Oilfield services consolidation

Navigating the rough waters of sector transformation

DOUG MEIER, MILE MILISAVLJEVIC, GREGG BYERS, KYLE WEST, PWC, HOUSTON

THE OILFIELD SERVICE INDUSTRY is still reeling from a severe industry downturn which began in mid-2014. With a significant crude price decline, M&A activity slowed substantially from the historically high levels of late 2013 and the first half of 2014. Adjusting to the "lower-for-longer" environment, oilfield services companies have been stabilizing their balance sheets and right-sizing cost structure. The sector landscape has been changing, with signs of readiness for corporate transaction activity. Energy executives are looking to deals as a means to achieve scale, fill in portfolios or enhance capabilities. Their strategic options depend on the company's liquidity, asset strength, and access to capital markets. Though a wide bid-ask spread, among other factors, hampered getting deals done, the market is starting to stabilize. Now, strategic buyers have a leg up given their ability to justify higher premiums through synergies and offer stock as a tax-advantaged transaction currency.

Market situation

The oil and gas (O&G) industry is renowned for its boom and bust cycles, creating fortunes and wiping them away equally as fast. The current downturn feels particularly sharp as Brent crude dropped 75% from $106/bbl in July 2014 to $26/bbl in January 2016. While prices have recovered modestly (currently trading at around $51/bbl as this article goes to print), market conditions remain challenging as the low prices weigh on sector performance. Demand for oilfield services is weak in many parts of the world, with a few exceptions of sustained areas of strength, namely the US Permian basin and the Middle East.

Looking forward to the balance of 2016 and into 2017, the O&G market recovery remains anything but certain. Determination of OPEC suppliers to battle for market share, and resilience of North American tight oil producers is yet to yield a victor. OPEC spare capacity is low and capital is increasingly constrained as major producing countries continue running high fiscal deficits. At the same time, distress is also taking its toll on North American producers, resulting in US domestic production drops of ~750K bpd in first nine months of 2016. Global demand, while relatively strong in the past year, is facing pressures in forms of slowing economic growth and fragile financial systems.

Natural production declines will likely result in a ~20 MMBOE supply gap by 2020. Most of the capital is expected to flow to OPEC, Russia and China, with the balance going to shale and pre-funded deepwater, based on relative play economics. The capital efficiency battle is expected to occur between shale and deepwater over time, and will likely lead to a need for higher levels of industry collaboration and integration.

The resounding theme across companies in the service space is a relentless focus on preserving cash flow by undertaking significant operating and capital cost reductions, and fighting to maintain market share. This unique time in the industry presents opportunities for the healthier companies to pursue strategic acquisitions or partnerships as, despite the uncertainty, these companies can re-focus their capability-aligned value proposition by engaging in corporate transaction activity.

Sector transformation under way

Service companies who previously focused on speed and effectiveness, must now compete to lower their customers' cost per barrel. Significant cost reduction and efficiency gains resulted in drilling costs and rig count declining to a nearly 10-year low, as shown in Figure 1. The decline in the rig count is attributed to improved efficiency combined with lower overall drilling activity. At the current E&P capital spend level, the oilfield services sector cost structure may not be sustainable.

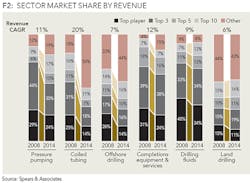

Adjusting to the "lower-for-longer" environment and preparing for an uneven recovery ahead, the industry has started to transform. Oilfield service executives are rethinking their competitive position and service model in light of their customers' acute focus on cost and efficiency gains. Furthermore, recent fragmented growth across oilfield services sub-sectors has left them primed for consolidation. Prior to the downturn, the market attracted many new entrants and top players lost market share to smaller competitors since the last market peak of 2008 (depicted in Figure 2). Although there are areas within the oilfield services sector with high barriers to entry that are still fairly concentrated, there is still significant price competition because the marginal supply is not provided by the top players.

Though some companies are in a better position to weather the downturn, the number of bankruptcy filings in oilfield services has grown to over 60 in just the first nine months of 2016 compared to 39 in all of 2015. However, many sellers appear hesitant to sell despite financial difficulties. The competitive intensity of the currently oversupplied market is testing all service providers – from smaller players with weak financials to larger diversified companies who continue innovating to justify their premium position. So, who is in the lead from a returns standpoint?

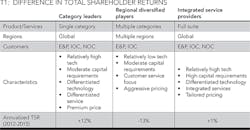

From 2012-2015, the market favored global category leaders over the integrated players as evidenced by a difference in total shareholder returns of 11% as shown in Table 1. Mid-tier companies with weaker technical capabilities had the lowest returns, -13% on average. Without clear differentiation, they may be challenged to capture customers' demand and generate margins in today's market.

