Buyers on the move with most active month since oil price decline

BRIAN LIDSKY, PLS INC., HOUSTON

TWO MONTHS AGO,PLS Inc. cited a clearer line of sight to an increasing decline in US oil production and stated, "we are biased to advising our clients to be buyers, now." Since making that call on March 22, WTI spot oil prices have risen from $39.95/bbl to $48.62/bbl on May 24.

The markets have responded. US upstream activity totaled $1.8 billion in the month prior to our market signals. This month, the markets notched more than $8.4 billion in deals - an increase of over 300% and the highest tally since July 2014's $12.9 billion. In July 2014, oil prices were $100/bbl and gas prices were near $3.75/Mcf. The logjam break is a confluence of multiple factors, not the least of which is a general industry consensus that the oil-price bottom is in the rear-view mirror.

Several key factors fuel the increased dealmaking. On the capital side, private equity buyers are on the move after a long period of relatively dead money awaiting a pricing bottom. In the public markets, companies that have navigated successfully through the cycle and are fortunate to have core areas in low-cost plays are tapping the equity markets to fund buying activity. On the supply side, there is a growing suite of opportunities as distressed companies shed assets to shore up broken balance sheets.

PLS expects the supply of quality opportunities to only increase. Part of the supply will be sourced from companies running short on options to fund large debt loads. From April 14-May 16, we saw 15 Chapter 11 filings including some large and well-known companies like Linn Energy, SandRidge Energy, Breitburn Energy Partners, Energy XXI, Chaparral Energy, Goodrich Petroleum, Ultra Petroleum, Midstates Petroleum and Penn Virginia. These companies alone produce 563 Mboe/d (32% oil, 11% NGLs and 57% gas). Clearly, not all of their assets will come to the deal markets, however it is indicative of the state of the industry and a changing of the guard.

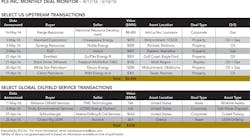

Interestingly, the largest deal this month is Range Resources' $4.4 billion acquisition of Memorial Resource Development Corporation. Struck on May 16, this 74% gas-weighted transaction was inked as Henry Hub prices were about $2.00/Mcf spot and $2.60/Mcf on the 12-month strip. The deal speaks volumes on the quality of Memorial's core gas resource play in North Louisiana, namely Terryville field with a prolific over-pressured lower Cotton Valley pay zone. With the deal, Range now is the only producer with core positions in the two most prolific and economic US natural gas resource plays. The deal is immediately accretive on a cash flow per share basis and according to PLS analysis was completed at metrics of $2,900 per flowing Mcfe, $13,000 per net acre and 10.9X estimated 2016 cash flow.

This month's deal geography spanned the country as opposed to recent deal activity concentrated in the Permian, Eagle Ford, and SCOOP/STACK. Examples include Indigo Minerals' $375 million buy of Cotton Valley and Haynesville assets in East Texas and North Louisiana, White Star Petroleum's $200 million buy of Oklahoma Mississippian Lime assets from Devon Energy and Continental Resources' $110 million sale of leasehold in Washakie Basin, Wyoming.

Outside of the US, however, deal activity remains sluggish. Canada's largest deal is Whitecap Resources' $458 million buy of legacy oil assets in Saskatchewan from Husky Energy producing 9,300 boe/d (after assuming a 20% royalty).

Internationally, the North Sea, South America and Southeast Asia are the most active areas. In the Norwegian sector of the North Sea, Statoil is active in multiple deals with Lundin Petroleum. Statoil purchased a 12% equity stake in Lundin in January to increase its exposure to the high-value core assets Lundin owns. On May 3, Statoil followed up in a second deal by selling Lundin a 15% stake in the prolific Edvard Grieg field for $471 million and also buying an additional 1% equity stake in Lundin for $68 million.

In the services sector, deal activity was slow this month. Clearly, the largest event was the termination of the $38 billion Halliburton/Baker Hughes merger on May 1. Originally announced with great fanfare on November 17, 2014, the deal was ultimately terminated under intense pressure of US antitrust concerns and a lawsuit filed by the US Department of Justice.

In the midstream sector, deal activity was also slow. The largest deal is a $1.3 billion buy by Hong Kong's Cheung Kong Infrastructure and Power Assets Holdings of a 65% interest in Husky Energy's Lloydminster midstream assets in Saskatchewan and Alberta. Both Cheung Kong and Husky are controlled by Hong Kong tycoon Li Ka-Shing.

As fundamentals improve, PLS expects deal activity to continue at a healthy pace as companies that have successfully managed through this cycle look to make strategic and accretive purchases. We also expect increasing amounts of private capital to start capturing existing opportunities.

Brian Lidsky can be reached at [email protected].