Hedging strategies surveyed

Aegis Energy Risk and OGFJ poll our readers about hedging decisions

OGFJ recently teamed up with Aegis Energy Risk, a Houston-based hedge advisory firm serving the oil and gas industry, to conduct a detailed survey on hedging strategies. The anonymous online survey was open to participants via www.ogfj.com during late February and early March. The survey results provide a glimpse into the strategies that responding producers currently employ.

Here are the questions and results:

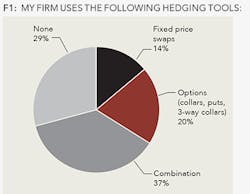

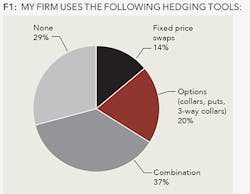

QUESTION 1: What hedging tools does your firm utilize?

SURVEY RESULTS (See Figure 1):

Fixed price swaps - 14%

Options (collars, puts, 3-way collars) - 20%

Combination of the above - 37%

None - 29%

QUESTION 2: What drives your firm's hedging decisions?

SURVEY RESULTS (See Figure 2):

Fundamentals and market view - 44%

Lender/investor requirements - 19%

Drilling budget protection - 13%

Gut feelings - 24%

QUESTION 3: Do you target a percentage of external debt coverage when hedging?

SURVEY RESULTS:

Yes, less than 25% - 4%

Yes, 25% to 50% - 24%

Yes, 50% to 75% - 16%

Yes, 75% to 100% - 10%

No - 46%

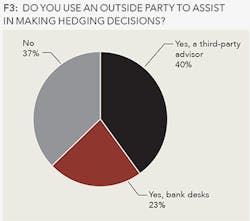

QUESTION 4: Do you use an outside party to assist in making hedging decisions?

SURVEY RESULTS (See Figure 3):

Yes, a third-party advisor - 40%

Yes, bank desks - 23%

No - 37%

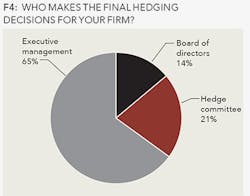

QUESTION 5: Who makes the final hedge decisions for your firm?

SURVEY RESULTS (See Figure 4):

Board of directors - 14%

Hedge committee - 21%

Executive management (CEO, CFO, COO) - 64%

QUESTION 6: Will your company spend more or less on CAPEX in 2015 versus 2014?

SURVEY RESULTS:

More - 23%

Less - 60%

About the same - 17%

QUESTION 7: Will your company's average production be more or less in 2015 compared to 2014?

SURVEY RESULTS:

More - 26%

Less - 40%

About the same - 34%

QUESTION 8: What is the production size of your company?

SURVEY RESULTS:

Less than 1000 boe/d - 34%

1000 to 2500 boe/d - 19%

2500 to 5000 boe/d - 16%

5000 to 10,000 boe/d - 6%

Greater than 10,000 boe/d - 26%

QUESTION 9: What percentage of production do you target when hedging in the first 12 months?

SURVEY RESULTS:

Less than 25% - 27%

25% to 50% - 21%

50% to 75% - 32%

75% to 100% - 20%

QUESTION 10: What percentage of production do you target when hedging in between 12 and 24 months?

SURVEY RESULTS:

Less than 25% - 23%

25% to 50% - 36%

50% to 75% - 24%

75% to 100% - 17%

QUESTION 11: One year from now, what do you expect NYMEX WTI Crude Oil prices to be?

SURVEY RESULTS:

Less than $50 - 3%

$50 to $70 - 60%

$70 to $90 - 24%

More than $90 - 13%

QUESTION 12: One year from now, what you do expect NYMEX Henry Hub Natural Gas prices to be?

SURVEY RESULTS:

Less than $2.50 - 9%

$2.50 to $3.25 - 41%

$3.25 to $4.00 - 36%

More than $4.00 - 14%

Thanks to Aegis Energy Risk President and CEO Chris Croom for his part in developing this survey. Croom has spent nearly 20 years in the energy markets developing hedge strategies, marketing structured energy derivative products, and trading crude oil and natural gas. Aegis Energy Risk's clients include oil and gas producers, energy consumers, and the petrochemical markets. Visit www.aegis-energy.com for more information.