depths and display a lower initial production rate and lower overall ultimate oil and gas recovery than the target formations in the southern Delaware, but they can be drilled for much lower total completed well costs, rendering many locations in the trend economic at current commodity prices.

EOG and others in the area are also targeting the Leonard Shale, which is in the northern Delaware Basin, and was explained by Bill Thomas: "The Leonard is equivalent to the Avalon, it's the upper part of the Bone Spring section. So it's what many in the industry call the Avalon, and it's a very significant shale play for EOG over the years." EOG went on to say that the company is targeting the Leonard primarily in southern Lea County.

DELAWARE BASIN TRANSACTIONS

EOG Resources (EOG-NC)

After the industry took a break for Labor Day, the action resumed promptly on September 6th with EOG Resources Inc. and Yates Petroleum Corp. announcing agreements under which EOG and Yates Petroleum (and certain other Yates entities) will combine. EOG will issue 26.06 million shares of common stock valued at $2.3 billion and pay $37 million in cash, subject to certain adjustments. EOG will assume and repay at closing $245 million of Yates debt offset by $131 million of anticipated cash from Yates.

Yates is a large, privately-held, independent E&P with a rich and favorable history in the industry. Yates has 1.6 million net acres across the western United States and has operated since 1924 (93 years) when Yates drilled the first commercial oil well on New Mexico state trust land. Highlights of Yates' assets are summarized as follows: 1) production of 29,600 BOE per day, 2) proved developed reserves of 44 million BOE, 3) a Delaware Basin position of 186,000 net acres, 4) a Northwest Shelf position of 138,000 net acres, 5) a Powder River Basin position of 200,000 net acres, 6) an additional 1.1 million net acres in New Mexico, Wyoming, Colorado, Montana, North Dakota, and Utah.

"EOG is our partner of choice as we look to extend Yates' 93-year legacy," said John A. Yates Sr., chairman emeritus of Yates Petroleum Corp. and son of founder Martin Yates Jr. "As we enter a new era of unconventional resource development, we are excited to join forces with another pioneering company like EOG." (Source: EOG press release dated September 6, 2016.)

Diamondback Energy (FANG-Buy)

Our first meeting on Wednesday was with Diamondback Energy (FANG-Buy). If you're gathering data on Permian Basin happenings, FANG is a great start.

The company recently signed an agreement to acquire 19,180 net acres from privately-owned Luxe Energy. The properties are located primarily in Reeves and Ward counties, along the Pecos River. The purchase price was $560 million. The properties currently produce approximately 1,000 BOE per day from 30 gross wells (11 Hz and 19 Vt) and 2.2 million BOE of proved developed reserves.

As we learned from FANG and also in several of our other meetings in Midland, there are a number of highly favorable geological characteristics in this area of the Delaware Basin. These include thicker formations and, in turn, higher estimates of original oil in place (OIP).

The drilling activity on and offsetting FANG's to-be-acquired properties, part of which is the Phantom Field, was also some of the industry's earliest and has yielded some of the best wells. This area also runs along the deepest axis of the Delaware Basin, which in turn leads to high TOC levels and also higher reservoir pressures.

As FANG advised in a press release, it believes it has identified 290 net potential horizontal drilling locations with an anticipated average lateral length of approximately 9,500 feet. The properties already possess tank batteries, frac water pits, salt water disposal facilities, and pipelines.

Management believes the acreage is in the top quartile of FANG's existing acreage portfolio based on well results in immediate proximity. FANG stated that it estimates three horizontal zones have been de-risked: 1) the 3rd Bone Spring, 2) the Wolfcamp A, and 3) the Wolfcamp B. FANG estimates further upside potential exists in additional Bone Spring and Wolfcamp intervals. (Source: FANG press release dated July 13, 2016.)

Silver Run to acquire Centennial

On July 6th, Riverstone Holdings LLC, an energy and power focused private investment firm, announced that it will acquire a majority stake in Centennial Resources Development LLC from NGP Energy Capital and others.

On July 21st, Riverstone agreed to assign its right to purchase the stake in Centennial to Silver Run Acquisition Corp. Silver Run will acquire an 89.1% stake and NGP retains the balance of 10.9% in Centennial. At closing, Silver Run is expected to be renamed Centennial Resource Development Corp.

Deal value breakout is as follows: 1) cash of $1,408.4 million, 2) additional contributed equity of $184.7 million, 3) debt of $142 million as of 3/31/2016, for an aggregate firm value of $1,735.1 million. The Centennial assets are located in the Delaware Basin, primarily in Reeves County, Texas, and also in Ward County, Texas and Pecos County, Texas. Acreage consists of 42,500 net acres, approximately 83% operated, and 67% HBP.

According to Silver Run and 1Derrick, the operated producing horizontal well count is 61, with an estimated 1,357 gross horizontal drilling locations. Formation targets include the Bone Spring, Upper Wolfcamp A, Lower Wolfcamp A, Wolfcamp B, and Wolfcamp C. Proved reserves as of 6/30/2016 are 48.6 million BOE split: PD/PDNP 20.3 million BOE and PUD 28.4 million BOE. Production during 1Q 2016 averaged 7,200 BOE/ per day and was 72% oil, 18% gas, 10% NGL.

PDC acquires Delaware Basin acreage from Kimmeridge

According to PDC Energy (PDCE-NC) and 1Derrick, PDCE has entered into two separate agreements to acquire acreage in the Delaware Basin through the acquisition of Arris Petroleum Corp. and 299 Resources LLC, portfolio companies of Kimmeridge Energy Management Co. PDC will pay approximately $915 million in cash and 9.4 million of PDCE shares valued at about $590 million. The aggregate transaction value, including shares and cash, is approximately $1,505 million.

