US sets 2014 M&A record, driving global values to $185 billion

David Michael Cohen, PLS Inc., Houston

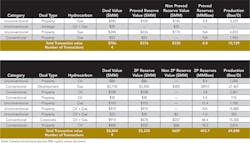

PLS reports that global upstream M&A markets saw an impressive 30% rise in deal value to $185.0 billion in 2014, mostly thanks to skyrocketing acquisition activity in the US. Deal value in the US reached a record $98.4 billion in 2014, up 79% YOY driven by new buyers entering de-risked shale plays combined with industry consolidation. In terms of deal count, Q1-Q3 activity was on par with the 2007-2013 average of ~150 US transactions per quarter (including deals without disclosed values) but then fell by a precipitous 47% to 89 deals in Q4 as plunging oil prices began to take their toll on the market. This pulled the 2014 deal total down 17% vs. 2013 to 542, the lowest level since 2009.

Of course, Q4 also saw the biggest US deal in two years (in fact, the biggest deal globally) with Spanish energy company Repsol's $13.0 billion acquisition of Talisman Energy. Though based in Calgary, Talisman draws more than 40% of its 1.63 bcfed output from its Eagle Ford and Marcellus shale positions in the US, followed by Indonesia and then Canada. The acquisition provides Repsol its initial entry to these prolific US shale plays. Repsol/Talisman is just the largest of many 2014 US shale play debuts. Often these arrivals occurred via corporate acquisitions of pure-play drillers, as in Encana's $7.0 billion purchase of Permian driller Athlon Energy and Baytex Energy's $2.6 billion takeout of Australian Eagle Ford player Aurora Oil & Gas. In other cases, the deals were at an asset level, with the seller exiting, as in Freeport-McMoRan's $3.1 billion Eagle Ford divestment to Encana and Chesapeake's $5.4 billion West Virginia Marcellus sale to Southwestern Energy.

Among the top 10 US upstream deals in 2014, six provided the buyer with its first foothold in a shale play. Another three of the top 10 deals were corporate acquisitions in which a company acquired a competitor with a similar operational profile.

The biggest of these was Whiting Petroleum's $6.0 billion purchase of Bakken peer Kodiak Oil & Gas, which launched the combined company's output ahead of the shale play's long-time top producer Continental Resources. Similarly, following Energy XXI's $2.3 billion acquisition of fellow shallow-water Gulf of Mexico driller EPL Oil & Gas, the combined company now operates 10 of the largest oil fields on the shelf. Finally, the upstream MLP space got a little less crowded as Breitburn Energy Partners bought QR Energy LP for $3.0 billion, combining portfolios of long-life conventional properties in oil-rich basins across the US.

Canada also performed well in 2014 with deal value rising 132% to $26.6 billion, although the number of deals declined 15% to 268. Dividend-plus-growth companies emerged as the leading buyers, snapping up high-cash-flow properties with mostly conventional oil production. Leading the charge was Canadian Natural Resources Ltd. in February with its $3.1 billion acquisition of Devon Energy's Canadian conventional portfolio. Also, 2014 saw the return of foreign investment: $23.4 billion in Canadian acquisitions by foreign companies vs. just $4.0 billion in 2013. Finally, the need for yield drove investor appetite for a new asset class. Encana very successfully spun off its royalty business via an IPO of PrairieSky, which subsequently bought Range Royalty Ltd. Other Canadian companies eyeing PrairieSky-style monetizations of royalties include CNRL and oil sands-focused company Cenovus Energy, which traces its roots back to the same lands as Encana.

Internationally, 2014 deal value was down 21% to $60.0 billion and deal count was down 30% to 399. Decreasing international M&A activity last year points back to the US and particularly the success of the shale plays. US drillers continue to focus resources on their domestic programs while eschewing overseas projects. Among the top 30 deals outside North America during 2014, not a single buyer was a US-based producer but seven of the sellers were. These sellers include Apache in Australia and Argentina and Marathon Oil in the North Sea as well as Anadarko Petroleum, Hess, and Murphy Oil divesting Asian assets.

Major increases in deal value were seen in Asia (69% to $8.0 billion), the Australia region (442% to $11.3 billion), and the North Sea/Europe (118% to $12.7 billion). However, these increases were overwhelmed a combined $35.0 billion decrease in activity in Africa (54% to $9.6 billion) and the FSU (72% to $9.0 billion).

Looking ahead, PLS notes that the first three weeks of 2015 have seen the oil and gas M&A markets crash to a halt with only nine deals globally with disclosed values totaling $260 million. Five are in the US totaling $141 million. The crash in no way reflects a lack of interest by buyers, as evidenced in PLS's own transaction business. Rather, with oil searching for a bottom (sitting now at $47 WTI), the markets will take some time for sellers to adjust to this new pricing and for bid/ask spreads to narrow. Having experienced multiple rapid price cycles, PLS certainly expects deal flow to increase during the year. In contrast to 2008/2009 when credit markets collapsed in tandem with commodities, today the credit markets are functioning strongly.