Developing sustainable solutions to volatile oil and gas pricing

Chuck Chakravarthy

Deloitte Consulting LLP

Houston

Oil and gas industry executives recognize the need to adopt a long-term, consistent plan to manage effectively through the sector's perpetual cyclicality. This philosophy often is not practiced and is easier to espouse in good times. Times of pronounced volatility often produce severe responses as companies scramble to navigate fluctuations in the business.

With a few notable exceptions, most oil and gas companies – and the drilling and services companies that serve them – surf the waves of commodity price volatility. During good times, they acquire companies and assets, expand their capital budgets, geographic presence, and product and service capabilities. When there are dramatic price drops, as from July to December 2008, they divest business units and assets, and reduce budgets, presence, and capabilities.

Energy companies are responding to the recent volatility and global economic crisis in a predictable manner: cutting costs in order to stay afloat. Few are developing sustainable cost reduction programs with initiatives tied to long-term strategy.

In times of crisis, the need to survive a dramatic price drop can trump consideration of how to thrive in a more favorable environment – the pain of hemorrhaging cash overwhelms the need to plan for profitability's return. Yet, planning for the future is exactly what is needed – both to survive the short-term, and to be well positioned for future growth.

The danger of a short-term approach

In the face of the most tumultuous economic environment in recent memory, some companies are using layoffs as a primary means of cutting costs. It's easy to understand why: personnel reductions are perceived as "low-hanging fruit" and are heralded as a winning formula among market analysts.

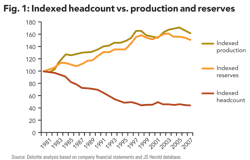

Oil and gas companies were quick to reduce headcount during the downturns of the mid-1980s and 1990s, and the industry has been slow to rebuild its human resources during recovering markets1. Indeed, the industry has managed to increase production and reserves over the past two decades while keeping employment relatively flat in the recent past, which followed a downward trend of almost two decades (see Fig. 1).

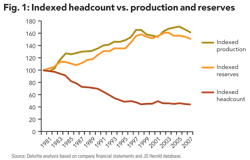

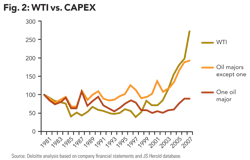

Statistics suggest that productivity has increased, but unless there are obvious productivity gains to be had, companies run the risk of cutting muscle and bone instead of fat. This situation, when coupled with simultaneous capital expenditure reductions, could imperil a company's ability to find, develop, and replace reserves when global demand rebounds. Evidence suggests that most oil and gas companies manage their CAPEX in sync with prices rather than following a long term strategy (see Fig. 2).

The risks of cutting are well articulated in an International Energy Agency report delivered at a recent meeting of the G8 energy ministers2. The IEA contends that the 21% reduction in capital investment in upstream oil and gas poses a "real danger that sustained lower investment in supply in the coming months and years could lead to a shortage of capacity and another spike in energy prices in several years time, when the economy is on the road to recovery."

From October 2008 through April 2009, projects totaling over US $170 billion (two million barrels/day of oil capacity and 2.3 bcf/day of gas capacity) were delayed by 18 months or more. The largest cuts were made in exploration.

Organizations that have not reduced costs thoughtfully will lack the resources needed to increase supply and take advantage of the improving market, thus stunting growth and damaging shareholder value. As noted in the IEA report—the industry's trend of decreasing investment could have "far-reaching and...potentially grave effects on energy security, climate change and energy poverty."

Framing cost reduction

Deloitte Consulting recently hosted a webcast on enterprise cost management for oil and gas companies, in which over 700 people participated. Participants were queried on their approach to balancing immediate cost cuts with future strategic considerations. The results suggest that most companies are doing what they have always done in a downturn - focusing on tactical cost reductions.

Strategic cost reduction efforts involve doing "more with less," whether through improved technology, productivity, or efficiency. Examples include streamlining business processes by cutting cycle time, reducing waste, improving response rates, and centralizing common activities.

These measures are more challenging because they take planning and time to implement. They also involve changes in the mindset, culture and behavior of a company, and require commitment and leadership from the top. When done well, these efforts produce lasting results that permanently alter the company's cost structure while enhancing its responsiveness and agility in a highly cyclical, capital-intensive business.

Planning for the upturn

To increase their chances of weathering today's storm and to position themselves to take advantage of the upturn, companies should consider taking the following actions:

Ensure that cost reduction is executed as a program that is consistent with long-term strategy.

Oil and gas companies tend to cut costs across regions, business units, and product and service lines. These areas, however, are rarely assessed using consistent criteria. As a result, some are hit harder than others and disproportionate to their ability to contribute to growth and profitability.

To create the lowest possible, scalable cost structure, each area should be examined through three different lenses:

- Risk & Liquidity: Working capital improvement, tax and treasury optimization, and prudent risk management are all areas that can help companies generate and manage cash, while reducing reliance on capital markets during periods of decreased liquidity and higher cost borrowing.

- Operations: Reducing operational expenses yields significant and sustainable margin improvement and can be accomplished by focusing on productivity and efficiency, selective outsourcing, and reducing shared services costs. Strategies that shift fixed costs to variable ones can create a more flexible cost structure, which enables more strategic options.