The transaction is expected to be completed by year end 2016, subject to necessary approvals. The assets are comprised of 1) 57,000 net acres in Reeves and Culberson Counties, Texas, 2) 7,000 BOE per day of current net production, 3) 530 million BOE of estimated net reserves potential, with 65% liquids, 4) 710 currently identified potential locations in the Wolfcamp A, B, and C zones assuming a combined total of four to 12 wells per section, 5) 93% working interest and 100% operated, 6) includes operated gas gathering systems, pipelines and five SWD wells.

MIDLAND BASIN TRANSACTIONS

Concho Resources acquires Reliance Energy

On Aug. 15th, Concho Resources (CXO-NC) announced its definitive agreement to acquire approximately 40,000 net acres in the core of the Midland Basin from Reliance Energy, a privately held, Midland-based energy company, for $1.625 billion. The transaction was privately negotiated. This is a meaningful deal as it expands CXO's core Midland Basin position to more than 150,000 net acres and boosts production to 30,000 BOE per day.

The deal adds approximately 40,000 net acres with an average 99% working interest and includes approximately 10,000 BOE per day of production with 67% oil content. CXO estimates the Reliance acquisition brings a drilling inventory of more than 530 long lateral drilling locations, targeting the Middle Spraberry, Lower Spraberry, and Wolfcamp B.

The acquisition includes 326 vertical wells and 44 horizontal wells, only one of which was completed in 2016. The present value of this production base at NYMEX strip pricing as of 8/15/2016 is approximately $0.5 billion, with the remaining $1.1 billion of the purchase price attributable to the 40,000 undeveloped acres. (Source: CXO press release dated July 15, 2016.)

Estimated proved reserves attributable to the acquisition total approximately 43 million BOE. Proved developed reserves represent approximately 69% of the total proved reserves. The estimate of proved reserves is based on CXO's internal estimates as of June 30, 2016, and utilizes the Securities and Exchange Commission's reserve recognition standards and pricing assumptions based on the trailing 12-month average first-day-of-the-month prices of $39.63 per bbl of oil and $2.24 per MMBtu of natural gas. (Source: CXO press release dated July 15, 2016.)

The acquired acreage is located in Andrews, Martin, and Ector counties in Texas with minimal leasehold drilling obligations. Please see the acreage maps shown below. Due to the contiguous nature of the acquired assets, two-thirds of these locations will accommodate two-mile lateral wellbores, and the remaining locations will accommodate 1.5-mile lateral wellbores. The engineered locations are based on eight locations per zone per drilling and spacing unit in the Middle Spraberry, Lower Spraberry or Wolfcamp B, with two to three of these zones targeted per drilling spacing unit. CXO believes there is substantial development upside from applying optimal drilling and completion methods, testing closer well spacing and delineating other zones. (Source: CXO press release dated July 15, 2016.)

Consideration in the transaction includes approximately $1.1 billion of cash and 3.96 million shares of Concho's common stock valued at approximately $0.5 billion and issuable pursuant to a stock payment option that CXO will exercise.

QEP Resources: Midland Basin acquisition

QEP (QEP-NC) is acquiring a contiguous acreage position in the core of the northern Midland Basin in Martin County, Texas for approximately $600 million. These properties are approximately 10 miles east of existing QEP operations. The package has approximately 9,400 net acres, with 98% of acreage held by production (HBP) to base of Wolfcamp formation or deeper. The average working interest is 96% WI with a 23% royalty burden. These properties are currently producing about 1,400 BOE per day with 83% oil content from 96 vertical wells. QEP believes there is the potential for over 430 horizontal locations in four target reservoirs. The QEP internal proved reserve estimate is 76 million BOE.

Callon Petroleum acquires assets from Plymouth Petroleum (Element Petroleum)

On Sept. 6th, Callon Petroleum (CPE-Buy) announced an agreement to acquire oil and gas properties for $327 million in cash. Key attributes of the pending acquisition include: 1) approximately 5,667 net acres, primarily located in Howard County, Texas, 2) over 75% of the acreage is offsetting CPE's position in northwest Howard County, providing opportunities for shared infrastructure and extended laterals, 3) 112 net identified horizontal drilling locations targeting the Wolfcamp A, Lower Spraberry, and Wolfcamp B zones, increasing CPE's existing inventory of drilling locations in these delineated zones in its WildHorse (Howard County) region by over 90%, assuming current development spacing, 4) current net production of approximately 2,300 BOE per day (86% oil) from 9 horizontal (gross) and 16 vertical wells (gross), 5) an estimated 12.2 million BOE (87% oil) of net proved reserves as of 9/1/2016 based on CPE's internal reserve report, 5) overriding royalty interests in three units offsetting the acreage. Upon closing, CPE will become operator of 90% of the acquired acreage and CPE's Midland Basin position will include approximately 40,000 net acres.

ABOUT THE AUTHOR

John White is a senior research analyst in ROTH Capital Partners' Houston office. Previously, he was a portfolio manager and analyst with Triple Double Advisors. Prior to that, he was an E&P equity analyst with Natixis Bleichroeder. From 1996 to 2003 he served as an energy high yield fixed income analyst for BMO Capital and John S. Herold Inc. His experience also includes banking and credit analysis responsibilities with Scotia Capital. His industry background includes working in acquisitions and divestitures and exploration and production, primarily with BP. White received a BBA from the University of Oklahoma and an MBA from the University of St. Thomas (Houston). He serves on the OGFJ Editorial Advisory Board.

ROTH makes a market in shares of CPE, CWEI, and FANG and as such, buys and sells from customers on a principal basis.