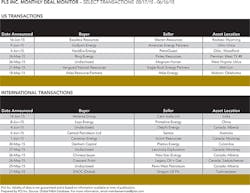

MLP & Utica consolidation lead US activity while Canada sees year's first billion-dollar deal

DAVID MICHAEL COHEN, PLS INC., HOUSTON

PLS REPORTS that the US upstream deal markets are showing further signs of recovery, driven by continuing Utica and MLP consolidation and strong deal flow by a number of companies in the Arkoma Basin.

Gulfport Energy made its second large dry gas Utica acquisition in as many months, agreeing June 9 to buy 35,325 net acres in eastern Ohio along with associated wells and midstream assets for $406.6 million. The acquisition is being carried out via a series of transactions with American Energy Appalachia Holdings, which is changing its name to Ascent Resources and transitioning to a fully independent operating company outside the American Energy Partners platform. The acreage forms a contiguous bolt-on with drilling units that overlap with both Gulfport's existing leasehold and a $301 million acreage deal from Paloma Partners III announced in April.

In the MLP space, Vanguard Natural Resources is also on an acquisition-driven growth trajectory, buying Eagle Rock Energy Partners for $614 million on May 21 after buying LRR Energy for $539 million in April. Eagle Rock adds scale in Vanguard's existing East Texas and Permian operating areas, while establishing a new platform in the SCOOP/STACK play of the Anadarko Basin. Consideration in both deals consists of stock and assumed debt, providing upside for unitholders of the acquired companies when oil and gas prices rise.

Oklahoma's Arkoma Basin has been one of the most active areas for deal activity in the past few months, exemplified most recently by PetroQuest Energy's $280 million sell-down on June 4 to JV partner NextEra Energy Resources. The two companies have been developing these assets in a 50:50 JV since 2010. PetroQuest will retain a small stake and continue to operate all existing wells and new drilling under a service agreement. Other recent Arkoma Basin deals include Atlas Energy Group's $35.5 million coalbed methane dropdown to MLP affiliate Atlas Resource Partners and SM Energy's $270 million Woodford exit in Q1, both of which closed in mid-June. Southwestern Energy also sold its Arkoma Basin and East Texas conventional gas properties during Q1 to Lime Rock Resources. A number of other companies have recently announced plans to exit the basin, including Sanchez Production Partners and Marathon Oil.

Canada saw its first billion-dollar deal of 2015, with Crescent Point Energy acquiring Legacy Oil + Gas in a $1.2 billion stock and debt transaction May 26. As in Vanguard's recent acquisitions, this deal preserves upside for Legacy shareholders when oil prices recover. Crescent Point expects to generate synergies and realize greater operational control over development in southeast Saskatchewan from the incorporation of Legacy's high-working-interest upstream assets and infrastructure in the area.

The same day as the Crescent Point/Legacy deal, privately held Calgary junior New Star Energy announced a deal to be acquired by an unnamed Chinese buyer for $173 million in cash and assumed debt. The deal marks one of the first signs this year of returning Chinese interest in Canada. Asian buyers have been almost completely absent this year after playing a major role in Canada's oil and gas deal markets in past years.

Internationally, recent deal activity has been dominated by large, diversified companies seeking to consolidate their ownership of successful E&P companies in which they already have majority stakes. On June 14, top Indian natural resources company Vedanta Resources struck a $1.6 billion deal to acquire the 40% of Cairn India's equity that it doesn't already own. Planned as a merger of Cairn India into subsidiary Vedanta Ltd., the deal simplifies Vedanta group's structure and provides $2.7 billion in cash to help reduce Vedanta Ltd.'s $8.5 billion net debt. For Cairn shareholders, the deal diversifies exposure to electricity and commodities such as zinc, copper and aluminum during a period of low oil and gas prices.

Turkmenistan-focused Dragon Oil received a similar takeover proposal from majority shareholder Emirates National Oil Co. ENOC is offering $1.7 billion (net of working capital surplus) for the 46.1% of Dragon's equity that it doesn't already own. It tried to take Dragon private in 2009 during the last oil price crash, offering ~$1.6 billion. It was thwarted by minority shareholders led by Edinburgh-based investment group Baillie Gifford & Co., who continue to state that the offer undervalues the company. However, the current uncertain oil price environment looks to play into ENOC's favor for getting the deal done this time.