- Growth & Sustainability: This area emphasizes CAPEX optimization, including segmenting and balancing discretionary versus non-discretionary capital expenditures, deferring spend, and negotiating improved contract terms. Companies can increase profitability by optimizing pricing, contracting strategies, and margins via effective processes, analytics and technology. Additionally, business process rationalization cannot only help companies streamline costs but also lays the foundation for facilitating potential mergers or divestitures.

Forward-looking companies go further by seizing the opportunity to make countercyclical moves, including increasing CAPEX as competitors cut back and negotiating more favorable contract terms. Other aggressive measures include standardization, reducing overdesign, and using advanced techniques like should-cost modeling and indexation to reduce costs and mitigate risks. Companies should also be prepared to become deeply involved with their suppliers, vendors, and contractors to help them manage costs.

Regardless of which cost reduction activities a company chooses to employ, all should be aligned with the company's strategy and coordinated via a structured program, with milestones, metrics, measurement, and accountability.

Examine efficiency and effectiveness across business processes spanning multiple geographies, products and services to drive sustainable savings.

Rationalizing computer applications is a commonplace, short-term cost reduction initiative companies employ; viewing it as an 'easy' fix. Yet, companies often find themselves spending enormous sums on unexpected ERP implementations a few years later because they suddenly need the capabilities that were eliminated during the cost-cutting process.

Time and again, we have seen instances where companies are compelled to undertake significant projects because of prior, short-term decision making. Without a clear path to long-term sustainability, this approach is risky, particularly for companies that are distressed.

In upstream, negotiating a lower day rate on a rig is helpful, but decreasing non-productive time, reducing the number of days a rig is utilized, and incorporating these metrics into the contract increases long-term productivity and makes the savings sustainable. Similarly, reducing maintenance expense through Reliability Centered Maintenance methods and/or equipment segmentation while simultaneously lowering Environmental Health & Safety incidents/exposure, improves a company's risk profile while making the savings sustainable.

In downstream, increasing the catalyst and energy efficiency in a refinery while negotiating lower unit rates on catalyst, natural gas, and energy usage results in sustainable savings.

Include scenario planning aligned with company's core competencies.

Leading companies undertake detailed and thoughtful scenario planning that considers the impact of price volatility on individual business lines and the company's overall operations. The objective is to determine what actions can be taken to capitalize on or mitigate these swings.

A key element of sound scenario planning involves tracking leading indicators such as forecasted commodity prices, implied volatility from option prices, and embedded inflation expectation in long-term interest rates. In so doing, a company identifies market trends and acts quickly to position itself for growth or to weather a drop in commodity prices.

Scenario planning is most effective when multiple scenarios are tested to establish a core set of actions that work irrespective of the scenario. This set includes activities aimed at deploying capital against the highest value opportunities while creating the lowest possible, scalable, and flexible cost structure.

For example, regardless of market conditions and in pursuit of reserve replacement, successful companies continually reduce finding and development costs, increase the exploration success ratio, and minimize the time from "prospect" to "production" — and employ a disciplined, countercyclical asset acquisition strategy.

Establish a cost reduction playbook to ensure effective execution.

A playbook is derived from scenario planning and should incorporate the applications outlined here. It requires specificity, taking into account which levers to pull, when to pull them, and under what conditions.

The ongoing health of a company often determines which cost reduction levers will have the most impact. If a company is in crisis, then the levers of SG&A, cash flow, and financial restructuring make the most sense. However, if the company is merely weathering the storm, then the levers will differ significantly and focus on aligning costs with strategy through revenue enhancement, process improvements and targeted SG&A reductions.

Structure the management and accountability from the top.

C-suite executives must be fully committed to cost reduction efforts if they are to be effective, sustainable, and aligned with the company's long-term strategy. C-suite commitment is also essential for securing employee buy-in throughout the organization. At a minimum, the CEO and the CFO must be absolutely committed to looking at risk, operational costs, and growth and sustainability across all areas of the company, including all regions, product lines, and service lines. This helps to ensure that cost reduction and productivity enhancement measures are allocated equitably.

Commodity prices are erratic; cost reduction programs shouldn't be

Many companies today are forging ahead with short-term cost-cutting activities without adequately considering the dangers of two worst-case scenarios. In the first, the economy recovers and prices rebound to the record highs of 2008 which could pose a significant risk to those that have cut costs and CAPEX with undue zeal. These companies will not reap the benefits of an upturn and their market capitalizations will decline relative to their peers.

In the second scenario, the economy declines further and prices fall under $40/bbl. Those that have not made their cost structures more flexible and have not aligned them with their long-term strategies will face selling assets or divesting business units at depressed prices.

A variety of scenarios could occur between these two ends of the spectrum. To be prepared, companies must take a balanced approach to cost reduction and ensure that cost programs align with future strategy. Following the whims of the market is an old habit that is incongruent with shareholder value creation and limits the industry's ability to meet the world's growing demand for secure, affordable and environmentally responsible energy.

About the author

1Energy Headcount Slumps Despite Record Oil Prices and Bright Fundamental Outlook, John S. Herold, Inc., April 15, 2005.

2The Impact of the Financial and Economic Crisis on Global Energy Investment, International Energy Agency, May 2009.

More Oil & Gas Finacial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles