Low prices curtail deepwater capex

Offshore activities are expected to respond to any future oil price recovery

MARK ADEOSUN, DOUGLAS-WESTWOOD, FAVERSHAM, UK

THE CONTINUED SUPPRESSION of global oil prices has impacted the development of oil and gas fields both onshore and offshore. However, deepwater developments are bearing the brunt, with the economic viability of a number of large and ultra-deepwater projects called to question - resulting in cancellations and deferred sanctioning.

Prior to the downturn, capital expenditure (capex) and operational expenditure (opex) rose, arguably, to unsustainable levels, putting pressure on operator budgets. The "lower for longer" oil price environment has prompted an industry rethink - increasing the focus on the standardization of subsea equipment, supply chain efficiency, and project simplification to streamline development processes. Despite these improvements, project execution challenges are set to continue due to the typical risks associated with local content issues, prompting widespread delays.

As production from mature onshore and shallow-water basins declines, development of deepwater reserves has become increasingly vital. The need to offset declining production from these matured basins, as well as the ability of IOCs to access world-class reserves with the use of new exploration and production technology will continue to drive deepwater expenditure. However, plunging oil prices have increased concerns in the sector - specifically, whether or not deepwater projects can be viable at current oil prices.

Douglas-Westwood expects deepwater capex to be suppressed over the next five years due to sustained low oil prices. This has forced operators to cancel or defer the sanctioning of mega deepwater projects - particularly in the usual deepwater hubs of West Africa and the Americas. However, in the near-term, deepwater projects that were sanctioned prior to the oil price downturn such as Total's Egina Project (Nigeria), Kaombo Project (Angola), and Moho Nord project (Republic of Congo) - all in West Africa - will help sustain deepwater spending. These projects will also account for over US$9 billion of Floating Production Systems (FPS) expenditure over the next 24 months.

MARKET SUMMARY

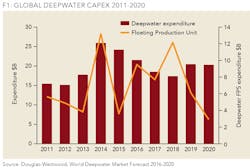

DW forecasts deepwater expenditures to decline at -6% CAGR over the 2016-2020 period, with expenditure totaling $137 billion - an overall increase on the previous five-year period of 5%. Project delays have resulted in a significantly slower growth profile than was expected a year ago.

DW forecasts deepwater capex - excluding FPS spend - to plummet from 2014's record levels until 2018, with a gentle upswing over 2019-2020. This will be driven by the development of mega deepwater prospects in Brazil and the commencement of offshore activity in the East Africa gas basin. The FPS market is also expected see a similar drop in spend. However, this will be most evident in the latter years of the forecast period.

Last year (2015) saw the lowest number of deepwater FPS units ordered since 1996 - 2016 unit orders are also expected to be minimal. The longer lead times associated with FPS projects has insulated the market to date - most 2017-2018 installations were ordered in 2013/2014.

In addition to the low oil price environment, reduced rig demand will impact capex growth over the forecast period. Prior to the downturn, record deepwater rig demand resulted in an unprecedented level of rig orders - leading to a supply-demand imbalance. Rig contractors are now facing plummeting day rates due to a combination of oversupply and reduced demand, with day rate suppression triggering delays and cancellations for new rigs and widespread stacking of deepwater rigs.

COMPONENTS

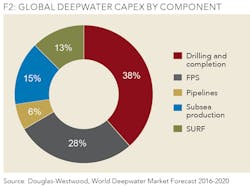

Drilling and completion (D&C) is the largest segment of the deepwater market with expenditure totaling $53 billion to 2020 - an incremental increase on the 2011-2015 period. The majority of spend in this category is associated with subsea well completion. Africa will have the highest number of deepwater subsea well completions - 38% over 2016-2020. Despite the high volume of completions in Africa, Latin America will account for the highest level of capex, accounting for 40% of expenditure due to lengthier D&C times in this region.

FPS account for the second-largest segment of deepwater expenditure at 28% of total capex. Expenditure in this sector is led by Brazil which accounts for 52% of total spend. FPSOs dominate FPS expenditure accounting for almost 81% of forecast spend. 82% of forecast units to be installed over 2016-2020 have already been sanctioned - these projects are expected to prevent a total collapse of the FPS market in the near-term. However, the low oil price environment is causing operators to re-evaluate the use of FPS in development plans. A clear example is the Leviathan field - Noble Energy abandoned a proposed FPS unit for a subsea tieback to a shallow water fixed platform in a bid to further reduce development cost.

Subsea Equipment (Subsea Production Hardware and SURF) jointly account for 27% of global expenditure over the forecast period. Subsea production hardware spend is driven by the number of development wells drilled - Africa is the largest market both in terms of the number of units installed and capex. SURF expenditure will total $17 billion over the next five years.

