PHOTOS BY HEIDI LYNNE PHOTOGRAPHY

EDITOR'S NOTE: Eclipse Resources is a pure play Utica Shale operator with assets in the core of the play located in Southeastern, Ohio. The company is headquartered in State College, Pennsylvania, about 140 miles east of Pittsburgh. State College is best known as the home of Penn State University. Benjamin Hulburt and his brother Christopher co-founded the company in 2011, and Ben serves as chairman, president, and CEO. Christopher is executive vice president, secretary, and general counsel, and is also a member of the board. Both previously served in similar roles at Rex Energy. OGFJ recently spoke with Ben Hulburt about the company and its plans.

OIL & GAS FINANCIAL JOURNAL: Thanks for talking with us today, Ben. I understand that Eclipse is ramping up operations and increasing production. And you've restarted your drilling program, completing your drilled-but-uncompleted well inventory and you're looking at adding a second drilling rig next year. But first, tell us about your primary areas of operation and what you are doing differently to set Eclipse apart from its peers.

BENJAMIN HULBURT: Thank you Don. As you know, our core acreage position is well delineated in the heart of a world-class play, the Utica, in southeastern Ohio. We began assembling our acreage position in 2011 based upon an analytical evaluation of the shale properties within the Utica and Point Pleasant formations across southeastern Ohio, and applying this evaluation, concentrated our acquisition efforts in an area spanning parts of five counties that we believe to be the most prolific region of the play. This area includes parts of Noble, Guernsey, Monroe, Belmont, and Harrison Counties. We have assembled an acreage position of about 103,000 net acres located in what we believe to be the most productive and economic area of the Utica Shale fairway. Roughly 13,000 of these net acres are also prospective for the highly liquids rich area of the Marcellus Shale.

We have identified approximately 437 net remaining horizontal drilling locations across our acreage assuming an average lateral length of 10,000 feet while significantly driving down the cost per lateral foot on our wells. Since entering the play in 2011, Eclipse and its operating partners have drilled more than 215 wells in this five-county area, which has proven to be the core of the play.

From a technological perspective, our Appalachian team, in my opinion, is unrivaled in its experience and expertise drilling in the Utica Shale play. Much of our drilling team joined the company several years ago from Chesapeake, including our SVP of Drilling and Completions, where they oversaw the drilling of the first Utica Shale wells drilled in Ohio which brought us the benefit of that early experience in the play.

We've been able to lower our costs while drilling our wells faster than our peers, which has led to higher efficiency rates. We're drilling wells in approximately 17 days, while our peers have taken significantly longer. Rates of return on our wells, even in today's modest commodities environment, are up to 60% plus. And drilling costs are roughly 30 to 40 percent cheaper than our peers.

On our Purple Hayes well, which set a world record for the longest onshore lateral ever drilled, our average cost per foot of completed lateral was just $854, which is truly remarkable. Our overall average in the dry gas area is about $1,000 per foot of completed lateral, which compares to around $1,200 to $1,400 for our closest peers. I can't emphasize enough how our deep experience and technology are pushing the bounds of well economics. We are achieving cost efficiencies that previously were not thought possible. More importantly, our unique designs and completion techniques are repeatable and can be applied across both our dry gas and liquids-rich acreage, which should yield a substantial improvement in well performance.

OGFJ: And you believe you have found the "sweet spot" in the Utica?

HULBURT: Yes. For dry gas, at least, we are in the core of the core. We were the first company to drill dry gas wells in the core of the Utica and we've led the industry on lateral lengths. I believe that this has provided us with a competitive advantage in the play. In addition, parts of Monroe County in southeastern Ohio is also prospective for the Marcellus Shale, so we have the ability to drill laterals into that formation off the same pads, which affords us additional opportunities and cost efficiencies.

OGFJ: Can you tell us a little about what led you and your brother, Christopher, to launch Eclipse Resources back in 2011? Also, how were you able to recruit talent and build a successful team in State College, Pennsylvania?

HULBURT: We exited Rex Energy in 2011 to start Eclipse Resources. We immediately focused on what is today seen as the core of the Utica and started to acquire acreage during the play's infancy. At the same time, we put in place a high-quality team. As I mentioned previously, our SVP of Drilling and Completions came to us as the Utica Shale asset manager from Chesapeake, but several others came to us with significant prior experience in the basin as well, including our COO who was formerly the Appalachian regional manager for Cabot where he spearheaded their operations in the Marcellus Shale and our SVP of Land who was the VP of Land for the eastern region for Chesapeake where he oversaw probably the largest land department in the basin. That, as much as anything, is what has allowed us to achieve such high efficiencies in drilling these wells. Recruiting the right people can always be a challenge, but we were able to attract experienced, high quality talent by allowing them to get in on the ground floor as we built an E&P company with a world class asset, from scratch. We did that with Rex Energy, so we had a track record that showed our capabilities.

OGFJ: Was the plan always to target natural gas in the Utica formation?

HULBURT: We liked the optionality of the Utica because it gave us the ability to operate in a number of different phase windows. What is nice about the Utica, is that you can move from one county that is more "oily" to an adjacent county with mainly dry gas. In the condensate area, our unique drilling and completion techniques have enabled us to change the cost structure of the play in certain areas so that when oil prices rise above $50 per barrel we can generate strong returns. Many of our peers are unable to generate these strong returns and subsequently forced to let acreage expire. That said, after we formed our joint venture with Antero Resources back in 2012, which has been very successful, we took some of the proceeds from that and acquired additional acreage in Monroe County, targeting both the dry gas portion of the Utica play and the liquids portion of the Marcellus and Upper Devonian plays. We were the first company to drill a dry gas Utica Shale well in this area that really kicked off the dry gas drilling in what is now the core of the play. This area has provided us with substantial upside potential. So we targeted the Utica for the optionality.

OGFJ: Eclipse is outperforming its peers on a number of fronts. Can you tell me what early decisions you made that are serving the company well during the current downturn?

HULBURT: One of the things we focused on from the beginning is costs. We scrutinize everything closely to see where we can achieve cost savings, so I think that has enabled us to survive this downturn and bounce back sooner than many of our peers. As commodity prices fell we made the decision to let our rigs go and artificially curtail our production. We shut in wells and saved that production to sell at a better price in the future. I believe we managed our company prudently and focused on preserving our capital. The strategy has proven very beneficial as we moved into the end of the second quarter of this year and started to see price realizations improve. We reinitiated a one rig drilling program and began completing our drilled uncompleted well inventory. Additionally, we hedged approximately 80 percent of our forecasted 2017 production at higher prices than we've seen in all of 2016 so far. At the same time, we bought back approximately $40 million of our debt at roughly $0.60 on the dollar. Today, debt levels are trading significantly higher, at about $0.95 on the dollar. I only wish we could have purchased more at that time.

OGFJ: I know you had to take your foot off the accelerator a little due to the collapse of commodity prices, but Eclipse recently said it was transitioning back to being a growth-oriented company. Can you explain what you mean by that and what specific growth initiatives you are pursuing?

HULBURT: Sure. We recently had a successful $125 million equity raise that will basically fully fund our 2017 drilling program. With commodity prices seemingly more stable, we made the decision to re-engage our drilling activity during the recent quarter and to focus on the dry gas area in Monroe County. We also decided to go back in and complete our DUC inventory, which is more in the condensate area. We increased our capital budget by approximately $25 million this year from what we had initially forecast, and we are now focused on resuming our peer leading growth trajectory. We anticipate 2017 production will grow by at least 30% and possibly closer to 40%. We have now brought back most of our shut-in production and have recently increased both our third quarter and annual production guidance for 2016 accordingly.

