Deal flow rises as public E&P firms let go of prized non-core assets to focus portfolios

DAVID MICHAEL COHEN, PLS INC., HOUSTON

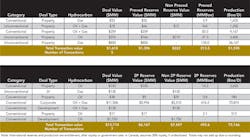

US UPSTREAM DEAL ACTIVITY appears to be loosening up as public companies facing borrowing base redeterminations have become more willing to part with prized but non-core assets to focus their portfolios on the highest-return properties. Private equity has jumped in enthusiastically to pick up the pieces, putting together strong positions through the acquisition market.

Highlighting this trend is Encana's $850 million sale of its Haynesville assets to privately held GeoSouthern and funds managed by Blackstone credit platform GSO Capital Partners. Encana was an early mover in the dry gas shale, and although it has dedicated the lion's share of capex to its four core liquids plays, it has maintained an inexpensive Haynesville refrac program. In multiple earnings calls, the company has expressed hopes of ramping up Haynesville activity once Gulf Coast LNG exports boost gas demand in the region.

Now GeoSouthern will benefit from the liquefaction buildout instead. The deal returns the company to the spotlight as a significant shale producer for the first time since it sold most of its Eagle Ford assets to Devon for $6 billion in late 2013. Founded in 1981 and operating initially in the Austin Chalk, GeoSouthern grabbed substantial blocks of Eagle Ford acreage in 2007-very early in the play's initial leasing stage. It is now trying to gain similar first-mover positioning for the Haynesville's second act.

A similar sell-side story presents itself in W&T Offshore's $376 million Permian near-exit. W&T acquired Yellow Rose field in the northern Midland Basin for $366 million in 2011 to add steady, predictable onshore reserve growth to its exploration-driven Gulf of Mexico portfolio. It suspended Yellow Rose drilling this spring to await a better alignment of oil prices and service costs. Now it is returning to its roots, selling the onshore field to pursue potential GOM acquisitions while valuations are favorable. Nonetheless, W&T will keep a sliding-scale 1-4% ORRI in the field. It also retains ~6,000 net acres farther north, which it is now evaluating, a spokesman told PLS.

The buyer of Yellow Rose is Ajax Resources, a new Houston E&P company backed by private equity firm Kelso & Co. Ajax is starting operations with a strong Wolfcamp and Spraberry position on a highly contiguous 25,800 net acres (100% WI, ~90% HBP) with net production of 3,000 boe/d.

Another privately held startup company has used the deal market to become the leading producer of Powder River Basin coalbed methane. Newly formed Carbon Creek Energy has acquired Anadarko and WPX's entire positions in the niche play, taking control of ~70% of the basin's CBM output. PLS research using TGS shows that Anadarko and WPX operated a combined 4,046 producing Powder River CBM wells with gross output totaling 386 MMcf/d. According to state data, gross CBM production basin-wide totaled 563 MMcf/d in 1H15. The WPX part of the deal came to $80 million, not including the assumption of plugging and abandonment liabilities, which can be substantial in the CBM sector.

PLS expects US deal activity to increase substantially in the next few months as a growing string of E&P bankruptcies brings cheap assets into the market. Quicksilver Resources is putting all of its assets up for sale after filing for bankruptcy protection in March, and Samson Resources-acquired by investors led by KKR for $7.2 billion in 2011-has now filed for bankruptcy protection as well and has identified a substantial package of non-core assets to sell, including scattered Mid-Continent acreage, mature Rockies gas properties and Permian minerals.

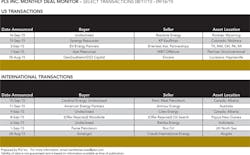

The international deal market is seeing signs of life after slowing down significantly in the previous month. Notable transactions include Cobalt's $1.75 billion sale of its Cameia oil discovery and other assets off Angola to state-owned Sonangol and a $130 million deal by Aubrey McClendon's American Energy Partners to expand beyond the US into Australia's shale frontier. Like W&T, Cobalt is refocusing its efforts on the Gulf of Mexico.

In what would have been the year's second-largest oil and gas deal after Shell-BG, Woodside put in an $11.5 billion stock and debt bid for Papua New Guinea explorer Oil Search. The target company's flagship assets are stakes in the Exxon-operated PNG LNG project and Total-operated Elk/Antelope gas development.

Oil Search rejected the bid, saying the implied premium of just 14% over its pre-offer price "grossly undervalues the company." That decision was given support by the subsequent announcement of the successful Triceratops-3 appraisal well, which flowed a constrained gas rate of 17.1 MMcf/d with 200 bbl/d of condensate. Oil Search didn't completely close the door on a buyout, saying it is open to any offer that reflects a compelling value for shareholders.