If this market bias persists, the oilfield services sector may gravitate towards a super-competitor structure. Super-competitors are companies that develop a clear idea of what the company does best and how it creates value. They focus their investment on the capabilities in support of this idea. Their advantaged position is often achieved by sharper customer focus, a drive for innovation and ability to gain scale in their specific markets. In oilfield services, super-competitors will likely be large-scale category leaders who can use technology to create a defensible position, build a cohesive platform organically or through acquisitions, and apply capital discipline to maintain portfolio excellence.

These changes resemble those which occurred in previous downturn cycles and yielded large service specialist companies. The thesis of specialist consolidation produced outstanding shareholder value creation for many years. Companies focused on internal capabilities while building a portfolio of products and services to address customer needs are more likely to be rewarded by the market compared to the players that are "all things to all people."

The overall M&A market for oilfield equipment and services through 3Q16 remains muted relative to 2014 activity, as market participants have been largely sidelined due to a large bid-ask spread, volatility in commodity prices, lack of acquisition capital, and continued uncertainty about the timing and shape of the recovery. Average quarterly deal volume from 1Q15 to 3Q16 is down 45% from 2013-2014 as shown in Figure 3. In 2016, the select deals that are getting done are market defensive reactions, while companies with clean balance sheets are looking for consolidation opportunities or product adjacencies.

Positioning, deals strategy

In light of the changing landscape ahead, now is the time for oilfield services companies to review market positioning. Consolidation activity is expected to take many forms: mergers to gain economies of scale, strategic acquisitions to gain critical mass or technologies in specific categories, and nontraditional forms such as joint ventures and strategic alliances to access the above mentioned benefits in a difficult capital market environment. What is the right strategy for oilfield service companies in today's market?

- To avoid the common pitfalls that plague transactions, successful dealmakers should consider several key factors: How are we positioned today and which capabilities do we need to enhance or obtain in order to deliver the winning value proposition to our customers?

- Which deals best fit with our position and allow us access to desired capabilities?

- Are target's business models complimentary to our own?

- Should we buy or seek an alternative way to obtain access to these capabilities?

- How should we execute the deal?

Successful companies develop a deal value proposition that differentiates them from their peers and enhances growth potential. Furthermore, deal strategy and a way to play should be aligned with current asset strength and liquidity position. The appropriate course of action for a given company can be defined by its fit in one of the following four categories:

- Healthy – companies with strong assets and liquidity are positioned to be consolidators or integrators to fill-out their capability portfolios. If a company prefers building out its platform through organic growth or is in pursuit of a capital-light strategy, it can consider strategic alliances or JVs with complementary entities in lieu of an acquisition or merger.

- Liquidity challenged - companies with productive assets, but near-term liquidity issues might find deals a way to alleviate liquidity pressures while providing the counterparty much needed asset strength. As such they are not in position to play offense and integrate product offerings through acquisitions. Instead, they can act as aggregators or platform providers to drive to industry consortia that will deliver more of an "open source" integrated solution to the industry.

- Treading water - players with weaker assets, but solid balance sheets have an opportunity to re-invent their core and improve asset productivity through deals. They can seek to become category leaders by re-positioning and divesting non-core assets. Such specialist players are likely to emerge from shedding of "eroding cores" and defining how to drive a higher level of scale and lower cost in the sub-segment.

- Distressed - To stabilize and improve financial performance, companies with higher likelihood of default and low asset productivity can evaluate structural changes. Selling assets or businesses that are not accretive to future earnings can help a distressed entity survive and come out of the downturn stronger, perhaps as a value player or fast follower.

While most executives focus on the valuation and transaction execution elements, they should increasingly also think about how the transaction will leverage or enhance their capabilities. For instance, a large engineering and construction company recently announced its intent to merge with a leading subsea equipment and service player that will significantly strengthen its technological innovation capability and provide access to a higher margin segment, creating integrated benefits from the combined offering. M&A deals that leverage or enhance a company's capabilities outperform other deals by 14% of annual total shareholder return per a recent PwC study.

Deal makers should also pay careful consideration to deal-making experience and deal size. Deal-making is a capability unto itself and those with strong, repeatable deal processes tend to realize between 30-40% more value than those that make one-off acquisitions. Deal size also matters as most successful dealmakers often start small and ramp up, enabling company knowledge and capabilities to increase over time while reducing the impact of failed acquisitions. Larger deals can be very difficult to integrate and consume resources needed for the buyer's legacy business.

Beyond traditional M&A, companies are transforming the landscape by formulating partnership strategies and considering different service models. For example, a leading oilfield services firm partnered with a global foundation drilling equipment manufacturer to deliver the rig of the future, enabling new integrated services. Leading oilfield services companies are evolving both their product and service approaches, with the industry being dramatically reshaped by use of technology. New products are using higher levels of data and analytics to improve performance and increased automation to reduce reliance on human interactions. Companies are delivering new products on ever-decreasing innovation cycles through creative use of ecosystems and partnerships. Services are becoming more bundled (if not integrated) and knowledge sharing across the E&P value chain is improving.

