UPSTREAM NEWS

CLR OK UPDATE

Global Hunter Securities spoke with Continental Resources management recently and, in a client note, provided an update on certain Mid-Continent projects. "CLR's 10-well Honeycutt density pilot - testing staggered laterals in the Upper/Lower Woodford akin to the successful Poteet experiment - was recently placed on production and we expect results to be forthcoming by earnings in August; success should lend further credence to management's claim that ~145K of its 480K net acres in the Scoop are amenable to dual-zone development, given adequate thickness. In addition CLR could present results from its first Meramec well (the Ludwid 1-22-15XH, 9.9K ft. lateral, $10.6MM D&C) in tandem with the Q2 update or shortly thereafter. Management is encouraged with nearby industry results and with four rigs drilling deeper Woodford wells CLR has gathered pertinent data from the shallower Meramec/Osage horizons," the analysts noted.

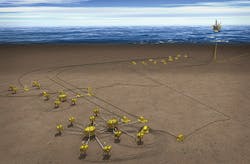

OPERATORS BACK NEXT PHASE OF INDUSTRY FORUM ON SUBSEA INTEGRITY

An industry forum that addresses challenges in subsea integrity management is being extended for a further three years with backing from global oil and gas operators.

Phase II of the The SURF IM Network is led by Wood Group Kenny with support from the Industry Technology Facilitator (ITF). Phase 1 was launched last year, supported by an industry wide group of 14 operators and has been extended to run on an annual subscription basis through to 2018 with an expected project value of around £300,000.

The SURF IM Network facilitates face-to-face and virtual forums for knowledge sharing and delivering solutions to subsea integrity and reliability challenges, focusing particularly on subsea hardware.

Kieran Kavanagh, Technology Development Director at Wood Group Kenny said: "The Network represents a significant collaboration among its participants to provide solutions that will help to reduce risk, improve reliability and minimize life-of-field costs in the subsea industry and we're very happy to be working with participant operators to enable this."

Dr Patrick O'Brien, CEO of ITF added: "Taking a standardized approach to complex subsea integrity issues that are common across the industry can help to drive efficiencies whilst creating a safer operating environment, so the Network is a win-win for all involved. It is a great example in the current climate of operators collaborating to support the development of effective and cost efficient means to inspect subsea facilities that are being installed in continually increasing water depths and longer step-out distances."

In Phase I, progress was made in understanding the issue of control system module reliability and the outcomes of a comprehensive participant survey was presented to subsea suppliers to highlight integrity challenges and find ways to enhance reliability for the future.

The SURF IM Network follows on from a Wood Group Kenny Joint Industry Project (JIP) facilitated by ITF, on integrity management of subsea, umbilical, riser and flowline systems that identified key failure mechanisms, investigated inspection and monitoring technologies and gaps, and developed best practice guidelines for the integrity management of subsea facilities.

IHS: OIL SANDS WILL CONTINUE AS OIL SUPPLY SOURCE DESPITE CHALLENGES

Despite lower oil prices and other challenges, growth in Canadian oil sands will continue and remain one of the top sources of global supply growth in coming years, according to a new report by IHS Inc.

Oil sands growth, which previously rose 1.2 million barrels per day (MMb/d) from 2005 to 2014, is expected to add an additional 800,000 barrels per day (b/d) of new production by 2020. This would keep Canada the third largest source of supply growth in the world through that period (a rank it has held since 2005).

"A review of oil sands development over the years shows a history of growth, even when headwinds to production emerged," said Kevin Birn, director for IHS Energy. "Oil sands growth has propelled Canadian production higher, and Canada now produces more oil -conventional, unconventional, and oil sands combined - than every member of OPEC except Saudi Arabia."

Among the attributes supporting continued oil sands growth are the enormous scale of the resource - oil sands are the third largest source of proven reserves in the world and the only reserves of this scale outside OPEC - and its location in a stable jurisdiction. Openness to private capital and proximity to the US are also factors.

The IHS report says that growth of oil sands supply will continue through the medium term despite headwinds that include lower oil prices, cost escalation, environmental scrutiny, and uncertain timing of new pipeline capacity to access new markets. Slower growth from the lower price environment is emerging from a slower pace of construction, declines from more conventional oil sands production, and delays in unsanctioned projects. Yet, the report concludes that growth is expected as a result of both existing projects and those under construction where capital has already been spent.

"Certainly, growth would have been greater had prices remained high, but there is sufficient inertia in the system from projects already under way to carry growth to nearly 2020," Birn said.

Environmental concerns include regional impacts and greenhouse gas (GHG) emissions. Though oil sands account for about 0.14% of worldwide emissions, their share of domestic emissions in Canada has grown with production. While GHG intensity of oil sands production ranges 1-19% higher than the average barrel of crude consumed in the US, other crude oils can have a similar level of GHG intensity. The report notes that some of the more recent oil sands projects have trended closer to the US average as a result of innovation and learnings over time.

Uncertainty of new pipeline capacity (Keystone XL being the most notable example) has, in the past, contributed to price discounts as high as $30 per barrel, the report says. The increase of rail transport for oil sands (from no notable movements in 2010 to nearly 190,000 b/d toward the end of 2014) has eased transportation bottlenecks and alleviated the price discounts. However, the report notes that moving crude by pipeline - which is generally less expensive and more predictable - remains the preferred option by producers and refiners alike.

Previous IHS research found that construction and operation of the Keystone XL pipeline would not have a material impact on GHG emissions. The study concluded that complex refineries on the US Gulf Coast that are designed to process heavy crudes will continue to demand types of crude that have a similar GHG intensity to oil sands, meaning that the US will continue to import crude oil of similar quality from offshore sources, such as Venezuela, if additional supply of oil sands were not available.

The report concludes that, while the long-term path of oil sands growth will be linked to the pace and scale of the global oil price recovery, the fundamentals that have supported oil sands growth in the past remain in place.

"While trajectory of longer-term oil sands growth beyond 2020 is not assured (for instance, the impact of some new government policies remains uncertain), the pillars of past growth - innovation, collaboration, and stable investment climate in Canada (not to mention US heavy crude demand) - certainly remain," Birn said.

REPSOL STARTS UP GIANT PERLA GAS FIELD IN VENEZUELA

Repsol has started up the first producing well at the Perla field, the largest offshore gas field in Latin America, holding 17 trillion cubic feet (tcf) of gas in place. Perla is located in the Cardón IV block, in shallow waters in the Gulf of Venezuela. The company expects to start producing 150 MMcf/d, rising to 450 MMcf/d by the end of 2015.In two phases to follow, output is expected to rise to 1.2 bcf/day in 2020, a volume that would be maintained until the end of the contract in 2036. The Cardón IV license is held by the Cardón IV SA joint venture between Repsol (50%) and Eni (50%).

EIA APRIL 2015 PRODUCTION

US crude production rose 9,000 b/d to 9.701 MMb/d in April 2015, according to monthly data released by the EIA in June. The production number is a slowdown from the six month average month over month growth of 122 Mb/d.

EY: CAPEX TRIPLED OVER PAST DECADE

Total capital expenditures for the largest 50 US E&P companies (based on 2014 end-of-year oil and gas reserve estimates) more than tripled for the 10-year period between 2005 and 2014, with an average increase in spending of 25% per year, according to an EY US oil and gas reserves study released in June. More important, EY noted, is the growth in the spending "gap" -the difference between total spending and nominal upstream cash flows. During the same 10-year period, "growth in nominal cash flows has been less than half that of total spending," the report noted. Further, "over the most-recent five-year period, the "gap" or cash flow overspend has averaged about 80% of nominal cash flows."