UPSTREAM NEWS

TETHYS HITS OIL ONSHORE LITHUANIA

The Tidikas-1 exploration well on the Raseiniai license, onshore Lithuania encountered oil in two limestone formations. Tidikas-1, the second well drilled on the license this year, encountered a combined oil column of nearly 170 feet. Bedugnis-1 was completed in August. Tethys Oil holds a 30% indirect interest in the 592 square mile Raseiniai license.

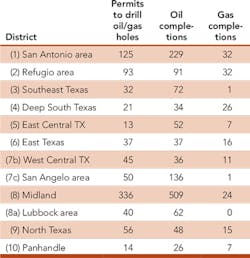

TEXAS DRILLING PERMITS, COMPLETIONS STATISTICS FOR AUGUST 2015

The Railroad Commission of Texas (Commission) issued a total of 864 original drilling permits in August 2015 compared to 2,440 in August 2014. The August total included 730 permits to drill new oil or gas wells, 14 to re-enter plugged well bores, and 120 for re-completions of existing well bores. The breakdown of well types for those permits issued in August 2015 included 222 oil, 59 gas, 518 oil or gas, 54 injection, zero service and 11 other permits.

In August 2015, Commission staff processed 1,113 oil, 172 gas, 36 injection and 11 other completions compared to 2,157 oil, 303 gas, 92 injection and four other completions in August 2014. Total well completions for 2015 year to date are 14,665 down from 20,657 recorded during the same period in 2014.

According to Baker Hughes Inc., the Texas rig count as of September 11 was 366, representing about 43% of all active rigs in the United States.

AUGUST TEXAS OIL AND GAS DRILLING PERMITS AND COMPLETIONS

CONOCOPHILLIPS DELIVERS FIRST OIL AT SURMONT 2

ConocoPhillips delivered first oil at its Surmont 2 in-situ oil sands facility in Canada.

Construction of the Surmont 2 facility, the largest single-phase steam-assisted gravity drainage (SAGD) project ever undertaken, began in 2010. Earlier this year, ConocoPhillips announced first steam, the initial step toward production. Since then, steam has heated the reservoir to a point where the well pairs can be converted to a SAGD configuration and allows the oil to flow. Production was declared once the inspected product was routed to sales tanks.

Production will ramp up through 2017, adding approximately 118,000 barrels of oil per day gross capacity. Total gross capacity for Surmont 1 and 2 is expected to reach 150,000 barrels of oil per day.

The Surmont project is located in the Athabasca Region of northeastern Alberta, Canada, approximately 35 miles southeast of Fort McMurray. Surmont is operated by ConocoPhillips under a 50/50 joint venture agreement with Total E&P Canada.

LGO ENCOUNTERS HYDROCARBONS IN TRINIDAD

With the last of its currently planned 2015 development wells, LGO encountered hydrocarbons with well GY-678 at its Goudron Field development in Trinidad. The well, which was spudded on August 13, successfully reached TD at 4,219 feet measured depth (MD) on September 5. Electric log interpretation from both the Goudron Sandstone and C-sand reservoir intervals confirm the presence of recoverable hydrocarbons, with a net hydrocarbon pay in the C-sand main target totaling nearly 480 feet.

Well GY-678 was the last development well currently planned for the C-sand reservoir in 2015 and the fourth well drilled from Pad-3 in the south of the field. Net oil pay in the Goudron Sandstone was encountered down to 1,065 feet with an estimated 199 feet of total net oil pay. The oil bearing C-sand interval was encountered between 1,535 and 4,147 feet MD. Net hydrocarbon bearing pay in the C-sand interval is estimated as 479 feet. The pre-drill expectations for this well were for a thinner than average Goudron Sandstone section, as has been observed, and a thicker C-sand section. Well GY-670 had a C-sand section of approximately 250 feet, of which 177 feet were perforated, and the 479-foot package in GY-678 exceeds both GY-670 and the pre-drill expectations.

Analysis of a 30-foot core acquired from the well will be used, along with other information collected in the 15 wells drilled since April 2014, in the ongoing EOR design work which the company hopes will lead to a pilot water flood commencing in late 2016.

WINTERSHALL AWARDS RIG CONTRACT FOR MARIA FIELD DEVELOPMENT

Wintershall, Germany's largest internationally active oil and gas producer, has awarded a rig contract for the Maria Field to Odfjell Drilling. The contract for the Deepsea Stavanger semi-submersible rig is worth close to USD 175 million (NOK 1.5 billion) based on 574 budgeted days.

