Bakken pipeline takeaway capacity

Dakota Access to close the gap

TOM BIRACREE, RBN ENERGY

Editor's Note: This article first appeared in mid-August as part of RBN Energy's Daily Blog and is being distributed to OGFJ readers with permission.

THE 450-MB/D DAKOTA ACCESS PIPELINE (DAPL) has broken away from the pack of out-of-the-Bakken crude takeaway projects. On August 2, Enbridge Inc., through its master limited partnership Enbridge Energy Partners, agreed to take a large stake in DAPL from Energy Transfer Partners (ETP) and Sunoco Logistics Partners (SXL), a move that suggests Enbridge's own 225-Mb/d Sandpiper Pipeline may drop out of the race soon. Joining Enbridge in the $2 billion deal is Marathon Petroleum, its former joint venture partner and anchor shipper on Sandpiper. Today, we consider these recent developments in the long-running effort to transport North Dakota crude oil to market more efficiently.

The apparent demise of Sandpiper could potentially change the outlook for the future balance between Williston Basin production and takeaway/in-region refining capacity. In a previous RBN Daily Blog post, it was noted that during the run-up in Bakken production earlier in this decade a lot of new crude-by-rail capacity was built, as were incremental additions to pipelines. Midstream companies also made big plans for more takeaway capacity, but some of those plans were reconsidered after the plunge in oil prices that started two years ago. As a result of that price decline, Bakken production fell from 1.3 MMb/d in December 2014 to an estimated 998 Mb/d in July 2016, according to the Energy Information Administration's (EIA's) Drilling Productivity Report. Based on our production economics analysis, it looks like the decline in production will be continuing until prices get back above $50/bbl netback to the basin. In the meantime, some producers are taking drastic action. For example, we hear that Continental Resources will be shutting in (yes, you read that right, shutting in) about 20 Mb/d of Bakken production in September. No doubt declines in production are one reason for the pullback in new pipeline takeaway projects, leaving only about 500 Mb/d of incremental pipeline and regional refining capacity on the drawing board. But that is still a big number. If it all gets built, pipeline takeaway/refining capacity in the Bakken would total 1.35 MMb/d (excluding rail capacity). So the big question remains, is that still too much?

Dakota Access Pipeline (DAPL) is the most critical factor in all of this. As shown in Figure 1, DAPL will carry at least 450 Mb/d of crude (it's expandable to 570 Mb/d) from the heart of the Bakken 1,124 miles to the Patoka Hub in Illinois. From Patoka, Bakken crude will be able to move south on the planned Energy Transfer Crude Oil Pipeline (ETCOP)-a reversal of an existing 30-inch-diameter natural gas pipeline that is part of the Trunkline system, plus 66 miles of new connecting pipe-to Sunoco Logistics' terminaling facilities in Nederland, TX. DAPL and ETCOP are the two primary element of the Bakken Pipeline system, which is currently owned by a joint venture (JV) of ETP/SXL (with a 75% stake) and Phillips 66 (with 25%). As we said, Enbridge and Marathon announced August 2 that they have formed a 75-25 JV of their own that has agreed to buy a 49% share of ETP/SXL's 75% stake in Bakken Pipeline. For those without a calculator handy, that will divvy up the new Bakken Pipeline ownership pie like this: 38.3% ETP/SXL, 27.5% Enbridge, 25% Phillips 66, and 9.2% Marathon.

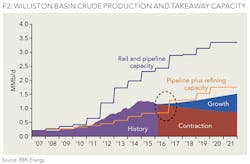

The Bakken production/takeaway scenario that we reviewed recently featured the contrast between plunging crude oil output and a big increase in planned pipeline capacity. According to Baker Hughes, the Williston Basin rig count dropped from an average of 190 in mid-2014 to just 22 in May 2016. As noted previously, the reduced investment in drilling eroded production in the play to under 1.0 MMb/d. The run-up in oil prices to the $50/bbl range a few weeks ago helped boost the latest rig count to 28 (as of August 12). RBN Energy's Growth Scenario forecast for the Bakken (based on a gradual rise to $60/bbl oil over five year) sees an increase to about 1.5 MMb/d in 2021-that's the red-plus-blue layers of production in Figure 2. RBN's Contraction Scenario, in turn, puts 2021 output at only about 900 Mb/d (red layer only).

