Private company update

INDEPENDENT RESEARCH FIRM IHS has provided OGFJ with updated production data for the OGFJ100P periodic ranking of US-based private E&P companies. The rankings are based on operated production only within the US.

Top 10

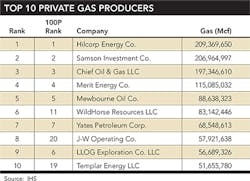

With this, the July installment of the OGFJ100P ranking of privately-held companies, comes the end of 2014 data. As oil prices continued to move (primarily downward) in the fourth quarter, the Top 10 ranked by BOE remained relatively stable. Dropping out of the Top 10 in this issue is Sheridan Production Co. LLC. The Houston, TX-based oil and gas company slipped to No. 13 from its No. 10 spot in April. On the flip-side, Texas Petroleum Investment Co. broke into the Top 10, jumping seven spots from its place in the April OGFJ100P. Breaking down production, the Top 10 Private Gas Producers and Top 10 Private Liquids Producers lists remained largely intact with only a handful of companies swapping places.

Funding

In late May, Sugar Land, TX-based Carrier Energy Partners saw its second investment from New York private equity firm Riverstone Holdings LLC. This recent investment, to the tune of $100 million, follows the $300 million investment made by Riverstone in 2013. With the money, Carrier Energy Partners has formed Carrier Energy Partners II LLC with plans to expand the Carrier strategy of acquiring and exploiting upstream oil and gas assets. The May investment consists of $67 million from Riverstone Global Energy and Power Fund VI, and $33 million from Riverstone Energy Limited. Houston-based Vinson & Elkins LP advised Riverstone in the deal.

Shortly after the April OGFJ100P went to print, Templar Energy LLC reported that the borrowing base under its revolving credit facility was reaffirmed at $625 million. The Oklahoma City, OK-based company noted also the March amendment of its five-year revolving credit facility, originally entered into on November 25, 2013. The amendment revised the net leverage ratio covenant for the remainder of the term of the facility. The moves are in reaction to changes in the marketplace, noted Templar's president and CEO, David D. Le Norman.

"The renegotiation of our covenant, coupled with the reaffirmation of the borrowing base, has positioned the company to successfully navigate the current environment. We have improved our financial flexibility while maintaining ample liquidity for the foreseeable future. The focus for 2015 will continue to be efficient utilization of our capital and strengthening our balance sheet." Templar retains its position at No. 19 on the OGFJ100P and produces approximately 35,000 boe/d net, according to the company. Approximately two-thirds of the company's 300,000 net acres are in the stacked pay trends inherent to the Greater Anadarko Basin. The remaining acreage is located in the Whittenburg Basin of the Texas Panhandle.

M&A

Wichita Falls, TX-based Cobra Oil & Gas, coming in at No. 86 in this issue's list, was part of a group of entities that sold Lower Spraberry and Wolfcamp assets in Texas to Diamondback Energy-called "one of the most efficient operators in the Permian" by an Oppenheimer analysts in an early June note to investors-for a total of $438 million earlier in the year. It is yet to be seen how the sale will impact privately-held Cobra's ranking going forward.

More recently in the Permian, Riley Exploration Group LLC acquired a 90% equity interest in Cinco Resources Inc. (CRI), through a share exchange with private equity funds managed by Yorktown Energy Partners. Riley also received an investment from funds managed by Yorktown to acquire a working interest in a new 25,000-acre horizontal oil play in the Permian Basin. The acquisition and investment, announced in May, provide growth opportunities for Riley. Pro forma for the CRI acquisition, Riley's 2015 net production will increase to 1,600 boe/d. Riley was advised by Petrides & Co. LLC.

Discovery

LLOG Exploration, one of the largest privately-held companies in the US and, according to the company, the largest private producer in the Gulf of Mexico, drilled a successful exploration test with its partners, Ridgewood Energy and Stone Energy Corp., at the Viosca Knoll 959 "Crown & Anchor" prospect, the company said in early June. The initial exploratory well encountered greater than 50 feet of net oil bearing sand in a high-quality Miocene reservoir. Covington, LA-based LLOG, ranked No. 6 in this installment of the OGFJ100P, owns a 60% working interest in the discovery and is currently evaluating regional hosts regarding subsea development options for the project.

Energy Players

Another Top 10 privately-held producer, Yates Petroleum Corp., confirmed an April management change to OGFJ. Effective April 9, Douglas E. Brooks was named president and CEO of Yates Petroleum. The company's former president, John Yates, Jr., was named chairman of the board.

Click here to download pdf of the "2014 Year-to-date production - alphabetical listing"

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.