INDEPENDENT RESEARCH FIRM IHS has provided OGFJ with updated production data for the OGFJ100P periodic ranking of US-based private E&P companies. The rankings are based on operated production only within the US.

Top 10

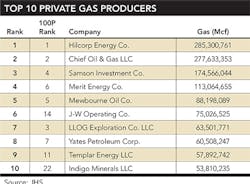

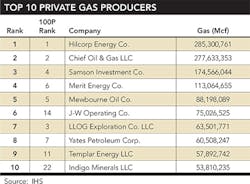

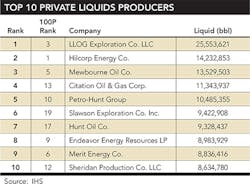

While only a slight drop, a slip from No. 8 to No. 10 makes Petro-Hunt the biggest mover in the Top 10 by total BOE production when comparing this OGFJ100P to the previous installment in April. The list of the Top 10 private gas producers remained relatively unchanged with movements of one spot in either direction. The Top 10 private liquids producers list remained largely intact, but it's worth noting that Sheridan Production Co. LLC (ranked No. 12 by overall BOE production) broke through to land at the No. 10 spot, pushing Yates Petroleum (ranked No. 7 by overall BOE production) out of the list of top liquids producers.

A&D

Deal-making is trending upward in the oil and gas space, and privately-held companies are in on the action. In fact, recent analysis by Evaluate Energy detailed the large impact privately-held companies had on the US upstream oil and gas industry in recent months. The analysis showed that US-based private companies were on the purchasing end of deals valued at $3.5 billion during the first quarter of 2016.

Once such deal was Covey Park's acquisition of Haynesville and Bossier assets. Covey Park Gas LLC, a subsidiary of Dallas, Texas-based Covey Park Energy LLC, agreed to purchase assets in the Haynesville and Bossier shales from subsidiaries of EP Energy Corp. for $420 million. The deal was announced in March, and is expected to close in the second quarter of 2016. The assets, primarily located in Louisiana's DeSoto and Bossier Parishes, consist of approximately 52,933 gross 34,167 net acres with Q4 2015 average production of 113 MMcf/d. Pro forma for the acquisition, Covey Park will own approximately 196,000 gross (137,000 net) acres of leasehold in Texas and Louisiana. Daily net production will increase to approximately 200MMcf/day. Total proved reserves will be approximately 2 TCF.

Covey Park Energy is primarily focused on the acquisition and exploitation of long-life reserves in the Ark-La-Tex and Mid-Continent regions and was formed in June 2013 with an equity commitment from Denham Capital.

Privately-held companies have been active in the second quarter, as well.

In May, Denver, CO-based Hawkwood Energy LLC noted that its wholly-owned subsidiary, Hawkwood Energy East Texas LLC, acquired producing and non-producing assets primarily in Leon and Madison counties in Texas. Terms were not disclosed. The newly acquired assets consist of producing wells with combined production of approximately 500 bo/d primarily from the Eagle Ford zone, along with undeveloped leasehold. The properties are immediately contiguous and complementary to Hawkwood's existing East Texas properties. With the addition of the newly-acquired properties, Hawkwood produces approximately 4,000 bo/d from 76 wells, which includes Woodbine, Buda, and Eagle Ford production, and holds in excess of 100,000 net acres of undeveloped leasehold primarily prospective for Woodbine and Eagle Ford.

Patrick Oenbring, chairman and CEO of Hawkwood said the company continues to seek additional similar opportunities to acquire quality East Texas assets.

Hawkwood Energy commenced operations in 2012 and is funded with a line-of-equity commitment of $500 million from lead investors Warburg Pincus and Ontario Teachers' Pension Plan.

Also in May, Titanium Exploration Partners LLC acquired Oklahoma oil and gas assets from Vanguard Natural Resources LLC for $272.5 million. The properties consist of more than 20,000 total net acres in the SCOOP/STACK with 2015 year-end reserves of 239 MMcfe (56% natural gas, 13% oil, 31% natural gas liquids). Current production from the assets is approximately 50 MMcfe/d from approximately 410 producing wells. RBC Richardson Barr acted as exclusive advisor to Vanguard for the transaction.

In June, Denver, CO-based FourPoint Energy LLC closed on its previously announced acquisition of Chesapeake Energy's remaining Western Anadarko Basin oil and gas assets for $385 million. The transaction was funded by proceeds from equity issued to existing and new investors.

