Deal activity slows to a crawl, with recovery expected in 2nd half

Brian Lidsky, PLS Inc., Houston

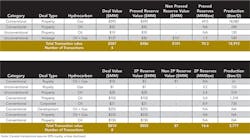

PLS reports M&A activity has predictably slowed to a crawl following the oil price downturn that began last summer and accelerated towards year's end, cutting oil prices by more than half. Spot WTI reached a high of $107.95 on June 20, 2014 before tumbling to a low of $44.08 on January 28, 2015. The full impact of this down cycle is reflected in this month's tally of deals. From January 17 to February 16, 2015, there were just 15 deals (with values disclosed) struck for a total of $1.4 billion. This is down substantially from 43 deals and $13.4 billion in deal value for the similar period a year ago. In fact, the first quarter of 2015 has the potential to be the slowest upstream deal market since at least 2007, eclipsing the low-water mark of $19 billion (121 deals) in upstream transactions in Q3 2009 - a period following the market meltdown in late 2008.

The downturn has stretched across the globe.This month's deal values regionally tally $592 million in the US (6 deals), $147 million in Canada (4 deals) and $681 million internationally (5 deals). The reasons are self-evident as the industry recalibrates its cash flows. Already, according to research by Tudor, Pickering, Holt & Company, North American independents have slashed 2015 capital budgets by nearly 40%. The impact of this spending slowdown is expected to decrease production from this group of companies from 9.9 MMboe/d in Q4 2014 to 9.7 MMboe/d average in 2015.

As in past cycles, the initial reaction by companies to sharp down cycles in commodity prices is to reign in discretionary capital spending. This impacts exploration, lease acquisitions, major project commitments and acquisitions. Management is laser-focused on their highest return projects to maintain cash flows as well as strengthen the balance sheet. In these early months of the down cycle, simply put sellers and buyers are too far apart on future price expectations to strike M&A deals. Once the dust clears and there is more certainty about global oil supply and demand, these expectations will recalibrate and the M&A markets will begin functioning at a normal pace.

In contrast to 2008/2009, this particular down cycle is limited to the industry itself while the financial sectors remain in relatively healthy shape. There is ample capital available for deals, particularly in the private equity sector where TPH estimates a record of nearly $100 billion of dry powder (assuming 50/50 debt/equity) is ready to be put to work. Traditionally, private equity has been deployed in the deal markets to back new management teams launching an acquisition-oriented growth strategy. In this current stalled market, private equity outfits are finding new ways to deploy capital. An example is the announcement on January 2nd by Linn Energy that the company had received a five-year, $500 million commitment from GSO Capital Partners to help fund Linn's drilling program.

There is little doubt that once the dust settles, the M&A markets will gain momentum as companies re-size their portfolios to meet the shifted paradigm of cash flows. In part, the jump start to a higher sustained deal flow will be driven by creditors as they go through their spring borrowing base redetermination processes. Also, once the markets gain confidence that, at a minimum, a bottom has been achieved on oil prices, then buyers and sellers will at least have a floor to begin narrowing the spread on price expectations for asset valuations.

Looking at this month's activity, it is noteworthy that there have not been any substantial corporate transactions - indicative of the fact that creditors are still providing some rope to management to work through this cycle. The largest US deal this month is Energen's $395 million sale of its natural gas assets in the San Juan Basin of New Mexico and Colorado to a private buyer. According to Energen, the assets cover 205,000 net acres with 414 bcfe proved (84% gas) and another 1.8 tcfe of probable, possible and contingent resources. Production averaged 108 MMcfe/d in 2014. Energen retained a large Mancos oil play (91,000 net acres) in the same basin for future growth.

In Canada, Torc Oil & Gas struck the month's largest deal for $102 million by purchasing light oil assets producing 1,550 boe/d (94% oil) with 4.4 MMboe of proved reserves located in southeastern Saskatchewan. Torc is paying for the assets entirely with equity, which will allow the seller to retain upside as the markets recover.

Internationally, the largest deals were in Nigeria where Chevron sold 40% WI in producing OML 55 for $235 million and a 40% interest in OML 53, which is under development, for $255 million. The buyer is Seplat Petroleum, a local Nigerian oil and gas company.