Under the terms of the contract, the Deepsea Stavanger unit will drill six wells on the Maria Field starting from April 2017 with options for additional wells. The Maria field is located approximately 20 kilometres east of the Kristin field and about 45 kilometres south of the Heidrun field in the Halten Terrace in the Norwegian Sea. Wintershall Norge is the operator of the license with a 50% share. Petoro has a 30% share and Centrica Resources (Norge) owns the remaining 20%.

QUADRANT WITHDRAWS FROM COASTAL PERMITS IN WESTERN AUSTRALIA'S CANNING BASIN

Buru Energy Ltd. has reached an agreement with Quadrant Energy Australia Ltd. (Quadrant) in relation to the Coastal Titles Farmin Agreement in Western Australia which was originally executed Nov. 1, 2013.

Under the terms of the agreement, Quadrant will withdraw from the Coastal Permits (EP390, 438, 471 and 473) and will pay the Buru Energy and Mitsubishi joint venture a gross sum of $7 million (AUD 10 million) or $6.9 million (AUD 9.8 million net to Buru Energy after adjustments), in fulfilment of its farmin obligations.

The terms of the original farmin agreement included a commitment by Quadrant (then Apache Energy) to fund a $17.6 milllion (AUD 25 million) exploration program on EP390, 438, 471 and 473. Through the farmin, Quadrant earned a 50% interest in these permits and Buru Energy and Mitsubishi each then held a 25% equity interest. Subsequent to the withdrawal of Quadrant, Buru and Mitsubishi will be the only holders of Coastal Plains.

The Coastal Plains are primarily located on the geological feature known as the Broome Platform with the Goldwyer Shale petroleum system being the principal exploration objective. Neither the Ungani trend or the Laurel Formation tight gas accumulation is present on these permits.

Subsequent to the Quadrant farmin, the joint venture drilled the Commodore 1 and Olympic 1 conventional oil exploration wells targeting Ordovician aged reservoirs sourced by the Goldwyer Shale. Although some hydrocarbon shows were encountered, the wells were non-commercial and were plugged and abandoned. The cost of these wells and other activities on the permits was substantially less than the $17.6 million (AUD 25 million) commitment farmin commitment by Quadrant.

Quadrant will fulfill its remaining obligations to the JV by paying a gross $7 million (AUD 10 million), adjusted for JV expenditure during July. After adjustments, Buru Energy will receive some $3.4 million (AUD 4.9 million) in cash within receipt of the funds.

AUSTRALIA'S EOR ACQUIRES CEP, GETS STAKE IN EAST KALIMANTAN'S WAILAWI FIELD

Australia's Enhanced Oil & Gas Recovery Ltd. has executed a Share Purchase Agreement to acquire 100% of Centre Energy Petroleum (CEP) from Vibrant Link SDN BHD, KEH Industrial Park SDN BHD, and Union Pacific Trading Pty Ltd.

CEP holds an 85% economic/participatory interest in P.T. Benuo Taka Wailawi (JV Company) which is the holder of an Extended and Amended Co-operation Agreement in the Wailawi Oil & Gas Field in East Kalimantan, Indonesia. CEP holds the rights to operate the Wailawi Oil & Gas Project pursuant to the Extended and Amended Co-operation Agreement.

The acquisition of CEP is constituted by shares in EOR to the value of approximately $9 million (AUD 12.8 million). This Share Purchase Agreement is subject to shareholder approval and compliance with Chapters 1 & 2 of the ASX Listing Rules.

ROC OIL SPUDS SECOND EXPLORATION WELL IN CHINA

ROC Oil Co. Ltd., the operator of Block 09/05 in the Bohai Bay Basin, China, has commenced drilling operations on the second of two planned exploration wells in the block. QK12-3-1D will be drilled to a planned total depth of 11,811 feet MDRT (Measured Depth below Rotary Table) and drilling operations are estimated to take 26 days to complete. The well has two primary stacked objectives (Miocene age Guantao reservoirs and Pliocene age Minghuazhen reservoirs), and a secondary objective (Oligocene age Dongying reservoir). The block covers an area of 335 km2 with water depths from approximately 16 feet to 32 feet.

2016 CAPITAL SPENDING

Wunderlich Securities Inc. released a note on capex spending recently, compiling data from 67 E&Ps and 10 large international and integrated companies. Here, a quick look at what might be capital spending in 2016:

"From 2014 to 2015, capex for the E&P names declined by ~44%, and capex for the large integrated players declined by ~11%. Although we don't have forward guidance for 2016 for the entire group, we can see trends developing. In short, we see the large integrated players reducing capex by another 8%, while capex among E&Ps providing guidance is down ~23%. We also note that analyst consensus estimates for companies without any 2016 guidance seem to underestimate capex reductions at only 2% from 2015. As we get more data points, we believe that capex declines in 2016 could be even greater than 23%."