Q3 upstream US deal value surges ahead on strength of acreage value

ANDREW DITTMAR, PLS INC., HOUSTON

PLS INC. reports that US upstream deal activity powered ahead during Q3 to $20.6 billion, largely on the increasing amounts paid for acreage. Q3 was the strongest quarter since oil prices collapsed in late 2014 and pushed total 2016 deal value to nearly $43 billion. Remarkably, more than half of the value was for acreage ($11.3 billion) which topped even the recent high-water mark of $10 billion invested in acreage in 3Q14. Only $6.5 billion was paid out for acreage during all of 2015.

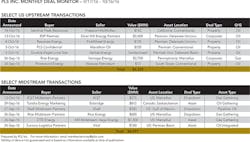

The majority of that acreage value flowed into the Permian, which easily maintained its lead as the hottest region. Private companies, primarily PE-backed but also venerable family firms like Yates Petroleum, were gobbled up by public E&Ps. In the Midland Basin, Rock Oil (backed by Riverstone Holdings) was sold to SM Energy while Plymouth Petroleum (backed by ArcLight Capital) was bought out by Callon Petroleum. In the Delaware Basin, Arris Petroleum (backed by Kimmeridge Energy Management) was acquired by PDC Energy, and Diamondback Energy struck a deal to buy Luxe Energy (backed by NGP).

The trend of private companies cashing in on the current Permian boom is continuing into Q4, headlined by the $2.4 billion acquisition of Kayne Anderson-backed Silver Hill Energy by RSP Permian. Silver Hill built a very substantial position focused on Loving and Winkler counties, Texas. The assets sold for $48,200/acre and set a new Delaware Basin high. That price is well within the expected range for top-tier Midland Basin assets and shows the convergence of valuations between the two basins. During Q3, Delaware Basin acreage sold for an average 60-70% of the cost of Midland assets.

One of the key drivers of Permian deal flow is the ability of public E&Ps to tap equity markets. Equity markets are also open for companies with strong balance sheets in other key plays. In the Marcellus, Rice Energy used equity as its primary funding source for Q3's largest deal: its $2.7 billion buyout of Vantage Energy. Rice raised $1 billion in cash from a public offering, while funding an additional $980 million through an equity issuance to Vantage sponsors Quantum Energy Partners, Riverstone, and Lime Rock Partners. The Marcellus is one of the few gas plays where sellers are still finding value for acreage, with Rice shelling out $13,300/acre. That is relatively in line with what Range Resources paid for Cotton Valley acreage in its buyout of Memorial Resource Development during Q2.

While unconventional plays were the main driver of value during Q3, the quarter also saw a number of notable conventional deals. The deepwater Gulf of Mexico returned to life after a period of historically low activity. Anadarko acquired the deepwater portfolio of Freeport-McMoRan for $2.0 billion, and EnVen Energy spent $425 million in an acquisition from Shell.

Production valuations have yet to see the market recovery that acreage has experienced. Based on a trailing six-month average, oil production is selling for $36,000/daily bbl while gas goes for $2,600/daily Mcf. The multiples may take some time to increase further as production values typically lag changes in the spot market. Early in Q4, Sentinel Peak made a $742 million purchase of conventional oil assets in California from Freeport and paid $26,000/daily bbl.

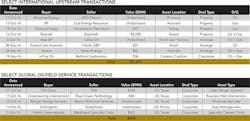

The still-recovering market for US conventional assets is mirrored by Canadian and international deal activity. Canada recorded just under $2.0 billion of upstream deal value during Q3, with the lion's share of that occurring in early July when Seven Generations Energy bought Deep Basin assets from Paramount Resources for $1.5 billion. Internationally, $7.2 billion in upstream assets changed hands. The main drivers there were the $2.45 billion buyout of LNG player InterOil by ExxonMobil and a $2.5 billion acquisition of offshore Brazilian assets by Statoil from Petrobras. Both LNG and deepwater Brazilian oil are two of the international areas where IOCs have been most consistently optimistic, although each still faces its challenges.

The midstream portion of the energy business had a strong showing in deal activity during Q3 with a total value of $61.5 billion across the globe. The $44.6 billion acquisition of Spectra Energy by Enbridge accounted for a large portion of that, but even aside from that merger there was healthy deal flow both in the US and internationally. Midstream companies in key plays like the Permian and Marcellus are adding capacity in expectation that volumes will increase as prices improve.

The oilfield services sector saw an active deal market during Q3, but lacked the big-name consolidation seen during the depth of the oil downturn. Many of the deals lacked a disclosed value and involved a private company on at least one side of the transaction.