Access to acquisition capital/ how deals get done

Acquisition capital has been in short supply for certain players in oilfield services sub-sectors that are out of favor with investors, and/or those with weaker balance sheets. While some capital markets activity in the oilfield services sector has been observed, they primarily tend to be for capital structure repair and/or to shore up balance sheet versus for use as acquisition currency.

In these situations, companies have been forced to find more creative methods to be acquisitive. With all the private equity money that has been raised to invest in the oil and gas space (around $100 billion in dedicated energy PE and another $75 billion in energy focus from diversified funds), financial sponsors have been the capital of choice as they typically offer the highest degree of flexibility in terms of structure and an understanding of the situation as it fits within the private equity mandate. While private equity capital typically comes at a high cost, financial sponsors have been willing to forgo the traditional 25% hurdle rate and 3x payback to play in multiple parts of the capital structure, and thus accepting lower return for the tradeoff of higher securitization.

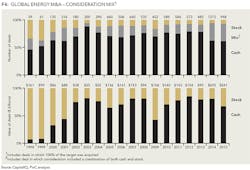

During the recent high-price cycle between 2011 and 2014, cash was the preferred deal currency forcing the acquirer to take on all of the pre-closing market risk. During 2015, we saw a transition towards more of mixed consideration or even all-stock deals as depicted in Figure 4.

While management impetus has historically been the primary driver of M&A, in this market, access to capital is now a key constraint. This tangible component is creating a very clear bifurcation between those being aggressors and those being defensive.

In the current depressed market environment, strategic buyers are in an advantages advantageous position due to the fact that synergies account for a greater percentage of transaction value than in a stable market. Therefore, they are often in a position to pay a higher premium. Additionally, strategic buyers have the advantage of offering stock consideration, providing certain tax benefits and giving sellers an opportunity to share in the potential recovery upside. A stock deal allows the buyer to maintain financial flexibility without added covenants and constraints that are typical of debt capital. A stock buyer also keeps any potential collateral clear of debt burden, and thus maintains optionality for future levered acquisitions, or access to rainy-day funds.

However, when equity is used as currency in M&A, the line between buyer and seller becomes blurred: an "all-stock" offer involves evaluating several questions:

- Is the offer a fair price?

- Are the shares of the acquirer fairly valued?

- Is the combined company an attractive investment?

Sector activity outlook

In response to the recent commodity price decline, companies have been right-sizing their cost structure to the "lower-for-longer" environment and strengthening balance sheets. Following a period of fragmented growth, the oilfield services market has become intensely competitive and is likely evolving towards category leaders. Strategic buyers are considering deals to achieve scale, fill in portfolios or enhance capabilities. However, their options depend on the company's liquidity, asset strength, and access to capital markets.

While the downturn put the oilfield service industry through the ringer, many executives think the worst is behind us. Commodity prices have rebounded modestly with Brent crude currently trading in the $48-$53 range compared to the lows of $26/bbl early this year. The Energy Sector ETF volatility index is down by about 50% from the highs observed in February 2016, indicating that market anxiety has subsided. This stabilization of commodity and equity prices should provide support for the deal market to pick up.

Limited M&A activity observed during this down cycle has left many attractive acquisition targets on the market, so prospective buyers have plenty of choice. In many sub-sectors consolidation is near a strategic necessity for the elimination of the marginal player, and is likely to come via the forced hand of bankruptcy. An uptick in mega-deals may create a domino effect of reactionary transactions from competitors not wanting to miss out on the quality assets.

Now, as the dust settles, the sector appears to be ready for consolidation. Many companies have already publicly stated their intent to use this opportunity to consolidate and a few have already started making their moves. While the availability of acquisition capital will likely provide some headwinds to consolidation, companies are expected to look for creative solutions to pursue the right strategy.

ABOUT THE AUTHORS

Doug Meier leads PwC's Deals practice in Houston, Texas. He is also the Oil & Gas sector leader for the Deals group. Working with companies contemplating cross-border acquisitions, Meier has advised clients headquartered in countries throughout Europe, Asia/Pac, Latin America and North America.

Mile Milisavljevic is a principal in PwC's deals practice in Houston. Milisavljevic is focused on organizations undertaking transformative change: developing breakthrough strategy and developing organizational capability to execute.

Gregg Byers is a managing director in the Houston office of PwC Corporate Finance where he leads the coverage effort for the oilfield services sector. His career experience includes over 20 years of domestic and international strategic financial advisory work for both corporate and private equity clients.

Kyle West is a director in PwC's Transaction Services practice based in Houston. He specializes in financial, economic and accounting analyses involving complex business transactions. His experience includes a wide range of M&A issues including acquisition due diligence, value drivers, purchase agreement negotiation, and sell-side diligence, among others.