Share issuances in vogue in 2016

US COMPANIES ISSUING SHARES REACHES 3-YEAR HIGH IN 2Q

HANNAH MUMBY, EVALUATE ENERGY, LONDON

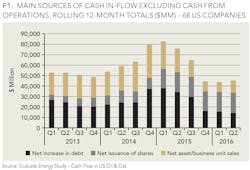

THE AMOUNT OF CASH RAISED by 68 US oil and gas companies via a net issuance in new shares soared to a three-year high of $19.4 billion in Q2 2016, according to Evaluate Energy's new study focused on US oil and gas company cash flow.

In response to changing attitudes to debt and fewer asset sales, companies have been more inclined to issue shares to source external cash in recent periods. (For purposes of this report, external cash is all cash raised excluding operating cash flow. This includes net increases in debt, net issuances of shares, and net sales of assets or business units.)

This trend started in Q1 2015, as the commodity price downturn began to impact cash flow, and has become more pronounced ever since.

Cash sourced via net share issuances made up 43% of all external cash raised in Q2 2016. This stands in stark contrast to periods before the downturn. In Q3 2014, only 16% of external cash raised came from net share issuances.

This finding is among several key conclusions of the new study that unpacks the altered relationship between cash flow and capital expenditure in the US oil and gas space.

Of course, the value of the individual shares being sold will be much lower than in 2013 or 2014, but US oil companies have clearly had success selling shares in recent periods despite the challenging climate, perhaps looking to benefit from bargain hunting investors looking to enter the oil market at a low price.

The movement towards share issuance in part reflects the oil price drop and a major reduction in the ability to secure debt financing, given continued market uncertainty. Since Q3 2014, the amount of cash raised by US oil and gas companies via a net increase in debt dropped by almost two-thirds to US$14.2 billion. The study discovered that, in fact, the 68 US companies raised the least amount of cash in Q2 2016 through net debt increases than in any other quarter over the entire three-year period.

Cash raised via net asset or business unit sales also dropped in 2016 compared to periods before the downturn. The 68 companies raised 69% less cash from net asset or business unit divestitures in Q2 2016 compared to Q3 2014, the final period before the price downturn began.

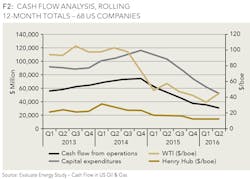

This raising of external finance, and the movement towards issuing shares, has been necessary for US oil and gas companies because their operating cash flow is not covering their capital expenditure needs. While this internal financing gap between operating cash flow and CAPEX was at its tightest in Q2 2016 compared to any other period over the last three years, external cash in some form was still required.

Of course, CAPEX is not the only cash outflow that oil and gas companies have seen piling up in recent times. However, it is encouraging that the majority of the 68 companies, despite their varying financing gaps, were actually able to cover all cash outgoings in Q2 2016 with a combination of operating cash flow and external cash sources – and many of the companies have a successful share issuance to thank.

ABOUT THE AUTHOR

Hannah Mumby is a senior oil and gas analyst with Evaluate Energy. She has a degree in Geology and a Msc. in Mineral Extraction. In her role with Evaluate Energy, Mumby has analyzed oil and gas company accounts and performance for the past 18 years. The Evaluate Energy database includes over 25 years of financial and operating data for more than 300 of the world's biggest and most significant oil and gas companies, including full coverage of the US E&P market. Evaluate Energy also covers upstream, downstream, midstream and oil service sector merger and acquisitions.