UPSTREAM NEWS

CNOOC starts production in South China Sea

CNOOC Ltd. has started production from the Huizhou 25-8 Oilfield/Xijiang 24-3 Oilfield Xijiang 24-1 District Joint Development Project. The project is in the Pearl River Mouth Basin of the South China Sea with an average water depth of 328 ft. The main production facilities include two drilling and production platforms and 29 producing wells. Four wells are producing 6,300 b/d. The project is expected to reach peak production of 33,000 b/d in 2016. Operator CNOOC holds a 100% equity interest in the project.

MRO makes IRAQ discovery

Marathon Oil KDV BV discovered multiple stacked oil and natural gas producing zones on the Harir Block in the Kurdistan Region of Iraq. Forty miles northeast of Erbil, the Jisik-1well was drilled to 15,000 ft. A drill-stem testing program yielded a sustained flow rate of 6,100 b/d of oil, and multiple non-associated gas zones flowed at a combined rate of approximately 10-15 MMcfd, without stimulation, together with associated condensate. The well will be suspended for potential future use as a producing well. Marathon is the operator of the block with a 45% working interest. Total holds a 35%WI.The Kurdistan regional government holds a 20% carried interest.

3Q results for North America- focused crude oil producers

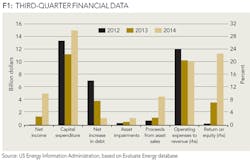

According to a review by the US Energy Information Administration of financial statements released in recent weeks and despite lower crude oil prices, companies drilling in North American tight oil formations recorded improved financial results in third-quarter 2014 as compared with third-quarter 2013 (Figure 1). The recent financial statements for a group of 30 publicly traded companies suggest that improved operational efficiency, asset sales, and increases in the value of the companies' hedging instruments contributed to better financial results despite front month West Texas Intermediate (WTI) crude oil prices averaging $97.24 per barrel (bbl) in the third quarter of 2014, $8.56/bbl lower than third-quarter 2013.

Net income for the 30 companies more than doubled, increasing by $3.6 billion to $5.0 billion. Liquids production, which totaled 1.8 million barrels per day (bbl/d), was 338,000 bbl/d higher in 3Q14 than in 3Q13. In addition, and consistent with prior-period trends, these companies were able to increase their profitability by controlling costs even while increasing production, as reflected in the lower ratio of operating expenses to revenue. The combination of these factors contributed to the highest return on investors' equity for any quarter in three years.

There were some areas where company performance lagged previous results. Third-quarter 2014 asset impairments totaled almost $1.1 billion-higher than in the 3Q13 and the highest level in 2014 as of this writing. Not only were absolute WTI prices lower than 3Q13, but the prices of other US crude oils such as WTI Midland and Bakken were more discounted to WTI than in the previous year.

This group of companies, while profitable, still spent more on capital expenditures than they generated from operations. In previous quarters, they met most of the cash shortfall through capital markets, raising debt or equity, to pay for investment. In the third quarter, the shortfall was met through sales of property or other lines of business, with sales totaling $4.5 billion, the highest level for any quarter in the past five years. Some sales were of non-core assets; e.g., natural gas utility business, suggesting that through the sales companies are increasing focus on upstream exploration and production. Cash from these sales helped pay for investment, which contributed to a substantially lower net increase in debt as compared with the previous two years.

Some producers may have protected themselves from declining crude prices by hedging. For this group of companies, the value of hedging contracts increased in the third quarter, resulting in an unrealized gain of nearly $4.1 billion (Figure 2) on previously purchased hedging contracts and the value of hedges purchased in the quarter. Hedging asset value had declined in late 2013 because oil price volatility was low and prices rose amid global supply outages. In 3Q14, however, crude prices declined because of growing supply and uncertainty about future demand, and, as a result, hedging asset value increased as compared with prior quarters.

The largest gain in the value of hedging contracts occurred in hedges on production within the next year. Details on specific hedging techniques used by these companies are difficult to obtain; however, a potential reason for the large gain in value for hedges on production in the next year may be that near-term crude oil futures contracts respond more to new information, whereas longer-dated futures contracts exhibit less price volatility. From June 30 to September 30, the December 2015 WTI futures contract price decreased by $7.56/bbl, less than the decline in futures contracts for WTI crude oil delivery in December 2014 and June 2015.

