US market increasing momentum and demonstrating diverse deal flow

US market increasing momentum and demonstrating diverse deal flow

BRIAN LIDSKY AND DAVID MICHAEL COHEN, PLS INC. HOUSTON

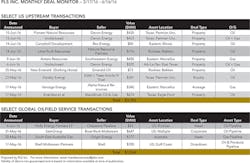

PLS Inc. reports that after last month's record $8.4 billion in US deal flow since the price crash (dominated by a $4.4 billion buy by Range Resources of Memorial Resource Development), the markets certainly are not following the "sell in May and go away" strategy. We have seen quite the opposite. The US upstream sector is very active virtually across the board, with an array of players on both the buy and sell sides. This recovery is taking place in both resource plays and conventional basins across the US, with big deals no longer confined to "core of the core" areas of the Permian and Eagle Ford. However, so far the recovery is only onshore; Gulf of Mexico activity remains at a virtual standstill. PLS expects deal activity to remain elevated as oil and gas prices both stabilize and recover, and some sellers will be looking to redeploy proceeds via like-kind-exchange transactions. As a punctuation mark to Wall Street's growing support of select public E&Ps' A&D efforts, at press time, Delaware Basin-focused Centenniel Resource Development filed for a $100 million IPO, led by Credit Suisse and Barclays. This would be the first E&P IPO since Appalachia-focused Eclipse Resources raised $818 million on May 2, 2014.

The speed with which the US market shifted into high gear is illustrated by Devon's $2-3 billion divestment program, which it embarked upon after its big strategic Oklahoma STACK and Powder River acquisitions last December. Devon put a wide array of non-core assets up for sale, but by the end of April, it had only sold the San Juan Basin and the Mississippian Lime for $281 million. Then within two weeks in June it announced five asset sales totaling more than $1.8 billion, bringing it above the low-end of its 2016 goal and effectively exiting East Texas, the Granite Wash and the Midland Basin. With the impending sale of its 50% stake in Canada's Access pipeline, Devon expects to pull above the $3 billion mark.

Interestingly, one man's core is another man's non-core. A case in point is Devon's sale of a Midland Basin position as non-core while maintaining the Delaware Basin as its core future. In contrast, Pioneer Natural Resources, which paid $435 million for the northern half of Devon's Midland Basin portfolio, said substantially all of the acreage is "located in the core of the Midland Basin." Nobody has done more work than Pioneer to delineate the Midland core, and much of the acquired acreage offsets its existing leases.

Moving on, buyers are paying for the best acreage in the highest-return areas of a few main liquids-rich plays. The Pioneer/Devon deal is one example. Another is EnerVest's $674 million acquisition of Eagle Ford assets in Karnes County, TX, from BlackBrush Oil & Gas. Also, in a deal after our cutoff date for the data below, Marathon paid $888 million for STACK pure play company PayRock Holdings. As a show of strength for the industry's ability to make profits and that of the STACK, single well economics in this deal support IRRs of >200% based on April 1 strip pricing with one mile laterals and EURs of 1.25 MMboe in the Meramac black oil core.

Quality assets are also going through the bankruptcy process, and buyers generally are dominated by private equity and institutional investors, sometimes in tandem - witness the partnership forged by Crestline Management and Sole Source Capital to place a stalking horse bid for the assets of Bakken driller Emerald Oil. To date, public E&Ps have largely avoided Chapter 11 buying, although Rice Energy made a strong $200 million stalking horse bid for the Marcellus/Utica acreage of former partner Alpha Natural Resources and upped its offer to $335 million at auction before being outbid by privately held Vantage Energy at $340 million.

International upstream deal activity remains slow overall. The North Sea, particularly the Norwegian sector, has consistently been a bright spot in past months. Det Norske kicked that trend up a notch last month, agreeing to acquire BP's Norwegian unit in a nearly $1.5 billion stock deal that, combined with a $318 million buy-in by Det Norske's controlling shareholder, Aker, will create a new independent Norway explorer called Aker BP. Another deal is Oil Search's $2.2 billion takeover offer for InterOil, derisked by a concurrent $1.7 billion sale of major stakes in InterOil's assets to Total. The three companies are partners on the Elk and Antelope gas discoveries in Papua New Guinea but have differed on LNG options to monetize the resources. With this deal, Oil Search and Total reiterate their commitment to LNG in a down LNG market.

Finally, oilfield service consolidation continues. Technip and FMC Technologies are working on a $6.8 billion combo to create an integrated subsea powerhouse called TechnipFMC. The complementary and non-overlapping offerings make the merger unlikely to face the severe anti-trust scrutiny that sank the $38 billion Halliburton/Baker Hughes deal.