Are the easy times ending for refiners?

Decade ahead could prove challenging, separating the best from the rest

PEDRO CARUSO, BAIN & CO., HOUSTON

DIEGO GARCIA, BAIN & CO., BUENOS AIRES

JOSÉ DE SÁ, BAIN & CO.., SÃO PAULO

The collapse of oil prices that began in the summer of 2014 wreaked havoc on many upstream and midstream businesses, but refiners have enjoyed a period of comparative prosperity as low crude prices buoyed margins. Now, as prices begin to recover, those easy times may be coming to an end. Margins have already tightened as crude oil prices stabilized and refiners began to pass their savings on to customers. Moreover, in the next few years, refiners will have to cope with several long-term challenges sure to separate leaders from laggards and possibly force some poor performers from the field.

First, the global supply of crude continues to get heavier and sourer—the US is an exception, thanks to the rise of light tight oil production—putting pressure on smaller, less complex refiners.

Second, new refineries are coming online that could boost capacity beyond demand, especially in the Asia-Pacific region. Their preferential access to markets, crude stocks and affordable labor supplies will make life harder for other refiners that operate where labor and energy costs are higher. Overcapacity may be an even greater challenge in some developed markets that may be reaching peak demand and leveling off, including the United States' West Coast and Midwest.

Third, regulations are becoming more stringent, especially in developing economies. Mexico, for example, is adopting rules that will require heavy-duty vehicles there to comply with emission standards as strict as those in the European Union.

Some refining segments are better positioned to thrive in this changing environment than others, depending on their markets, operating conditions and asset portfolio.

Markets. Consumption of refinery products is shifting from developed to developing markets, especially to China and other developing countries in the Asia-Pacific region, favoring refiners there as well as the national oil companies (NOC) in the Middle East and Commonwealth of Independent States (CIS) independents, who have competitive access to this market.

Operating conditions. Middle Eastern NOCs and CIS refiners have good access to feedstock, lower energy costs and efficient capital, all of which can give them an edge in operations. European independents and Latin American NOCs may find it harder to make gains. Africa, given its low labor costs and surplus of crude, seems a good candidate for refinery operations, but refiners there have not capitalized on these advantages due to a lack of engineering and construction capabilities.

Asset portfolio. Globally integrated companies and independents in the US and the Asia-Pacific region are best positioned in terms of the scale and complexity of their portfolios, followed closely by the NOCs in the Asia-Pacific region, the Middle East and the CIS, which are investing to make their portfolios more competitive.

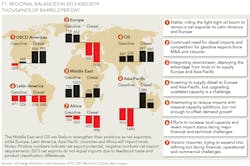

These changes will combine to shift the flows of refined products around the world, with the Middle East and the CIS becoming the major suppliers to the world, North America essentially balanced, and Europe, Latin America, Africa and the Asia-Pacific region remaining net importers.

Clearly, the world will become more complex for even the most competitive refiners, requiring them to embrace an agenda of strategic and operational efficiency. The elements will differ from one refiner to the next, but several key elements will help refiners remain competitive.

Protect and expand access to markets. Whether focused on a local market or exports, refiners must understand their competitive edge and threats.

Identify opportunities based on access to feedstock. More than ever, leading refiners need to enhance the refinery's linear program model to market demand and price differentials, as US refiners did with the light tight oil boom.

Achieve operational excellence. Plant reliability, energy efficiency, front-line labor productivity, SG&A optimization and working-capital management are key to achieving excellence.

Improve ability to manage capital projects. Better management of projects and vendors will help bring costs in line.

Optimize the refinery portfolio. Pursue full potential for each refinery without compromising safety, yield, reliability or environmental compliance.

The decade ahead could prove challenging for refiners, separating the best from the rest. The agenda is likely to be complex: rising feedstock prices, heavier and sourer crudes, increased competition, and new regulations. Those who capitalize on the gains won in the most recent cycle to prepare their organizations and assets for the challenge are more likely to thrive.

ABOUT THE AUTHORS

Pedro Caruso is a partner with Bain & Company in Houston, Diego Garcia is a principal with Bain in Buenos Aires and José de Sá is a Bain partner in São Paulo. All three work with Bain's Global Oil & Gas practice.