INDEPENDENT RESEARCH firm IHS has provided OGFJ with updated production data for the OGFJ100P periodic ranking of US-based private E&P companies. The rankings are based on operated production only within the US.

TOP 10

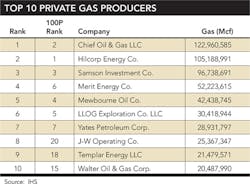

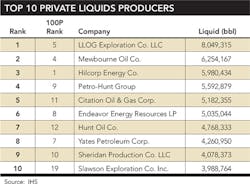

With this, the October installment of the OGFJ100P ranking of privately-held companies, starts the beginning of 2015 data. There was a little shuffling in the Top 10 lists as the companies across the board continue to grapple with the impacts of depressed oil prices. Hilcorp Energy Co. remains King as it retains its place among the top three in both liquids and gas producers. The company, ranked No. 1 in overall BOE, sits at No 2 in the Top 10 Private Gas Producers list and No. 3 in the Top 10 Private Liquids Producers list. Citation Oil & Gas Corp. remains a top liquids producer, but fell out of the Top 10 overall by BOE, dropping from its previous spot at No. 8 in July to its current place at No. 11. Texas Petroleum Investment Co. also dropped out of the Top 10 BOE listing, slipping from No. 10 to No. 16 in this installment. Replacing the two companies in the Top 10 BOE listing for this issue are No. 9 Petro-Hunt Group, jumping up from No. 15 in July, and No. 10, and Sheridan Production Co. LLC, climbing up a few spots from its No. 13 position in July.

FUNDING

The industry is feeling the squeeze of low oil prices, but capital continues to change hands for some. On September 10, a private equity fund managed by ArcLight Capital Partners LLC, along with management from Element Petroleum LP, formed Element Petroleum III LLC with a $200 million aggregate equity commitment. The capital will be used to find, develop and acquire oil and gas reserves and production, primarily in the Permian Basin. The deal marks the third partnership between ArcLight and Element Petroleum management, dating back to affiliates of Element Petroleum founded in 2006. Element III is headquartered in Midland, TX and is led by long-time president and CEO Todd Gibson.

Around the same time, privately-held All American Oil & Gas entered into a $50 million second lien term loan facility with AB Private Credit Investors LLC, the middle market direct lending platform of AllianceBernstein, to refinance debt and fund reserve development in the Kern River Oil Field in California's San Joaquin Valley. San Antonio, TX-based All American, through its upstream entity Kern River Holdings Inc., is the largest private oil and gas producer in the Kern River Field. All American has grown production to over 2,000 b/d through its EOR steam flood program. Cappello Global LLC acted as exclusive financial advisor to All American Oil & Gas and Kern River Holdings.

A&D

Since the last installment of the OGFJ100P in July, notable deals took place in the private company arena.

In early July FourPoint Energy LLC agreed to purchase oil and gas assets in Oklahoma's Anadarko Basin from two Chesapeake subsidiaries for $840 million-roughly $40,000 per flowing boe, according to Wulderlich Securities analysts. The assets include an interest in roughly 1,500 producing wells primarily in the Cleveland, Tonkawa, and Marmaton formations with average daily net production of 21,500 boe/d over the 12 months ending in April. The production mix is 7,000 b/d of oil, 5,000 b/d of natural gas liquids and 57 MMcf/d of natural gas from assets covering nearly 250,000 net acres centered in Roger Mills and Ellis counties, OK, of which nearly 95% is held by production. The deal will be funded by $619 million in FourPoint Holdings equity issued to funds managed by GSO Capital Partners and cash drawn from existing FourPoint Energy credit facilities.

Also in early July, October's largest privately-held company by BOE, Hilcorp Energy, agreed to buy the Cook Inlet assets of an Exxon Mobil subsidiary XTO Energy. The transaction includes two offshore platforms, along with a tank facility and offices in Nikiski, Alaska, on the Kenai Peninsula. The two platforms produce approximately 1,750 b/d.

Privately-held RKI Exploration & Production LLC agreed to acquisition by Tulsa, OK-based WPX Energy for $2.35 billion in plus the assumption of $400 million of debt. The deal, which closed in mid-August, gives WPX entry into the Permian. RKI's assets in the Permian Basin include approximately 22,000 boe/d of existing production - more than half of which is oil; about 92,000 net acres in the core of the Permian's Delaware Basin, 98% of which is held by production; more than 3,600 gross risked drilling locations across stacked pay intervals; and more than 375 miles of scalable gas gathering and water infrastructure.

The acquisition metrics include $1.1 billion for the existing production at $50,000 per flowing barrel, $500 million for the established midstream infrastructure, which equates to an average of $12,500 per acre - or $1.15 billion - for the undeveloped locations.

"To help finance the transaction, WPX is raising $300 million in equity, $1.2 billion in notes, and $300 million in convertible notes on top of $1.3 billion in liquidity at Q1," noted Global Hunter Securities analysts following the deal's announcement in July.

In August, privately-held White Marlin Oil and Gas Company LLC closed its acquisition of certain properties from Dune Energy Inc. and affiliates. The assets were purchased in a sale after Dune filed voluntary petitions for Chapter 11 relief on March 8, 2015.

As described in the Purchase and Sale Agreement, White Marlin purchased interests in the following fields: Abbeville North, Bayou Couba, Chocolate Bayou, Comite, Lake Boeuf SW, Leeville, Los Mogotes, Malo Domingo, Manchester SW, Manchester W, and Toro Grande. White Marlin paid $19 million for the assets. White Marlin estimates the assets were producing approximately 626 boe/d net as of the July 1. White Marlin Oil and Gas is a wholly-owned subsidiary of White Marlin Energy Partners LLC, a portfolio company of the private equity firm Parallel Resource Partners.

Click here to download pdf of the "2014 Year-to-date production - alphabetical listing"

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.