Shell & BG shock market with $82 billion deal after a deal market near-shutdown in Q1

David Michael Cohen and Brian Lidsky, PLS Inc., Houston

Coming off a near-shutdown in global upstream deal activity during Q1 2015, Shell shocked the market on April 8 with the announcement of an $81.8 billion agreement (including assumed debt) to acquire LNG powerhouse BG Group. The deal comes in as the second-largest in industry history, just barely below Exxon's $82.3 billion acquisition of Mobil in late 1998. The announcement has sparked a lot of talk of improving deal markets and perhaps even a new wave of industry consolidation similar to that which created the current constellation of supermajors in 1998-2000, but for now buyers and sellers overall still seem far apart on valuations, particularly in the US shale plays.

For a recap of Q1 M&A markets, PLS reports that US upstream transactions barely cleared the $1 billion threshold in Q1 after $28 billion in Q4 2014 and a record high of $98.4 billion in 2014. The slowdown of Q1 is eclipsed only by the record low quarter in Q1 2009 where just $0.5 billion of deals were announced. This low level of activity compares to an average quarterly volume in the US of $17 billion since 2007. Globally, only $4 billion in deals were announced during Q1 vs. a quarterly average of $43 billion since 2007. Not unexpectedly, US deal activity took a shift toward lower-risk conventional assets, which made up two-thirds of total deal value after seven years of unconventional deals making up about half or more of deal value. At sub-$50 oil, most of shale plays become uneconomic to drill.

While no two down cycles in this industry are driven by the same fundamentals, PLS recognizes that the history of cycles is simply part of our business. Looking back at the 2008/2009 downturn, not only did commodity prices slide but so did the backbone of the financial industry-hitting the deal markets with a double whammy. In this cycle, the financial sector is in high performance as shown by the plethora of dry powder in the private equity sector and the rapid sale of secondary equity offerings. If we view 2008/2009 as a proxy for this cycle, at the latest we can expect M&A activity to rebound in Q4. We note that following the bust of Q1 2009, the US M&A markets came back with a vengeance, scoring $53 billion of deals in Q4 2009.

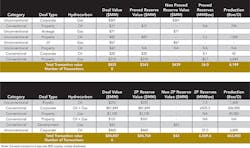

After the close of Q1 2015, the blockbuster $82 billion Shell/BG deal highlights the speed at which things can change. This deal had little to do with US shales and everything to do with Shell's core LNG and deepwater businesses. Shell was already the world's largest supplier of LNG, ending 2014 with equity liquefaction capacity of 26 mtpa vs. runner-up ExxonMobil's 22 mtpa. Adding BG's global LNG portfolio will secure this leadership role by boosting Shell's pro forma liquefaction capacity to 33 mtpa immediately with another 20 mtpa expected online by 2018. BG is positioned as a first mover in US LNG exports, having signed the first offtake agreement for Cheniere Energy Partners' Sabine Pass liquefaction plant in Louisiana. The deal also gives Shell entry into the emerging East African LNG province, where BG and partner Statoil have a 10 mtpa liquefaction project in pre-FEED planning to monetize neighboring gas discoveries offshore Tanzania. In addition, it further enhances Shell's already huge presence in Australia and Canada while boosting its liquefaction capacity in Trinidad.

In terms of deepwater, the most important component of the deal is expansion in the prolific pre-salt oil province offshore Brazil, to which CEO Ben van Beurden said Shell is "insufficiently exposed" on a conference call. BG's pre-salt assets had net production of 78,000 boe/d during 2014 and reached 130,000 boe/d in January, allowing Brazil to overtake Kazakhstan and the UK to become the company's top producing country. BG's portfolio will add net resource potential of 3.5 Bboe to Shell's pre-salt position. By the end of the decade, the supermajor sees potential for combined Brazilian production exceeding 500,000 boe/d.

The most important Brazilian asset being acquired is BG's 25% WI in the producing Lula/Iracema development in the pre-salt Santos Basin. Discovered in 2006, Lula is one of the three biggest oil and gas finds of the past decade with ~9 Bboe recoverable. Combining Lula with its existing 20% WI in the giant 2010 Libra discovery, Shell will now have exposure to the two largest pre-salt projects.

Despite the excitement generated by this mega-deal, it is likely a unique merger that fits hand in glove rather than the start of a larger trend. Despite a plethora of would-be buyers in the market, most of them are still looking in the shale plays, where it will take some time for oil prices to firmly establish a floor and the bid/ask spreads to narrow. The deals that do occur in the next several months will likely be driven by the private equity firms, which saw their buying peak after the 2008/2009 crash and have built up war chests totaling nearly $100 billion to pursue opportunities in the current environment.