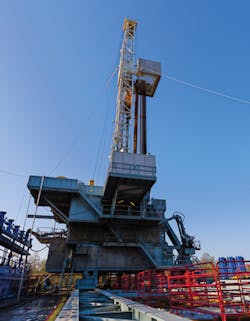

OGFJ: As you alluded to earlier, Eclipse accomplished an amazing technical feat in 2016. You drilled the longest onshore lateral ever drilled in the United States. What factors led to the decision to drill this lateral? Did the well accomplish its goals from a business perspective?

HULBURT: We had been extending our lateral reach longer and longer in the dry gas area, and we were leading the play in that regard. So we decided to see how this concept would work in the condensate area. The idea was to extend our reach in the productive zone to make the economics in the condensate portion of the play more attractive relative to our dry gas position by significantly reducing the average cost per foot of completed lateral. Over about a six-month period, our team studied, analyzed, and took into account all contingencies and operational risks. From a technical perspective, we felt it was feasible. From a business perspective, we think the market will be balancing in the short term at about a low to mid $50s oil price and at least a $3.00 gas price, so we decided drilling the super lateral would achieve what we wanted in terms of economics. In Appalachia, pad drilling costs are much higher than in, say, the Permian Basin or the Eagle Ford in Texas. So, by drilling longer laterals, we're able to lower our costs and improve estimated ultimate recoveries (EURs). Not only were we successful in drastically reducing cost per foot on this well but we believe the well is exceeding our type curve expectations of .8 Bcfe per thousand lateral foot, providing a significant economic enhancement. Although still early, we currently believe that the well's performance to date will result in a EUR at the high end of our expectations of 1.2 Bcfe per thousand lateral foot. With these kind of results and commodity prices, we believe our "Super Lateral" concept will present highly economic returns. This high degree of innovation and step change in cost structure will ultimately enhance the value of our asset base and our company.

Photo Eclipse Resources

OGFJ: What are the company's expectations for the remainder of the year and for 2017? Are you optimistic?

HULBURT: As we move through the balance of this year and into the next, I think we'll see higher prices for natural gas and stabilization in strip prices moving forward. Consequently, we've been able to hedge a large portion of our production. As mentioned, we're basically about 80% hedged right now for 2017 on the natural gas side. That helps us lock in returns and enables us to go back to work. The idea is to not stop at one working rig. Longer term, we see prices moving higher, so I would not be surprised to see us bring in a second rig in the second half of 2017 to take advantage of that. We have more than 100,000 acres to drill, so it would take a long time for one rig to go through that inventory. Bringing in that second rig in the second half of 2017 will also drive 2018 production levels.

OGFJ: So do you think the commodities market has turned a corner?

HULBURT: I would say so. I think we've seen the worst, not only in Appalachia but across all the different basins. Everyone, including the majors and large caps, cut their capital budgets for 2016, so we have seen that reduction result in lowered production. Week in and week out we've seen natural gas storage injections that are over 30 bcf less than the same period last year which is helping to reduce storage levels back to normal levels by the end of the injection season. Several weeks ago, we actually saw withdrawals in the summer, which is virtually unheard of, a very interesting phenomenon. Power producers are relying increasingly on natural gas for power generation, and if we have a normal winter this year, we believe the gas market will continue to move higher.

OGFJ: Last question: With the $125 million equity raise and increased production, do you feel that Eclipse is well prepared financially for whatever occurs in 2017?

HULBURT: I do. We've proved that we can drill wells quickly and efficiently, but with reduced revenue from lowered production, it was critical that we figured out how to fund 2017. The equity raise was crucial for this. We currently maintain a strong liquidity position of $334 million and more importantly, our bank revolver credit facility remains completely undrawn with our objective being to keep it that way. We're also looking at a non-core acreage divestment by the end of this year. During the first part of the year, we had some non-core divestitures including our conventional shallow wells to allow us to better focus our attention on our shale drilling.

OGFJ: Sounds like a game plan, Ben. Thanks very much for your time today.

Anthony Andora of Edge Consulting Solutions ([email protected]) contributed to this article. He is a contributing editor to OGFJ.