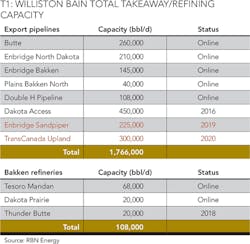

Now let's compare expected Bakken production to current and projected takeaway and in-region capacity. Table 1 lists the existing Bakken pipelines and their capacities, as well as Dakota Access/DAPL (which is expected to come online in late 2016/early 2017), Sandpiper (still penciled in for a 2019 start) and TransCanada's planned 300-Mb/d Upland Pipeline, an even longer-term project that would run northeast from the Bakken into Saskatchewan and go commercial as soon as 2020. Existing capacity on five crude oil export pipelines servicing the Williston Basin reached 763 Mb/d a year and a half ago after Kinder Morgan's Double H Pipeline began service in February 2015. The three planned pipelines-DAPL, Sandpiper, and Upland -together would boost that takeaway capacity to more than 1.7 MMb/d, and in-region refining capacity adds another 108 Mb/d that the Bakken's existing infrastructure can handle (granted the Thunder Butte refinery project looks pretty dicey at this point). This total of more than 1.8 MMb/d of pipeline-plus-refining capacity is depicted graphically in the orange line in Figure 2, which assumes the addition of DAPL, Sandpiper and Upland. Added to that, there's the Bakken's huge crude-by-rail (CBR) capacity of 1.5 MMb/d (area between orange and blue lines in Figure 2), which-if all the proposed pipelines are built-would bring total takeaway/refining capacity for the basin to about 3.3 MMb/d (blue line), or more than three times current production.

Building crude loading terminals along rail lines in the Bakken was a relatively quick and inexpensive alternative that took advantage of the vast US rail network and offered a valuable diversity of destinations for Bakken producers. The downside, of course, is that CBR is expensive-for example, about twice the per-bbl cost of shipping on DAPL, according to a recent RBN Energy Spotlight Report on Energy Transfer Partners. New pipelines have already halved the volume of Bakken crude shipped by rail since CBR's peak in mid-2013, and another big chunk of production is sure to be stripped away by DAPL. However, CBR is unlikely to completely disappear. For one thing, producers have contract commitments that they cannot shed immediately unless they want to pay double shipping costs. Also, access to pipelines is not available or convenient in certain parts of the Bakken. And the ability to ship crude to areas not served by pipelines, such as the East and West coasts, will keep some crude moving on the rails.

So where does all this leave the Bakken as far as production, takeaway capacity and regional refining capacity are concerned? Construction of DAPL is underway, its prospects for success solidified by the planned addition of Enbridge and Marathon to its ownership team. Sandpiper looks to be withering on the vine, with two of its lead sponsors (Enbridge and Marathon) shifting their focus to DAPL. And TransCanada's proposed Upland project, which would connect to TransCanada's planned Energy East project, remains iffy at best; only 25% of the capacity on Upland has been contracted and Energy East has run into fierce resistance in Ontario, which will likely delay Upland well past its currently planned 2020 start.

If Upland is scrapped or at least delayed, that would leave the Bakken with about 1.35 MMb/d of pipeline after Dakota Access comes online four to six months from now. If we assume that CBR eventually falls to a steady 100 Mb/d, that would mean that the Bakken's takeaway capacity would be about 1.5 Mb/d, which is equal to 2021 production in our Growth Scenario. Reaching production and takeaway equilibrium by 2021 (excluding all that surplus rail capacity, of course) would not only benefit DAPL, it would remove some of the re-contracting risk that the existing Bakken pipelines may face, given the volumes committed to DAPL.

That would be a happy scenario, at least for the owners of the existing pipeline capacity -and of DAPL. But of course, a lot could go wrong. If, for example, the trajectory for production turns out more like our Contraction Scenario, there would be about 900 Mb/d to fill that 1.5 MMb/d of capacity. That's a lot of capacity looking for barrels. And it could go the other way. Nature-and midstream companies-abhor a vacuum. If Sandpiper and Upland do, in fact, bite the dust, an uptick in crude prices could propel other midstreamers to step into the breach with an additional pipeline proposal or two. Clearly there are a lot of variables that play into whether Bakken takeaway capacity will tighten up, or offer more than enough room for everyone.

ABOUT THE AUTHOR

Tom Biracree is currently a director at Oil and Gas Financial Analytics LLC. He was Senior Principal Editor at John S. Herold Inc., then IHS Inc., for 15 years. He led the senior editorial team for IHS Energy Insight research and was responsible for structuring and content editing valuation and transaction research. Tom wrote the Herold Oil Headliner, a daily newsletter aimed at senior industry and financial executives. He was co-author of the Global Upstream M&A Review and contributed to the Global Upstream Performance Review. He is also the author of more than 100 published books.