Permian Basin deals lead the pack on a global stage

ANDREW MASON DITTMAR, PLS INC., HOUSTON

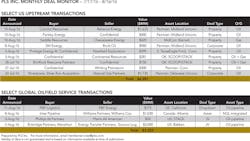

PLS INC. reports that through the middle of August, Q3 upstream deal activity has remained strong and particularly in the Permian Basin where the white-hot activity has led in terms of deal flow, size and valuations. In this month alone, the Permian accounted for 69% of all US deal activity and 40% of global activity. Excluding Statoil's $2.5 billion deal in Brazil and Exxon's $2.4 billion deal in Papua New Guinea, the juggernaut play accounts for a whopping 64% of all upstream deal activity across the globe. Within the West Texas neighborhood, recent deal activity is clustered around two main blocks - one in the Midland Basin centered on Martin and Midland counties and a second in the southern Delaware Basin along the Pecos River dividing Ward and Reeves counties.

Interest in the southern Delaware has been rocketing forward throughout 2016. This culminated in July with the buyout of NGP-backed Centennial Resource Production by Silver Run Acquisition Corp. and Riverstone Holdings. The $1.735 billion deal, including the rollover of seller equity, values acreage at over $35,000/acre according to PLS' proprietary valuation methodology. The addition of Mark Papa (Silver Run's founder) to the players working in the southern Delaware is a tremendous endorsement of the future of the basin from one the industry's most knowledgeable experts. Companies are looking to replicate the success seen in the Midland Basin with multi-bench development of four or more productive oil plays. The Wolfcamp A and B benches are common to both basins, with the Delaware also having development potential in the Bone Spring as an alternative to the Midland Basin's Spraberry.

While drawing the attention of some Midland Basin drillers including Diamondback Energyand Parsley Energy, increasing activity in the Delaware hasn't dampened at all the seemingly limitless appetite for core Midland Basin acreage. The Midland Basin continues to consistently draw among the highest acreage valuations in the country across a fairly widespread geographic area. In mid-August, Midland-based Concho Resources dramatically boosted its inventory by spending $1.625 billion to buy privately-held and Midland-based Reliance Energy's 40,000 net acres in Martin, Andrews and Ector counties along the western edge of the Midland Basin. On the other side of the Midland Basin in Howard County, SM Energy acquired Rock Oil for $980 million in early August and added another 25,000 acres to its Permian position. Parsley Energy rounded out the list of recent buyers in the Midland Basin with a $400 million acquisition in Glasscock County that also included mineral interests and an override.

Despite their geographic spread, all three of these Midland Basin deals were priced at $30,000/acre or more. This is in contrast to the southern Delaware, where top-tier valuations are still limited to a relatively narrow portion of the play along the Pecos River. The Midland is unique among US shale plays in being able to draw such high acreage valuations across a wide area. A number of Eagle Ford deals have approached or even exceeded Midland Basin valuations, but these have largely been very narrowly confined to a small "core of the core" area in Karnes County. Outside of this core, Eagle Ford deals are more typified by Newfield's recent sale of Eagle Ford and conventional gas assets for $390 million. PLS calculated the Eagle Ford acreage portion of that deal in Atascosa, Dimmit and Maverick counties at less than $10,000/acre. The SCOOP and STACK in Oklahoma have also drawn buyer interest, but sell for a fraction of the cost of top-tier Permian assets with a much smaller core footprint. Continental Resources sold non-core SCOOP at $9,000/acre and RimRock Resources bought in at $3,400/acre.

One constant across the shale plays is the use of increasing amounts of proppant to drive better well results. The demand for islands of sand is reflected in the oilfield service deal market, with three of the largest oilfield service deals focused on the production and transport of proppant.

In the midstream deal market, both Williams and Energy Transfer Equity moved forward from their failed merger. Williams and Williams Partners sold their Canadian NGL business to Inter Pipeline for $1.03 billion while Energy Transfer Partners and Sunoco sold down their stakes in a Bakken pipeline system to Marathon Petroleum and Enbridge Energy.

Outside the US, upstream markets continue to gain strength with a good diversity of asset types changing hands across South America, Africa, the North Sea and the South Pacific. While Norway may have come away from the 2016 Rio Olympics well back in the medal count, Statoil grabbed one of the biggest prizes in Brazil with a $2.5 billion acquisition of pre-salt assets in the Santos Basin from Petrobras. On the other side of the world, ExxonMobil outbid Oil Search and agreed to acquire InterOil for almost $2.5 billion plus contingent payments. Cobalt, however, will have to find a new buyer for its Angolan assets after state-owned Sonangol pulled out of a $1.75 billion deal to pick up the interest.