Drilling in a competitive environment

REDUCE COSTS AND REGULATORY LIABILITY BY PROPER MANAGEMENT OF SOLID DRILLING WASTE REMOVAL

BLAKE SCOTT, SCOTT ENVIRONMENTAL SERVICES INC., LONGVIEW, TEXAS

OIL AND GAS OPERATORS are feeling the pressure of cost-reduction and regulatory liability in their operations, leading them to search for the solution-based companies that can help them operate in this increasingly competitive environment. Taking care of resulting solid drilling waste is a top consideration.

CUTTING-EDGE SOLUTIONS REQUIRED

With one client alone last year, Scott Environmental Services processed enough drilling cuttings to build Texas Motor Speedway nine times. In fact, every foot drilled in the United States generates an estimated 1.2 barrels of drilling waste, according to the American Petroleum Institute. In 2014 alone, US land drilling produced more than 196 million barrels of solid drilling waste - enough to fill AT&T Stadium 10 times. Oil and gas operators are not only developing more areas, but they are drilling deeper and longer wells - producing much higher volumes of solid drilling waste.

To deal with this increased volume of waste, engineers must source today's most innovative solid waste management plans.

Operators now have many cutting-edge options available to manage solid drilling waste. New solidification and stabilization technology, for example, offers numerous benefits to minimize impact or delays to drilling activities. Solidification and stabilization technology treats contaminated sediment, sludge and soils by mixing contaminated solid waste materials with treatment "additives" to cause physical or chemical changes that reduce environmental impact.

Solidification processes encapsulate waste to form a solid material and to restrict contaminant migration by decreasing the surface area exposed to leaching and/or by coating the waste with low-permeability materials.

Stabilization processes involve chemical reactions that reduce the leachability of a waste.

By taking advantage of these technologies, oil and gas operators can choose waste management programs that provide multiple benefits to not only keep their investors comfortable, but also to comply with government regulators and help to build community goodwill. Here are four of these benefits:

Cost Reduction Leading to Increased Profits

Oil and gas companies are producing much higher volumes of solid drilling waste while solid waste disposal costs are on the rise. Solidification and stabilization technology provides a cost-effective solution.

Traditional methods for dealing with solid drilling waste include onsite burial, landspreading, and offsite commercial disposal. Onsite burial and landspreading often treat waste by diluting contaminants for disposal. Waste with high levels of contaminants require more dilution in order to lower contaminant levels to a point at which they do not affect human health and the environment. This is expensive. The costs of offsite commercial disposal also increase the greater the distance travelled to disposal sites.

Additionally, the cost of building new infrastructure, such as roads and drilling pads, to support drilling sites has also increased. Companies using solidification and stabilization technology as part of their solid drilling waste management programs can save money by producing their own construction material. By recycling solid drilling waste, companies can turn waste into material used to build lease roads and drill pads that take into account unique traffic volumes and loading weights. This can eliminate the operators' downtime that results from poor design and construction.

Liability Reduction

Oil and gas companies often face myriad state and local rules regarding how they should dispose of solid drilling waste.

On the federal level, the United States enacted the Resource Conservation and Recovery Act (RCRA) in 1976 to provide guidance for managing hazardous and non-hazardous solid waste. While RCRA exempted most oil and gas exploration and production waste from hazardous waste requirements, most states and some local governments have since enacted their own regulations, which can vary dramatically.

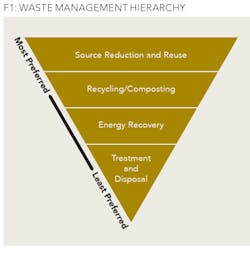

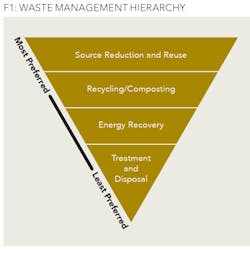

Many states and local governments have adopted the Environmental Protection Agency's Waste Management Hierarchy (Figure 1), which emphasizes reducing, reusing, and recycling the majority of wastes. The last and least-preferred option at the bottom of the hierarchy is treatment and disposal, which regulators often see as a last resort - and an expensive option for oil and gas companies.

The EPA, various state agencies, industry organizations, and companies have recognized that disposing of waste should not be the first line of defense for protecting the environment. A solid drilling waste management program that takes advantage of solidification and stabilization technology to recycle waste can help companies comply with whatever disposal regulations are in effect. In fact, regulators prefer this method.

Companies using advanced and tested technologies can reduce an operator's liability by ensuring:

- The waste is handled using sound scientific principles - in a manner that exceeds regulatory requirements and is defendable in the long-term.

- The waste remains on the lease and is never commingled, which prevents association with another operator's issues.

- Pads are designed and constructed for safer operations and accessible year-round in all weather conditions.

Sustainability

Ensuring solid drilling waste is managed so it cannot affect the environment is critical. Oil and gas companies must take steps to limit impacts to land, vegetation, water, air, natural habitats, and the surrounding community. The solidification/stabilization method of encapsulating contaminants renders them virtually insoluble. As a result, the movement of waste offsite is limited and the possibility of spills reduced.

Not only does this decrease costs but companies can minimize their environmental footprint by recycling the solid drilling waste into construction materials instead of disposing of it. In contrast with an engineering control, which requires continuous monitoring, a solidification/stabilization waste management program eliminates environmental concerns.

Accountability

Companies that implement their environmentally friendly solid drilling waste management programs are demonstrating accountability, which includes their willingness to account for the sensitivities of the communities in which they operate.

More specifically, companies and their employees must do business in communities near where they operate. They may purchase supplies from local vendors, hire local workers, live in those communities, send their children to local schools and obtain regulatory approval from local governments. Acting as a good neighbor can help build goodwill and ultimately make it easier for them to do business and achieve profits. Companies that fail to do so may face increased public scrutiny, which could slow down production permissions, or create opposition to their activities.

Choosing a solid waste management partner who will respect and understand community relations and corporate responsibility is integral to implementing a successful program.

CONCLUSION

An oil and gas operator that chooses the right solid waste drilling program can help to ensure that the company is not only reducing costs and liability for its shareholders, but also proving to be a good neighbor and steward of the environment.

ABOUT THE AUTHOR

Blake Scott is president of Scott Environmental Services, a company he founded in 1994 with his father, Bill R. Scott. Scott received the first statewide permit in Texas from the Railroad Commission for recycling contaminated waste in mud and drill cuttings using stabilization/solidification technology. He has given presentations at conferences and universities and has served on the Interstate Technology & Regulatory Council team for solidification and stabilization. He holds patents in the US, Canada, and Mexico.