Subject to closing and post-closing adjustments the assets acquired include an interest in nearly 3,500 producing wells primarily in the Granite Wash, Missourian Wash, Upper and Lower Cleveland and Tonkawa formations. The production mix is approximately 64% natural gas and 36% oil and natural gas liquids. The assets cover approximately 473,000 net acres, within 15 counties in Western Oklahoma and the Texas Panhandle and are 98% held by production.

FourPoint Energy has assumed full operations of Chesapeake's remaining Western Anadarko Basin properties and will take over three Chesapeake field offices located in Elk City, Oklahoma and Borger and Shamrock, Texas. Upon closing, FourPoint hired over 90 former Chesapeake employees to join its existing field staff of 42. Including FourPoint's current field office located in Woodward, Oklahoma, the company will now manage its field operations from all four of these locations.

Prior to customary post-closing adjustments, FourPoint's Western Anadarko footprint sits close to 900,000 net acres and net production of 435 MMcfed with 42% of the production coming from oil and natural gas liquids. With the completion of the transaction, FourPoint becomes a large player in the Mid-Continent exploration and production space.

Jefferies LLC acted as financial advisor and Andrews Kurth LLP acted as legal advisor to FourPoint Energy in connection with both the M&A and equity transactions.

Privately-held companies also sold assets.

In May, Midland, TX-based Big Star Oil and Gas LLC and Callon Petroleum Co. closed on the Midland Basin deal announced in April. For $220 million in cash and 9.3 million shares of Callon common stock, privately-held Big Star Oil and Gas sold certain operated assets in the Midland Basin, including approximately 14,089 net surface acres, primarily located in Howard County, Texas, with additional acreage in Martin, Borden and Dawson counties, Texas.

Additional deals are likely in negotiations. In May, CohnReznick Capital Markets Securities announced its service as exclusive advisor to Harmonia Petroleum Corp. in its effort to divest operated core Permian Basin properties in Howard and Borden Counties, Texas. Harmonia Petroleum is a Houston-based private oil and gas company affiliated with Shanghai, China-based fund, Harmonia Capital Group. HPC currently owns and operates the leases of more than 16,000 gross acres (15,000 net acres) in the Midland Basin.

"The Permian Basin has remained resilient for its resource potential and strong well economics, even in today's volatile market. This particular asset has been largely de-risked by Harmonia and further delineated through horizontal drilling by a number of offset operators," said Sam (Yinglin) Xu, head of oil and gas investment banking at CohnReznick Capital Markets Securities.

Capital

Dallas, TX-based Hunt Oil, No. 17 in this installment of the OGFJ100P by total production and the seventh largest liquids producer, has made a deal with TSPP, a special situations investment platform, to jointly develop some of its Midland Basin acreage.

The development area covers approximately 18,000 net acres across Martin, Glasscock, Midland, and Upton counties. Under the agreement, TSSP has committed up to $400 million to fund the development which is expected to take approximately three years to deploy. Additional terms were not disclosed.

"This partnership will provide strategic capital to efficiently develop a premier asset position in a world-class basin," said Travis Armayor, senior vice president for Hunt Oil Company.

Jefferies LLC acted as sole financial advisor and Baker Botts LLP acted as legal advisor to Hunt in the transaction. Kirkland & Ellis acted as legal advisor to TSSP.

Indigo Minerals LLC, ranked No. 22 in total production and the tenth largest gas producer, has completed a $375 million equity capital raise and the acquisition of certain producing properties and undeveloped acreage in the core of the Cotton Valley and Haynesville plays from a private exploration and development company.

The capital raise was led by private equity firm Trilantic Capital Management LP, which invested $300 million in Indigo, in partnership with the company's existing investors, including the Martin Companies LLC, Yorktown Partners LLC, and Ridgemont Equity Partners, who together invested $75 million of additional equity in Indigo.

Pro forma for the acquisition, Indigo holds approximately 160,000 net acres in Northwest Louisiana and East Texas in addition to a portfolio of minerals and leasehold interests across 15 states.

Indigo was advised by Jefferies LLC and Kirkland & Ellis LLP. Trilantic North America was advised by Latham & Watkins LLP. The Martin Companies were advised by their general counsel, Ray Brown. Yorktown was advised by Thompson & Knight LLP. Ridgemont was advised by Troutman Sanders LLP.

Click here to download pdf of the "2015 Year-to-date production - alphabetical listing"

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.