Upstream developments in northwest Europe face delays

With oil prices falling to a four-year low, the development of two frontier basins in northwest Europe, the Barents Sea and the West of Shetland (WoS), is likely to be postponed and further progress will require cost reductions, according to a GlobalData analyst.

Chevron, operator of the WoS Rosebank, and Statoil, operator of the Barents Sea Johan Castberg fields, continue to delay final investment decisions on the projects, which have 240 and 545 million barrels of oil equivalent of recoverable reserves, respectively. The sanction of the projects is crucial to permitting the construction of needed infrastructure that will provide an export route for the regions hydrocarbons, noted Matthew Ingham, GlobalData's upstream analyst covering Europe.

"The implications of plummeting oil prices will be felt most heavily by the UK and Norway's governments, highlighting the ripple effect of petroleum production on state tax revenues," Ingham said.

"Although Rosebank is currently the only UK field to qualify for the large deepwater oil field allowance, further fiscal allowances may be required for the project to go ahead. As such, it would not be surprising to see further delays in the FID for Rosebank and Johan Castberg to 2016," he continued.

Despite this, the analyst notes that oil price volatility is expected to stabilize in the medium-to-long term and the development of the two projects is anticipated to begin, providing there are cost reductions and near field discoveries made in both projects.

"The latest estimates put total development capital expenditure for Rosebank at $9.68 billion, but cost reductions of around 30% are required for the project to become economically viable. Assuming these reductions can be achieved and the project sanctioned, production seems likely to come on-stream in 2021, three years later than previously anticipated," Ingham said.

"For the Barents Sea project to progress, oil prices must return to levels of around $110 per barrel, if no tax allowances are forthcoming from the Norwegian government, to achieve a full-cycle net present value of $318 million and an internal rate of return of 11.1%. Assuming that Johan Castberg is sanctioned in 2015, Statoil will aim to commence production in 2020, two years behind schedule," he concluded.

Chevron begins first oil from Jack/St. Malo in the Gulf of Mexico

Chevron Corp. has begun crude oil and natural gas production at the Jack/St. Malo project in the Lower Tertiary trend, deepwater US Gulf of Mexico. The Jack/St Malo semi-submersible floating production unit is the largest of its kind in the Gulf of Mexico and has a production capacity of 170,000 barrels of oil and 42 million cubic feet of natural gas per day, with the potential for future expansion. Production from the first development stage is expected to ramp up over the next several years to a total daily rate of 94,000 barrels of crude oil and 21 million cubic feet of natural gas. With a planned production life of more than 30 years, current technologies are anticipated to recover in excess of 500 million oil-equivalent barrels.

Crude oil from the facility will be transported approximately 140 miles to the Green Canyon 19 Platform via the Jack/St. Malo Oil Export Pipeline, and then onto refineries along the Gulf Coast. Chevron, through its subsidiary, Chevron USA Inc., has a working interest of 50% in the Jack field, with co-owners Statoil (25%) and Maersk Oil (25%). Chevron, through its subsidiaries, Chevron USA Inc. and Union Oil Company of California, also holds a 51% working interest in the St. Malo field, with co-owners Petrobras (25%), Statoil (21.5%), ExxonMobil (1.25%) and Eni (1.25%); and a 40.6% ownership interest in the host facility, with co-owners Statoil (27.9%), Petrobras (15%), Maersk Oil (5%), ExxonMobil (10.75%) and Eni (0.75%).

Statoil recommended as Johan Sverdrup operator

Johan Sverdrup partners have agreed to recommend Statoil as operator for all phases of the field.

Their agreement will be included in the unit operating agreement (UOA), which is planned to be submitted to the authorities in February 2015 together with the plan for development and operation (PDO). The goal for the project is to achieve a recovery factor of at least 70%. The Johan Sverdrup field lies across several licenses, which are operated by Statoil and Lundin Petroleum. Other shareholders include AP Moller-Maersk, Det Norske, and state holding firm Petoro.