Diversity lags in oil industry

HAVING DIVERSITY ON CORPORATE BOARDS HELPS PREVENT 'GROUP THINK.'

TOM FURLONG, HARVARD GROUP INTERNATIONAL, ATLANTA, GA.

WHILE US PUBLIC COMPANIES in other industrial sectors have been diversifying their corporate boards over the past 15 years, the energy sector has lagged behind in opening its boards to new ideas and backgrounds. By looking at recently announced board additions from leading oil and gas corporations, it appears that these companies are looking to the same types of individuals to help advise and guide their senior management teams that they have turned to in the past.

A common theme among energy industry executives and board members is that the corporate governance status quo is working fine. However, shareholders seem to have a differing viewpoint, especially after the sector lost hundreds of billions of dollars in shareholder value since July 2014. Questions regarding "group think" among these boards are giving investors pause and fueling investor discontent which may force changes to how the corporate governance teams are composed.

The danger with board homophyly is that the vast resource of outside backgrounds and experiences are not available to a corporate governance team. Having diversity on a board helps to prevent "group think" by introducing differing backgrounds that can approach a common strategy/situation in different ways. Such an approach offers the opportunity for someone in an oversight role to ask a question that might otherwise not be considered - questions that, if they had been asked, might have prevented many energy companies from being caught flat-footed when the commodity price of hydrocarbons started to fall during the past year.

Corporate board diversity goes far beyond gender metrics. Other avenues to consider include the experience, background, age, and length of service of members on a company's board. The size of a corporate board also is a key determinant in the quality of guidance it can offer to its management team.

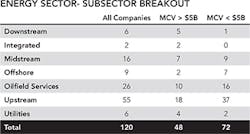

Our firm reviewed the corporate boards of the top 100 Texas and the top 20 Colorado energy companies (rankings based on market cap value) at the end of 3Q2014. The aggregate compilation from these 120 public companies shows the lack of diversity when compared to US public companies in the Russell 3000 group of companies (to which almost all of these 120 companies belong), an important factor to realize when the these 120 energy companies combine for over US$1 trillion in both market cap value and combined sales.

Here are the major diversity criteria that nominating committees need to review when looking at their boards and considering new candidates to join their teams:

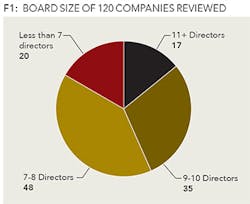

BOARD SIZE

There are 986 directors sitting on the boards of these 120 companies, an average of 8.22 members per board. The average board size for the Russell 3000 is 10.42 directors per company. Of these energy companies, 68 have 8 or fewer directors while only 17 exceed the national average with 11 or more directors. Adding at least one additional member to 103 companies below the national average can immediately bring increased diversity of experience, thoughts, and guidance to these boards. One key recommendation of the Sarbanes-Oxley legislation was for corporate boards to increase their size which would result in more well-rounded advice to their management teams; our research shows that the energy sector is the main industrial sector resistant to this change.

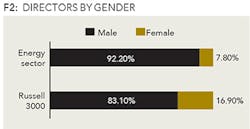

GENDER

There are several studies (most recently by Credit Suisse in September 2014) that demonstrate that companies with at least one woman on their board outperform companies with all-male boards in a number of metrics including stock price appreciation, return on equity, and higher dividend payouts. Women hold nearly 17% of board seats within the Russell 3000 companies; within the 120 energy companies surveyed, women hold only 7.8% (77) of the available board seats. Female executives from both within and outside the energy sector offer a tremendous upside to corporate boards that are looking to improve the value of their guidance to their management teams.

WORK EXPERIENCE

More than 80% of the board members (800) of these 120 energy companies come from either the energy or financial services/capital markets sector. Further analysis shows that, as a company becomes smaller, the percentage of energy/financial executives on a board dramatically increases. Industry expertise and financial acumen are important to the quality of advice and guidance given by a board, but the failure to have lessons learned from other industrial sectors might diminish the overall consultative value that the corporate board offers its management team.

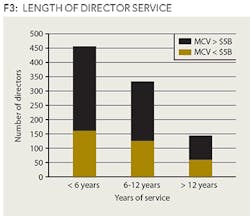

LENGTH OF SERVICE

Board refreshment is critical to maintaining both the objectivity and the high value of both the advice and guidance a board can offer their management teams. Long-tenured directors may lose their outside objectivity and come to view themselves as an advocate for management and not the shareholders. International Shareholder Services is considering lowering their proxy recommendation scores when multiple directors have been on a company's board for 12 years or longer. Currently just over 16% (124) of energy sector board members have this tenure length-a ratio similar to other industrial sectors. At issue are the 49 energy companies that have multiple long-tenured directors (and the 26 with 3+ long tenured directors). These boards can remedy their tenure imbalance by introducing a board refreshment/retirement strategy that attracts new directors who can to bring fresh concepts and enthusiasm to their unit.

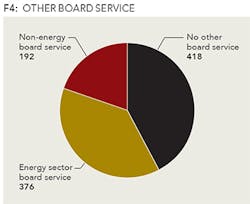

OUTSIDE BOARD SERVICE

Over 57% (568) of the energy sector board members sit on the board of at least one other publicly traded company; of this group, two thirds of the directors (376) sit on the board of another energy sector company. This high number of energy sector directors adds to the probability of industrial "group think" that could pervade the top companies in the industry and limit the knowledge gained from experiences in other sectors. A combination of attracting sitting board members from outside the energy sector with first time board members would help to bring this benchmark into more balance.

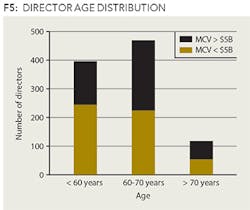

DIRECTOR AGE

One area in which the energy sector boards closely resemble those in other sectors is with the age distribution of their directors. This distribution is nearly bell shaped with almost half (468) of the energy sector directors between the ages of 60 and 70; a small minority (124) of energy sector directors are over the age of 70. The percentage of directors under 60 (40%) is slightly higher than in other US companies showing that the Great Crew Change is already occurring in boardrooms across the industry. The age distribution is worth noting when considering that future retirements of board members offers additional opportunities for boards to look for candidates from outside the "traditional" energy company director profile.

BOARD MEMBER RECOMMENDATIONS

Though the level of diversity within the corporate boards of energy companies pales in comparison to other sectors, there are a few simple and common-sense steps these boards can take to improve the quality of oversight and guidance to management teams and returns to shareholders:

- Add at least one additional director.

- Recruit qualified executives from outside the energy and financial services sector who can bring fresh perspectives and ask unconsidered questions.

- Develop more aggressive board refreshment strategies to prevent director complacency.

Utilizing these action items offers a holistic method of increasing the diversity on the energy sector corporate boards. Looking at a larger pool of talent for more openings provides these boards with an opportunity to attract female and first time board members along with veteran directors from other industries, all of which can help existing boards to best advise management teams during the current crisis and future recovery cycle within the energy sector.

ABOUT THE AUTHOR

Tom Furlong is the managing director of the energy practice and a member of the corporate governance practice at Harvard Group International, an executive search firm based in Atlanta, Georgia. He has led a number of studies examining corporate governance diversity in different industrial sectors and geographic areas.