Midstream assets in the Permian Close doesn't count

MATTHEW LEWIS, EAST DALEY, DENVER

OIL AND GAS PRODUCERS have been scrambling to acquire drilling acreage in the Permian Basin in what is turning into one of the biggest land grabs since commodity prices tumbled in late 2014. Over the past few months, QEP Resources, PDC Energy, Concho Resources, SM Energy, and Parsley Energy have all announced deals to enter or expand into the basin. Billions of dollars are being spent with some deals inked at well over $30,000 an acre-valuations higher than when oil was priced over $100 a barrel. The recent buying spree is a welcome sight to the midstream sector that has been desperate to find a growing basin since drilling peaked in 2014. Oil is certainly the main focus for these producers, but the river of hydrocarbons flowing below West Texas is also rich with copious amounts of natural gas and other liquids that need to be gathered, processed, and transported. And while most of the major midstream players have at least some exposure to the Permian, a majority of the current business is dominated by just a handful of midstream companies.

From an asset-level perspective, the Permian can be broken down into 48 separate natural gas gathering and processing systems. Those 48 systems include more than 150 processing plants which are gathering supply from around 160,000 active wells based on drilling from hundreds of active rigs. Interestingly, of the 48 systems tracked, we estimate only 14 will have significant growth based on current Permian drilling expectations. These 14 systems are well positioned in core areas and over 70% of the rigs operating in the basin are currently drilling on their footprints. So while it is true that the Permian is a hot investment right now, this isn't horseshoes or hand grenades. Close doesn't count.

Acquisitions aren't the only thing on the rise in West Texas. So is drilling. Recent quarterly conference calls of 75 public oil and gas producers have indicated they collectively plan to add 28 incremental rigs in the Permian for the second half of 2016-more announced additions than all other oil and gas basins combined (See Figure 1).

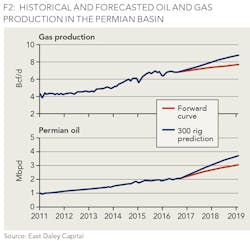

Over the past few years, rig additions in the Permian have correlated well with the price of WTI. Lagged regression analysis shows historically a $1 change in WTI oil price adds or subtracts approximately five rigs from the basin. However, the recent buying spree may break this trend as acreage acquirers are adding rigs aggressively. Scott Sheffield, CEO of Permian producer Pioneer Natural Resources recently predicted that the basin will add 100 incremental rigs within the next 12 months as producers ramp up activity on newly acquired acreage. To illustrate the increase in rig activity on basin production, Figure 2 compares estimated oil and gas production based on two scenarios: the historical rig correlation tied to the forward curve (red) and 100 additional rigs over the next 12 months (blue). In both scenarios oil and gas production is predicted to grow significantly by 2019. While the outlook appears to be welcome news for the midstream sector, only some companies are well positioned to benefit.

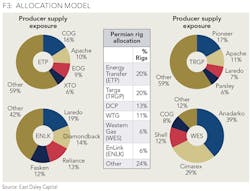

Consolidating the 48 modeled Permian systems together at the corporate level gives good insight into the best positioned gathering and processing companies serving the basin. As shown in the table in Figure 3, Targa and Energy Transfer combined have approximately 40% of the total basin rigs drilling on their systems. Moving down the table, the top six midstream companies have over 75% of the rigs locked into their systems, leaving only a small share of rigs left over for other midstream companies to fight over. Drilling deeper, the pie charts in Figure 3 break out producer specific volumes being gathered and processed by each midstream company. It should be noted that several of these producers and midstream companies are tied together via partnerships or ownership structure. For example, Anadarko is the general partner and owns a significant portion of Western Gas (WES). Given this structure we would expect that most of Anadarko's volumes will continue to be directed toward Western Gas systems.

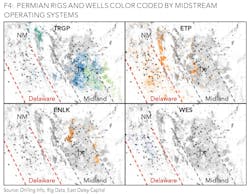

Visualized in Figure 4, East Daley's production model allocates producing wells and rigs to specific gathering and processing systems in the Permian Basin. Wells (dots) and rigs (squares) are color coded to respective systems for Targa, Energy Transfer, EnLink, and Western Gas. Using this visual and analyzing raw data behind the model gives good insight into the advantages some systems have over others. In the case of Targa, their largest system (West Texas) is well positioned in a core area on the east side of the Permian (Midland sub-basin) and benefits from a unique ownership structure where Pioneer Natural Resources is a 27% joint owner. As such, Pioneer is incentivized to allocate their rigs and volumes to it. It should be no surprise that our model shows they are the largest system producer and we estimate that 10 of their 13 active rigs are allocated to Targa's system. Energy Transfer's advantage comes both from geographic location and vertical integration. Their two systems sit in the heart of core areas in both the Midland and Delaware sub-basins. Additionally, unlike some other midstream companies, Energy Transfer can offer a full suite of services that get hydrocarbons all the way from the wellhead to demand markets via their liquids pipelines, natural gas pipelines, and fractionation facilities.

The increase in drilling activity has also brought increased competition. Several small, privately funded companies have entered the basin and built out gathering and processing systems in active drilling areas. For example, EagleClaw Midstream has been aggressively expanding its system in Reeves County-an area we expect production will ramp as more infrastructure is built out. Given that some of the bigger midstream players (names missing from Figure 3) have still not made inroads into core Permian areas, these smaller systems could be acquisition targets if production continues to trend favorably.

It should also be noted that while the G&P model shows that Targa and Energy Transfer are currently winning the midstream market share battle in the Permian, both of these companies are diverse and a careful review of all of their assets should be conducted before making company-level conclusions. For example, Targa has several other Texas, Midcontinent, and Gulf Coast systems that have flat or declining volume profiles. Similarly, Energy Transfer has assets with some regulatory risk (Dakota Access Pipeline) and natural gas pipelines with contract expirations in a few years.

There is no doubt that the Permian is one of the hottest producing basins in the country. That excitement has and will continue to translate into midstream investment opportunities. Within the Permian the more defined areas of the Midland and Delaware basins, which are dominated by a few larger players, have been the focal point for investment and drilling. Additionally, in those basins, some of the hottest assets are highly dependent on the investment strategy of specific producers. Finally, as is often the case, many of the companies whose assets are benefiting the most are large and diverse.

While there are opportunities to leverage Permian growth within a vertically integrated system, with energy markets in transition, growth in the Permian may mean retractions for assets in other basins within those same companies. Considering these elements will help paint a clearer picture of opportunities.

ABOUT THE AUTHOR

Matthew Lewis, CFA is a Director of Research for East Daley Capital and is responsible for asset-level analysis for midstream companies and producing basins. Lewis holds a bachelor's degree in Biology from Iowa State University and a master's degree in Global Finance, Trade and Economic Integration from the University of Denver.