A hybrid approach to well economics

USE MODERN PORTFOLIO THEORY AND MACHINE LEARNING TO DRIVE PRUDENT DECISION MAKING

PATRICK NG, REAL CORE ENERGY, HOUSTON

TYLER CHESSMAN, MICROSOFT CORPORATION, HOUSTON

IN FINANCE, we've witnessed an emerging application of machine learning algorithms, e.g., robo-advisor, and earthquake prediction technology. Here, we illustrate with examples, practical applications of a hybrid approach that combines fundamental well economics modeling, modern portfolio theory, and algorithmic machine learning to generate actionable insights and drive prudent investment decisions.

FUNDAMENTAL ROI SENSITIVITY

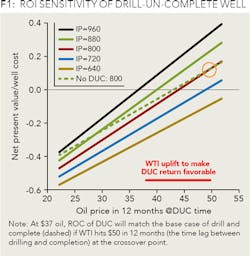

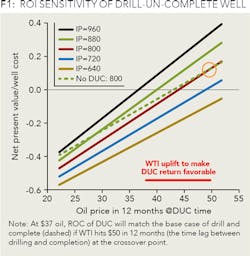

Figure 1 shows how we can model discounted cash flows and better understand the sensitivity of ROI over different WTI prices for drill-but-uncomplete (DUC) and refracking a well. Assume typical unconventional well costs and decline rates. Implicit in DUC is how much WTI will rise to make it work from a return perspective.

Figure 2, assuming $37 oil today, illustrates WTI will have to increase by 40% to be viable when compared to the baseline case of drill-and-complete. In refracking, we want to know if a before-and-after uplift in production will have material impact. For example, with moderate 30-day initial production, if WTI ranges $ 45 to 50 in 24 months, refracking with 400% uplift can boost ROI.

TECHNOLOGY APPLICATION - MACHINE LEARNING

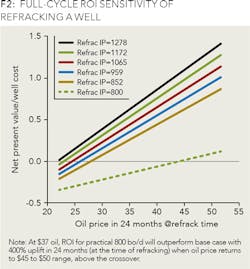

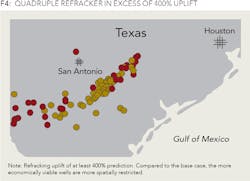

UNCONVENTIONAL - Combining operational data extracted from FracFocus with production data from the Texas Railroad Commission, we attempt to identify wells with a high probability that refracking uplift exceeds economic threshold (determined from ROI modeling) using logistic regression. Figures 3 and 4 compare the prediction success over the Eagle Ford area for a base case of uplift exceeding 100% and that in excess of 400%.

FINANCIAL TECHNOLOGY - PORTFOLIO OPTIMIZATION

If the objective is to generate actionable insights that we can act on and make better investment decisions, with key production and performance parameters defined, we can forward model and evaluate the aggregate performance from a portfolio of wells.

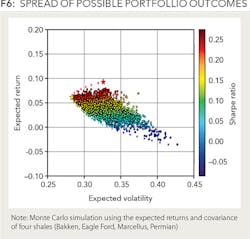

Figure 5 illustrates an actionable portfolio optimization of four shales. Using typical well cost and production profiles, we compute their expected returns and covariance as well as adjust for variability in basin geology. Building on the modern portfolio theory from finance, we derive the efficient frontier and determine the optimal portfolio weights (e.g., percentage of capital allocated to each of the four shales).

To gain insights, we use Monte Carlo simulation to better understand the dynamic and visualize the spread of returns versus volatility. In this example, the simulation suggests by underweighting Bakken, a portfolio including Eagle Ford, Marcellus, and Permian will deliver higher returns with lower volatility. If certain key parameters change, e.g., breakthrough in completion technology, greater refracking uplift, or pad drilling efficiency, we can quantify their impact on return (possibly further boosting portfolio performance - migrating toward the upper left quadrant in return-volatility).

Figures 6 and 7 show the use of Monte Carlo simulation to determine the spread of various portfolio outcomes.

SUMMARY

What does it take to thrive in the lower for longer (oil price) environment? Make prudent decisions and minimize surprises. A hybrid approach combining bottom-up well modeling, machine learning, and top-down portfolio simulation gives us an unbiased second opinion. It can be scaled to accommodate a large number of wells and stress test a multitude of WTI scenarios. Insights gained can help operators develop robust field development strategies, seek out the best refracking candidates or acreage and identify opportunities for acquiring and divesting assets.

ABOUT THE AUTHORS

Patrick Ng is a partner at Real Core Energy with focus on acquisitions and divestitures. He held technical and operational leadership positions at WesternGeco and Fugro, developing and bringing solution to market at the intersection of data and technology.

Tyler Chessman is a technology specialist for Microsoft, helping customers evaluate and adopt Microsoft's business intelligence (BI) platform. He's the author of the book Understanding the United States Debt.