Pipeline capex will account for 6% of spend over the forecast period, representing a 2% decline from the hindcast. Pipeline expenditure has been tempered by the conflict of interest between Russia and Turkey over Syria. This political power tussle has led to the cancellation of the Turkish Stream pipeline, which was expected to boost expenditure in this sector over the forecast period. Projects such as the Texas-to-Mexico gas pipeline and the commencement of offshore installation activity of the SAGE pipeline in the Middle East in the latter years of the forecast period will contribute to expenditure.

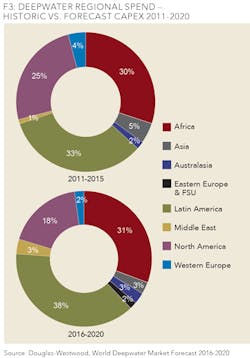

REGIONAL SUMMARY

The market downturn has negatively impacted all regions. However, this varies based on ongoing and prospective projects. Over the forecast period, Africa and the Americas will account for 87% of total deepwater expenditure. Latin America will have the highest capex with 38% of total expenditure, driven by the number of FPS units expected to be installed over the forecast period. However, Petrobras' problems are likely to result in substantially constrained future expenditure on new units.

Mexico showed much promise after reform of its energy sector to allow foreign upstream participants, but recent interest in licensing rounds has been tempered by the prolonged suppression of oil prices - widespread exploration activity is unlikely in the near-term.

Pemex was expecting production from its Lakach deepwater development by 2018. However, development of this project has been suspended for at least a year due to budget cuts.

East Africa is expected to be the next key deepwater hub, with offshore installation activities in Tanzania and Mozambique expected to commence in the latter years of the forecast period. Development in these gas basins is highly likely, as planning for these projects is well developed - Anadarko has awarded onshore LNG contracts that will process gas reserves in Mozambique.

North America is forecast to account for 18% of total capex over the forecast period. Spending in the region will decline by 24% compared to the preceding five years - the outlook is gloomy due to prolonged delays to project FIDs and cancellations. Notable projects affected include BP's Hopkins project and Murphy Oil's Thunder Bird. However, projects such as BP's Mad Dog Phase II and Shell's Appomattox are expected to carry on as planned.

Other regions have minimal deepwater activity forecast. Therefore, the majority of capex in these is driven by a handful of specific projects such as the Shah Deniz Phase II field development in Eastern Europe and the FSU.

Asia is expected to see growth at a 4% CAGR over the forecast period, while Australasia will see the fastest growth in capex, at 37% CAGR. However, the region remains a comparatively small deepwater market.

Western Europe's capex will account for 2% of global expenditure. Cancellations and delays to individual projects are expected to have a substantial impact on the market outlook. For example, expenditure within the UK is highly dependent on Rosebank, but there have been numerous changes to contractual terms associated with the project and this has led to a degree of uncertainty regarding development timelines. Further delays to this project represent a potential downside to total UK capex.

CONCLUSION

Growth in the deepwater market is expected to be constrained as low oil prices increase pressure on project economics over the forecast period. OEMs, vessel owners, and rig owners are likely to find the next few years difficult as project delays continue. Operators are expected to re-engineer and re-evaluate development plans of various projects so as to improve their economic viability. Lower drilling and equipment costs has so far provided limited upsides for project sanctioning.

In addition to the low oil price environment, the corruption scandal and financial difficulties rocking Petrobras will restrict the NOC's ambitious spending plans for the foreseeable future - impacting deepwater capex growth in the region beyond the forecast period.

In Africa, the breakup of the Nigerian National Petroleum Corporation (NNPC) highlights continued efforts to overhaul Nigeria's oil and gas sector. However, the future of the long awaited PIB (Petroleum Industry Bill) remains unclear. This prolonged uncertainty and various regulatory bottlenecks between the state and IOCs has led to a lull in the country's oil sector, causing further delays to major deepwater projects such as Shell's Bonga South West-Aparo, and Chevron's Nsiko which were already challenged by the low price environment.

The outlook for North America over 2016-2020 is largely negative - there have been major delays to prominent deepwater projects due to cancellation or re-engineering. However, in contrast to other regions, North America is well positioned for recovery by the end of the forecast period due to existing infrastructure. This is likely to lead to increased use of subsea well tiebacks for future developments. Furthermore, some project re-engineering and various cost reduction exercises give a reason to see the light at the end of what has been a very long tunnel. Offshore activities are expected to respond to any future oil price recovery.

ABOUT THE AUTHOR

Mark Adeosun is the author of "The World Deepwater Market Forecast 2016-2020." He has authored various industry reports and has conducted high-level research into various oil and gas projects, with a focus on offshore drilling and deepwater activity. He has undertaken market modelling and analysis, focusing on offshore markets and E&P activities. Adeosun has a BSc degree in geology and a master's degree from the University of South Wales in geographic information systems GIS).